A £20,000 second income is a great target for many novice investors. It represents the point at which an ISA stops feeling like a savings vehicle and starts looking more like a meaningful income stream — one that can supplement work, fund early retirement, or simply provide financial breathing space.

And let’s put it into perspective: this is £20,000 without any taxation. That’s because there’s no capital gains, dividend, or income tax on the Stocks and Shares ISA. It’s the equivalent of working in a job and earning a before-tax salary of £23,500 a year.

Making it a reality

The obvious question is how big does an ISA need to be to make that happen? In simple terms, it comes down to yield. An ISA producing a dependable 4% annual income would need to be worth around £500,000 to generate £20,000 a year. That might sound like a daunting figure, but it’s entirely achievable.

Push the yield higher and the required pot shrinks. At 6%, the same income could be generated from closer to £330,000. At 7%, it drops below £300,000.

The catch, of course, is that higher yields rarely come without higher risk. Dividends can be cut, share prices can fall, and income that looks generous on paper can prove unreliable in tougher markets.

That’s why the real challenge isn’t hitting £20,000 once — it’s making sure the income lasts.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Building the portfolio

The average growth rates of Stocks and Shares ISA in the UK in recent years is nearly 10%. That’s actually quite impressive, but good investors can far exceed that.

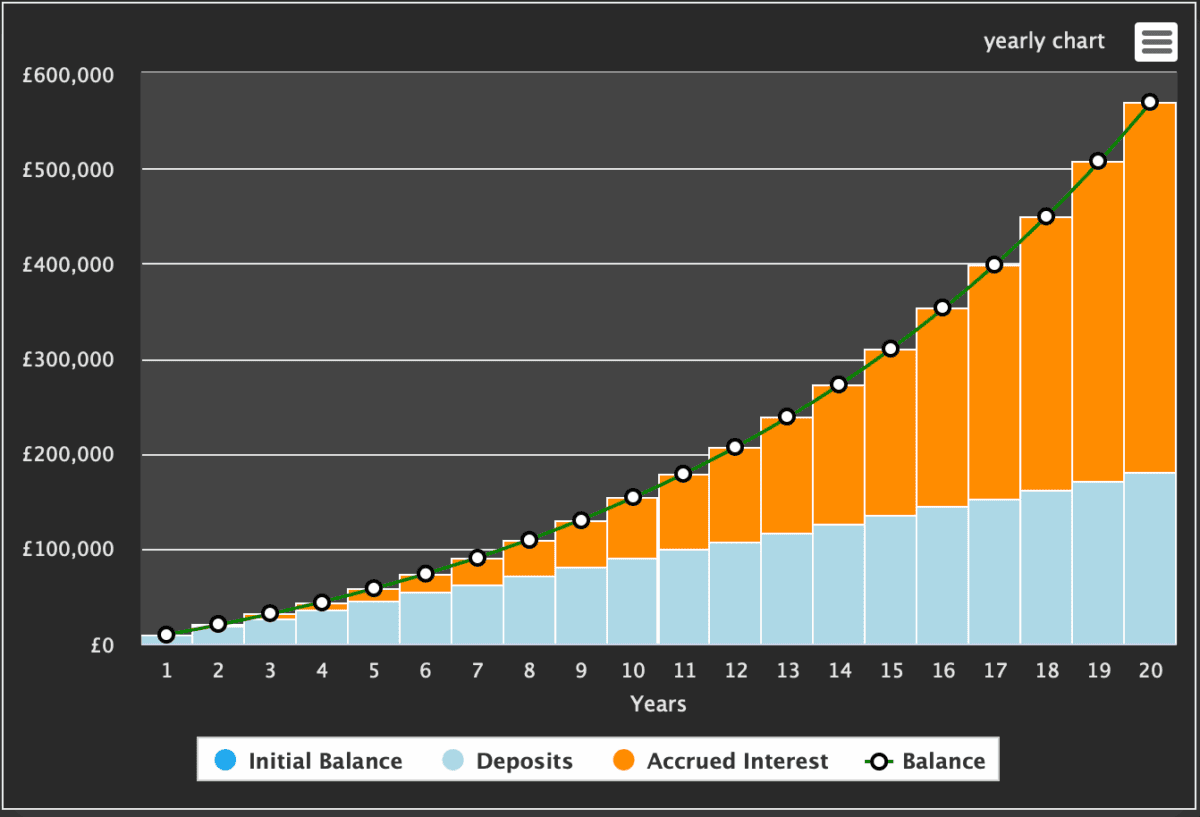

Below, we can see how £750 a month could compound over 20 years, assuming a 10% annualised return. That £500,000 could be reached in 19 years.

Great in theory

The theory here’s great, but you’ve got to know where to invest. That’s because poor investment decisions can lose money.

So where to invest to build the portfolio? Well, one stock I believe’s well worth considering is Scottish Mortgage Investment Trust (LSE:SMT). Those of you more familiar with investing might think it’s a bit of a cop out to pick an investment trust. But in this case, that misses the point.

The trust offers exposure to a concentrated portfolio of high-quality growth companies, many of which would be difficult for most individual investors to access directly. This includes SpaceX, which represented 15.2% of the portfolio.

Actually, this SpaceX exposure is one of the reasons I’m so bullish on the trust. I’d assume this holding percentage reflects the latest reported valuation for the Elon Musk company, which is $800bn. But there’s talk of SpaceX going public next year with a valuation of $1.5trn. All things being equal, that would drastically increase the net asset value of the trust.

But it’s also interesting because of its track record. The trust has a great track record for picking the next big winners.

Risks include leverage, as the trust borrows to invest. Not a huge amount, but this can amplify losses if the value of its investments fall.

Nonetheless, there’s a lot to like about the portfolio. It’s a core part of my pension and a smallish part of my ISA.