A £250,000 ISA sounds like a major financial milestone. But when it comes to replacing a salary, the reality is far more sobering than it first appears.

Sustainable income

Once contributions stop, the focus shifts from growth to sustainable income. That requires an understanding of how withdrawals, longevity, and inflation interact during the drawdown phase.

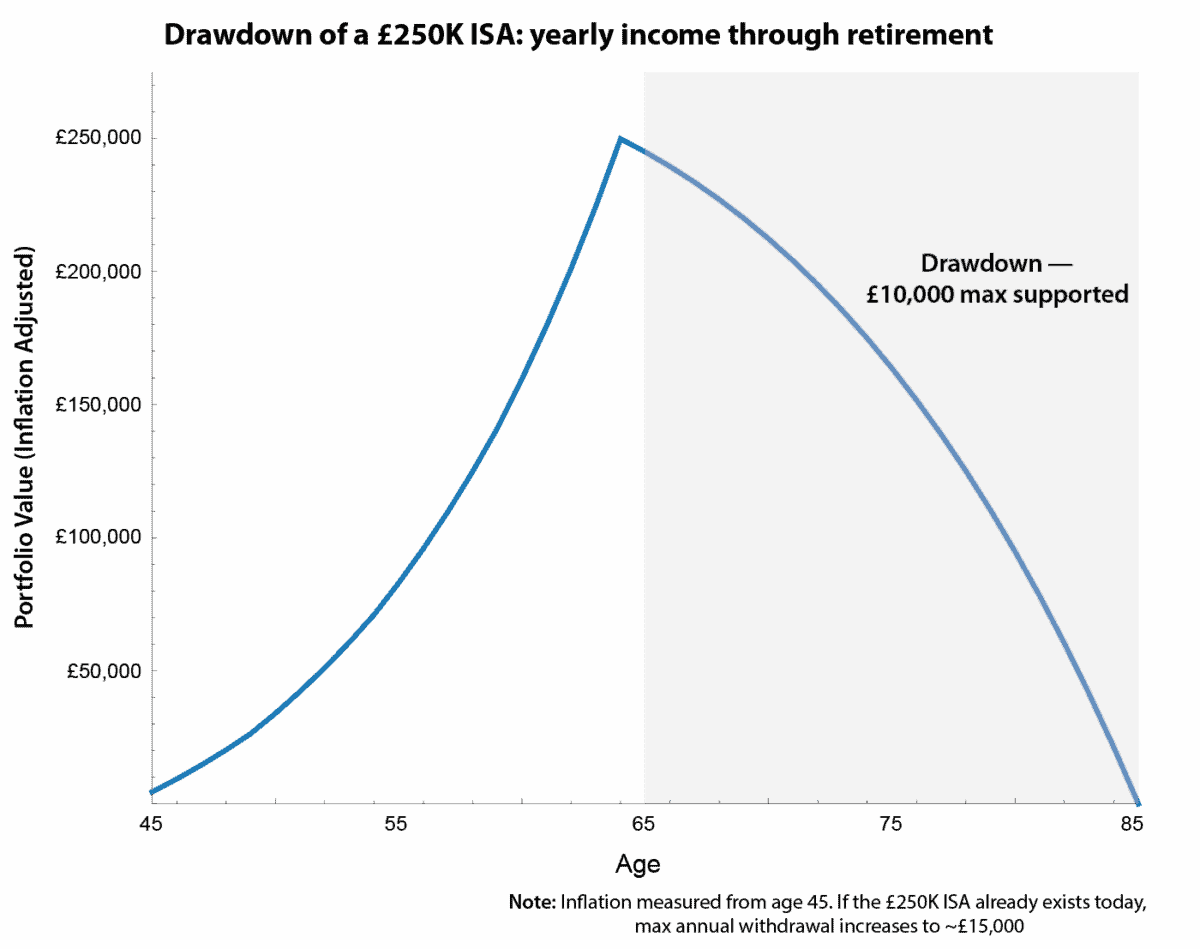

The chart below assumes a cautious long-term return of 4% a year and inflation of 2% during drawdown. By running the portfolio down to zero by age 85, it effectively stress-tests the maximum sustainable income over a 20-year retirement.

Chart generated by author

Under these assumptions, a £250,000 ISA can generate around £10,000 a year, or roughly £833 per month, in inflation-adjusted income. That may cover some essentials or supplement other income, but it falls well short of replacing a typical salary.

Allowing for market volatility or longer life expectancy reduces sustainable income to around £750 per month, while leaving a residual balance of roughly £57,000.

Inflation timing

For investors who already hold the full £250,000 today, the inflation ‘clock’ starts now. In this scenario, the same modelling assumptions could support income closer to £15,000 a year, or about £1,250 per month.

This shows how prior accumulation improves flexibility. Even so, it still represents partial salary replacement rather than full financial independence.

The message is clear: a £250,000 ISA is a solid foundation, but not life-changing on its own. Its value lies in flexibility – supporting spending and supplementing pensions – rather than fully replacing earned income.

Growth and income

Few stocks are suited to both building an ISA and drawing income from it later, but Aviva (LSE: AV.) is one that deserves a closer look.

Its share price rose 42% in 2025, underlining its growth credentials. Supporting that performance has been an ongoing shift towards a capital-light business model, which has improved returns and cash generation.

The buyout of general insurance rival Direct Line at the end of last year should help accelerate this trend. By 2028, it’s targeting more than 75% of operating profit to come from capital-light divisions.

But there’s more to the business than Direct Line. The partnership with Nationwide Building Society has proved to be a winner, attracting new business and strengthening distribution. Meanwhile, in Commercial Lines, the successful integration of Probitas has given the company access to the lucrative Lloyd’s insurance market.

Dividends

The company’s strong share price performance has pushed the dividend yield lower. Even so, at a trailing yield of 5.2%, it remains comfortably ahead of the FTSE 100 average.

In the last financial year, dividend cover was just 0.66 times, meaning reported earnings did not fully cover the payout. That doesn’t overly concern me, as traditional accounting metrics can be misleading when assessing insurance businesses with complex capital structures.

Of greater concern is Aviva’s large corporate bond portfolio. If companies continue to struggle in a weak economic environment, default rates could rise, weighing on investment returns and, in turn, dividend sustainability.

Bottom line

Aviva is a stock with clear momentum. With management setting ambitious new three-year targets, including 11% annual EPS growth, I believe it has the potential to support both earnings growth and a rising dividend as I work towards a £250,000 ISA myself.