The FTSE 100 may have hit another record high earlier this week, but passive income opportunities still persist across the wider London Stock Exchange.

Here are a pair of FTSE 250 dividend shares that I think income investors might want to assess further.

Banking

Let’s start with the highest-yielder — TBC Bank Group (LSE:TBCG). The Georgian bank stock is offering a very attractive 7.1% dividend yield, which towers above the FTSE 250’s 3.5%.

This comes despite a 200% share price surge over the past five years!

The reason for this outperformance is exceptionally strong revenue and earnings growth, driven by the booming Georgian economy. It has benefitted from rising tourism in Tbilisi, a pro-business environment, and a huge influx of wealthy migrants (primarily from Russia, Belarus, and Ukraine) following the Ukraine invasion.

TBC has also aggressively expanded into nearby Uzbekistan, which is another part of the growth story. Its digital bank there now has millions of users.

Yet, despite this geographic expansion, what happens with the Georgian economy is key. If economic growth suffered a setback, this would likely see earnings dip significantly across the banking sector. Adverse regulatory changes may also arise in future.

On balance though, I like the risk/reward setup here. The stock is trading at just 4.8 times forward earnings while offering that juicy 7.1% forecast dividend yield.

Plus, most economists see Georgia growing strongly for at least the next two years. While no payout is nailed on, TBC’s is very well-covered by expected earnings, suggesting it’s safer than most.

Infrastructure

Next, I want to highlight 3i Infrastructure (LSE:3IN). This investment company has diversified assets across digital infrastructure (fibre networks, for example), renewables, and transportation logistics.

These businesses tend to throw off reliable cash flows, which support regular dividend growth. Given this safer profile, the forward-looking yield is lower at 3.7%.

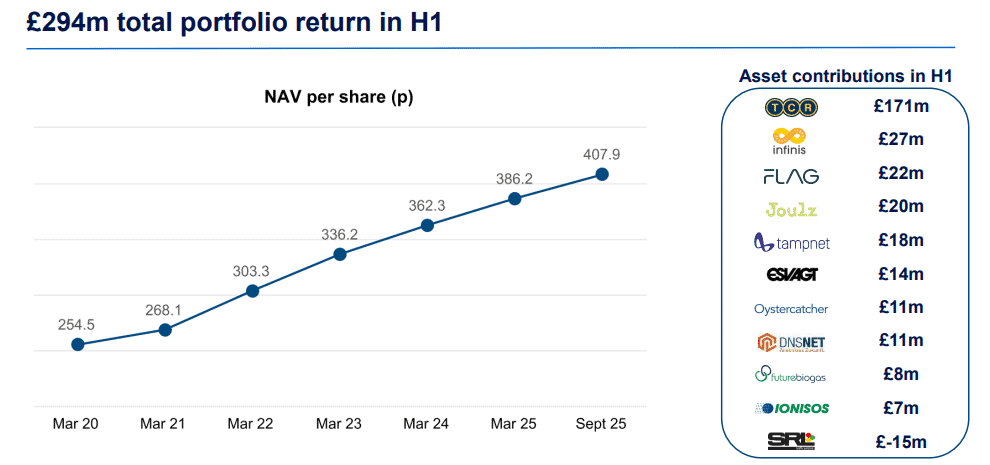

However, the portfolio is high-quality and demonstrating strong growth. In the six months to the end of September, 3i Infrastructure generated a 7.4% total return on opening net asset value (NAV).

This exceeded its target total return of 8% to 10% per year, meaning the portfolio was “performing ahead of expectations“.

A key driver has been TCR, a leader in aviation ground support equipment. Think vehicles we see on the tarmac from airport lounge windows (baggage loaders, aircraft tugs, passenger stairs, and so on).

Airports don’t want to own and repair this essential equipment, so they lease it from TCR on long-term contracts. These are the sort of unsexy-but-reliable businesses that 3i Infrastructure specialises in.

That said, the portfolio is quite concentrated, with the top three holdings (TCR, ESVAGT, and Infinis) making up more than 40% of assets. So if anything went awry at one of these, it would likely have an outsized negative impact on the portfolio.

As things stand though, the long-term dividend growth potential looks very solid to me. The infrastructure specialist specifically targets markets with structural growth drivers, like decarbonisation and data connectivity.

Meanwhile, the firm is on track to deliver its FY26 dividend target, which is a 6.3% increase on the year before.

And the good news is the shares are currently trading at a 6% discount to NAV, which I think offers a nice entry point to consider.