The Nvidia (NASDAQ:NVDA) share price has been a runaway train in recent years, but it could still be a bargain. Analyst forecasts for the company suggest there’s a lot more to come.

Not everyone is convinced. But if the business can live up to expectations, then investors who buy the stock at today’s prices could still do very well over the long term.

Growth and value

Based on the last 12 months, Nvidia shares trade at a price-to-earnings (P/E) ratio of around 46. That’s a big number, but a high P/E multiple hasn’t held the stock back in recent years.

The reason is that the underlying business has been growing quickly enough to justify a high valuation multiple. And investors seem to think it’s set to continue.

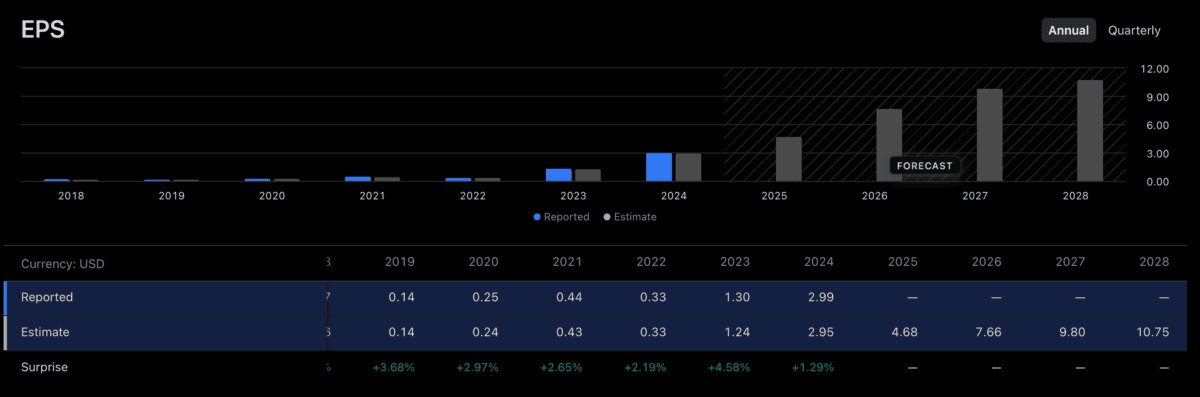

Source: TradingView

Analysts are expecting earnings per share to increase 64% in 2026. If this happens, a P/E multiple of 46 is arguably relatively attractive in today’s market.

The PEG ratio compares a company’s P/E ratio with its anticipated growth rate. A lower number implies investors are paying less for growth, making the valuation more attractive.

Based on expectations for the year ahead, Nvidia shares are trading at a PEG ratio of around 0.72. That’s well below the S&P 500 average, which is between 2.5 and 3.

In other words, the expected growth means the stock looks cheaper than other US equities. But investors need to do a lot more than just read analyst forecasts and look at a price.

Forecasts

Nvidia’s shares look like good value if the business does what analysts expect it to – especially in the next 12 months. But the big question is whether or not it’s going to do this.

Future earnings are never guaranteed and a lot can happen, including some things that are out of the company’s control. But there are a lot of reasons for positivity.

CUDA – Nvidia’s operating system – provides some defence against companies switching to rival chip offerings from Alphabet and Amazon. And demand for new products looks strong.

As well as the new Vera Rubin chips, the company has just announced its autonomous vehicle platform. This marks the firm’s shift to embedding itself in physical products and ecosystems.

I think this type of move should help alleviate some of the pressure on the stock after recent concerns about saturation and competition. But some things aren’t under the firm’s control.

The company’s ability to sell chips in China is one example. That depends on US trade policy – which is hard to predict – but investors have to try and factor it into their models somehow.

Investing 101

Analyst forecasts give investors an idea about what the stock market is expecting from Nvidia in terms of future earnings. But there are definitely no guarantees.

Unfortunately, there’s more to investing than just comparing forecasts with current prices. It involves thinking through how likely those estimates are to be correct.

That’s what investors need to focus on. And while I think Nvidia has a lot of promising growth opportunities ahead, it’s not at the top of my list of stocks to buy right now.