Many investors dream of building enough passive income to cover their monthly outgoings, and an ISA producing £1,618 a month would go a long way towards that goal. That equates to a very appealing £19,416 a year, all potentially tax free.

But how large would an ISA actually need to be to generate that level of income sustainably? It comes down to the return an investor can achieve without eating into capital. At a cautious long-term 4% yield, the ISA would need to be worth around £485,000.

At 5%, which could be achievable with a diversified mix of dividend-paying shares and income funds, the required pot falls to roughly £388,000. Push the yield to 6%, and it drops again to about £324,000, although higher yields usually bring greater volatility.

Thanks to the ISA’s tax-free wrapper, every pound of that passive income is retained by the investor. That’s a huge benefit.

It shouldn’t feel daunting

For some however, the whole prospect of building a a six-figure ISA can feel daunting. Yet it’s often less about huge lump sums and more about time, discipline, and compounding. Regular monthly investing, topped up by dividend reinvestment and the occasional market dip, can steadily snowball into something substantial.

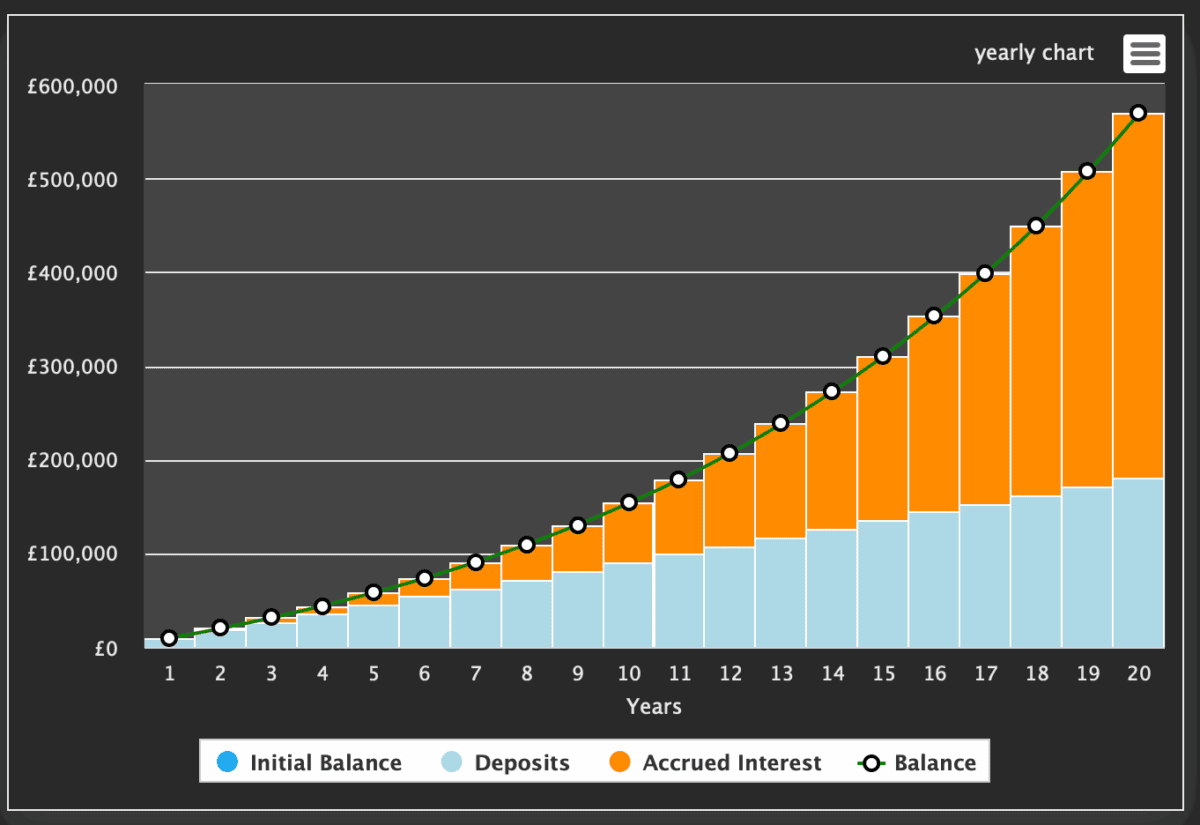

As the below graph shows us, it would take just over 15 years for £750 of monthly contributions and a 10% annualised return to reach £324,000.

However, this is theoretical. Investors need to put their money in the right places. Invest poorly and you could lose money.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Where to invest?

Me and my Foolish colleagues typically believe that the best way to build long-term wealth is by investing in a handful of well-researched stocks.

One such stock is Melrose Industries (LSE:MRO). It’s a company I like a lot because of its positioning within the aerospace and defence sector. Melrose has carved out a distinctive niche by acquiring, restructuring and repositioning industrial assets where operational improvements can unlock real value.

It has a sole-source position for 70% of its sales. This gives it incredible pricing power, but that isn’t currently reflected in the valuation. The company has been undergoing a significant overhaul in recent years and, as such, maybe somewhat overlooked.

The stock trades around 16.2 times forward earnings (the coming 12 months). However, earnings are expected to grow by more than 20% per annum in the years through to 2029. That gives us a price-to-earnings-to-growth (PEG) ratio significantly under one. This provides a margin of safety based on projected earnings.

However, there are always risks. Trade disruption or supply chain bottle necks could impact operational improvements. It really needs to deliver in the coming years to convince the market it should be trading at higher multiples.

It’s also worth remembering that Rolls-Royce and other peers in this sector trade with much higher multiples. In fact, Rolls is essentially three times more expensive on a growth-adjusted basis.

Personally, I think Melrose should be strongly considered.