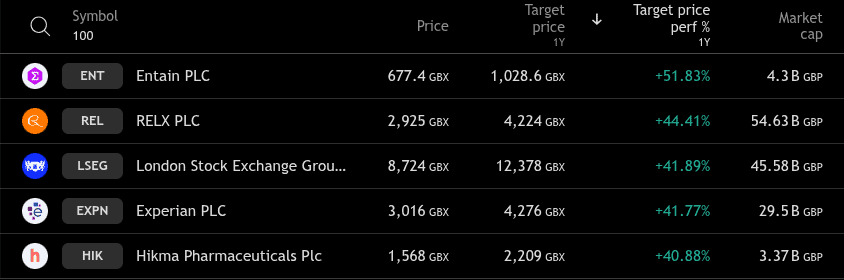

Established FTSE 100 stocks may sometimes seem like low-growth options. But I’ve identified five of them that are forecast to grow at least 40% on average in the next 12 months.

Let’s kick off with one of my favourite Footsie stalwarts — and the number one stock that I think is worth considering on this list.

RELX

RELX (LSE: REL) provides information-based analytics and decision tools, having transformed from a traditional publisher into a technology powerhouse. Operating across multiple technical and scientific segments, it offers proprietary data assets and workflows to help support businesses.

It delivered 7% underlying revenue growth in 2025, with Risk and Legal divisions growing in high-single to low-double-digits. Although its 2.1% yield is low, dividends have increased by over 7% year on year, which is encouraging news for income investors.

Recent AI integrations have helped it achieve 91% penetration among Fortune 100 companies, promising high-margin, mission-critical revenue streams.

But it faces intensifying competitive pressure from AI-native consultancies and data providers that are disrupting traditional market segments. Rivals like Thomson Reuters, along with tech start-ups, are increasingly challenging its historical monopoly position in research and risk analytics.

Currently trading at 2,925p, its average 12-month target is 4,223p — a 44.4% increase.

Entain

As a global leader in online sports betting and gaming, Entain owns popular brands such as Ladbrokes, Coral, and BetMGM. It offers sports betting, casino games and live gaming experiences globally and it benefits from growing digital adoption and regulatory expansion (particularly in North America). There it has established significant market presence through BetMGM.

Latest interim results showed pre-tax earnings up 11% year on year to £583m, with guidance forecasting a 5% higher 9.8p interim dividend.

At 677.4p, its average 12-month target is 1,028p — a 51.8% increase.

London Stock Exchange Group

Beyond managing the exchange, the London Stock Exchange Group builds financial market software and provides critical data to over 40,000 customers globally. It manages leading equity indexes and operates a comprehensive Data & Analytics solutions arm (previously Refinitiv).

Strategic partnerships with companies like Databricks have helped it become an essential infrastructure provider for market participants worldwide.

Trading at 8,724p, its average 12-month target is 12,378p — up 41.8%.

Experian

Experian is one of the world’s largest credit score providers but also provides comprehensive data and analytics solutions across multiple segments. It maintains the industry’s largest credit database, serving financial institutions, telecoms, insurance, utilities and government sectors.

H1 2026 results revealed a 12% boost in revenue from ongoing activities with 8% organic growth, pre-tax earnings up 14% and earnings per share up 12%.

Trading at 3,016p, its average 12-month target is 4,276p — a 41.7% increase.

Hikma Pharmaceuticals

The £3.37bn pharma giant Hikma develops and distributes injectable, generic and branded drugs, manufacturing across North America, Europe, and the Middle East/North Africa (MENA).

It’s in the top three in US generic injectables, ranking second-largest by sales in MENA. And $1bn worth of investments in the US along with expanding partnerships has helped strengthen its growth prospects.

Trading at 1,568p, its average 12-month target is 2,209p — a 40.8% increase.

Final thoughts

Forecasts should never be used alone to drive investment decisions. Well these are all strong, well-established companies, they are not immune to risk. Always conduct a comprehensive analysis before picking stocks — and stay tuned for more insightful commentary!