The full rate of the new State Pension is £230.25 a week, which works out at roughly £1,000 a month. For many, that may not be enough to maintain their lifestyle in retirement.

One way to top up is through a self-invested personal pension (SIPP).

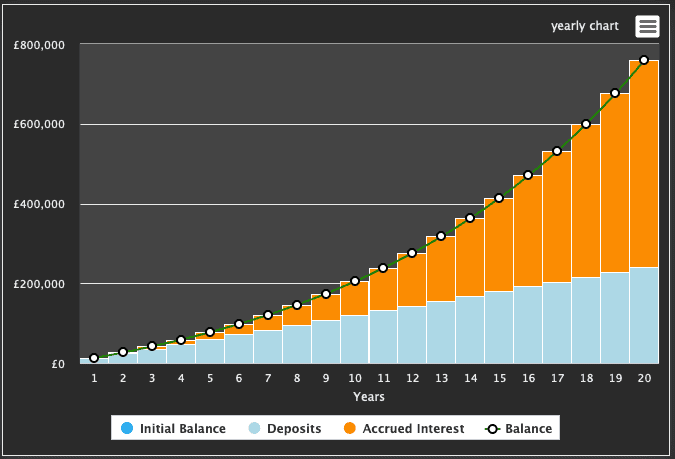

To receive an extra £2,000 per month from a SIPP, you need to consider how much you can safely withdraw each year. A common rule of thumb is the 4% withdrawal rate. At that rate, generating £24,000 a year would require a pension pot of around £600,000.

However, a higher yield would bring that required number down. At 5%, you would need £480,000, and at 6% just £400,000. The issue is, higher yields are typically less sustainable.

Making plans

If you aim to retire in 18 years, you can work out how much to contribute each month depending on expected growth.

However, it’s important to note that a SIPP also comes with a tax advantage. Contributions receive tax relief at your highest marginal rate, which effectively reduces the cost of saving. For instance, a £1,000 contribution from a basic-rate taxpayer only costs £800 after tax relief, while higher-rate taxpayers benefit even more.

Assuming an annualised growth rate of 10% — just above long-term Stocks and Shares ISA average returns — and £800 a month of contributions plus basic-rate tax relief of £200, it would take 18 years to reach the £600k mark.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Where to invest?

Of course, this is great in theory, but investors need to know where to put their money. Bad investments can lose money.

My colleagues and I at The Motley Fool believe a well-researched portfolio of stocks is a best way to maximise returns over the long run.

And one stock I believe is strongly worth considering is Sanmina Corporation (NASDAQ:SANM), offering exposure to long-term growth trends in AI and cloud infrastructure at a reasonable valuation.

A recent acquisition transforms the company from traditional provider of electronic manufacturing services into a company that’s capable of delivering fully integrated data-centre racks (AI servers) for big tech companies.

This shift increases scale, deepens customer relationships, and moves Sanmina closer to the strategic infrastructure model seen in peers like Celestica. Yet, unlike Celestica, which trades on much higher multiples, Sanmina is trading at a forward price-to-earnings of 17.3, around 34% below the sector median, with a price-to-earnings-to-growth ratio of 0.69.

Moreover, enterprise value-to-sales also looks similarly discount at 1.08 versus the sector’s 3.76.

The main risk is execution. Scaling up manufacturing to build data-centre servers and winning business with hyperscalers is complex, and any delays or operational issues could impact growth expectations. It’s already got a deal to work with AMD — from whom it’s acquiring ZT — but Sanmina still needs to prove it can reliably deliver full racks at scale.

For me, however, this is an outlier in the sector for value and growth.