Exchange-traded funds (ETFs) offer investors a low-cost way to buy a basket of stocks in one fell swoop. I particularly like sector and thematic ETFs, as they provide concentrated exposure without the need to pick and monitor individual shares.

Here are two such funds that I reckon are worth considering for a Stocks and Shares ISA in 2026.

Robotics revolution

Let’s start with the iShares Automation & Robotics ETF (LSE:RBTX). This one does what it says on the tin really, offering exposure to 137 stocks associated with the development of automation and robotic technology.

It’s no surprise then that we see Nvidia among the top holdings, as modern robotics is inseparable from AI, and that’s currently inseparable from Nvidia.

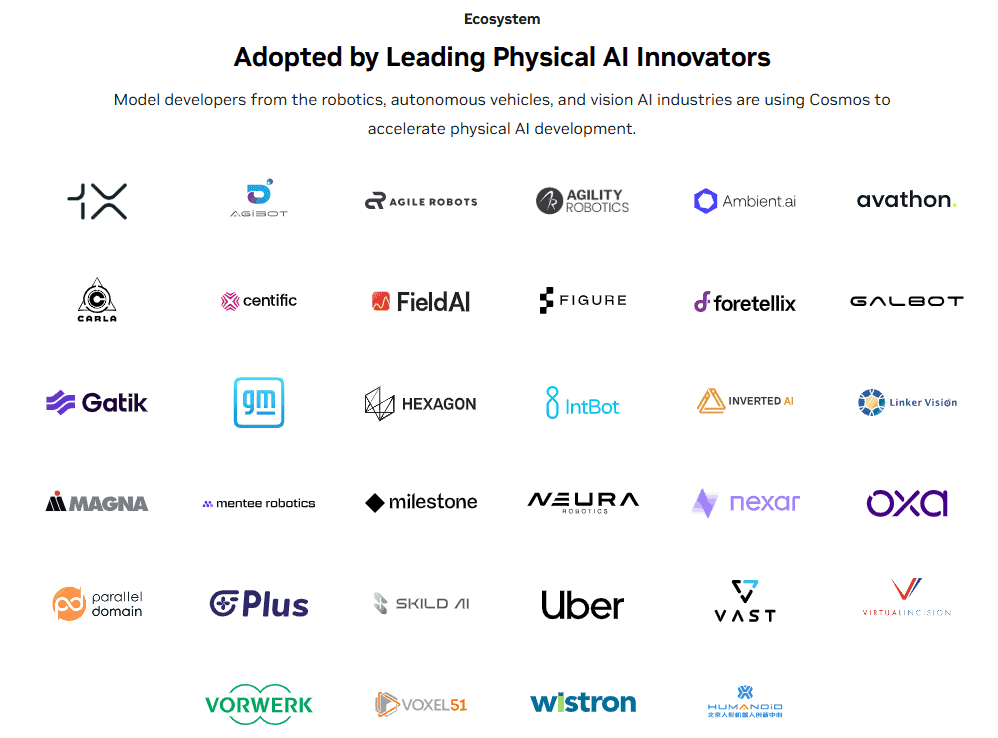

Take the company’s Cosmos platform, for example. It’s purpose-built for physical AI, enabling leading developers to use Nvidia’s software to accelerate the development of self-driving cars and robots. The list of customers speaks for itself.

However, the largest holding in the ETF, carrying a weighting of 5.2%, is Advantest. This Japanese company is the world leader in semiconductor automatic test equipment. Basically, before any chip is placed inside a robot, it must pass through an Advantest machine, making the firm a sort of hardware gatekeeper.

Elsewhere in the portfolio are chipmakers Intel and Advanced Micro Devices, as well as Rockwell Automation and surgical robot pioneer Intuitive Surgical. So it holds a wide range of stocks across the global robotics ecosystem.

Despite the ETF’s diverse holdings, any popping of the feared ‘AI bubble’ would likely hurt performance for a while. Meanwhile, further tit-for-tat tariffs could fuel inflation and squeeze supply chains, potentially slowing the industry’s progress.

However, with self-driving cars and robots still early in their development, I expect this one to perform well for a very long time to come.

The ETF is up more than 200% since launch in 2016, and there’s an ongoing charge of 0.4%.

UK property

Turning to a very different idea now with iShares MSCI Target UK Real Estate ETF (LSE:UKRE). This fund is invested in 28 UK real estate investment trusts (REITs), property companies, and fixed income securities.

Now, this one hasn’t performed well in recent years. Since the start of 2022, when interest rates first started shooting up, the share price has slumped by 36%.

This fall reflects the challenges higher interest rates pose for REITs, including increased debt-servicing costs and a more expensive environment for expanding property portfolios. These risks remain, which is reflected in a near-record low for the ETF’s share price.

However, the potential reward for taking on this risk is a chunky 6.5% dividend yield. And while there’s no guarantee all its underlying REITs will pay their dividends, the fund also has around 40% of the portfolio in UK inflation-linked government bonds, which provide a far more defensive income stream.

Looking ahead, interest rates are expected to keep falling next year, which would help REITs reduce the cost of their large debts. This could boost sentiment for high-quality REITs like Londonmetric Property, which makes up more than 6.5% of the ETF.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.