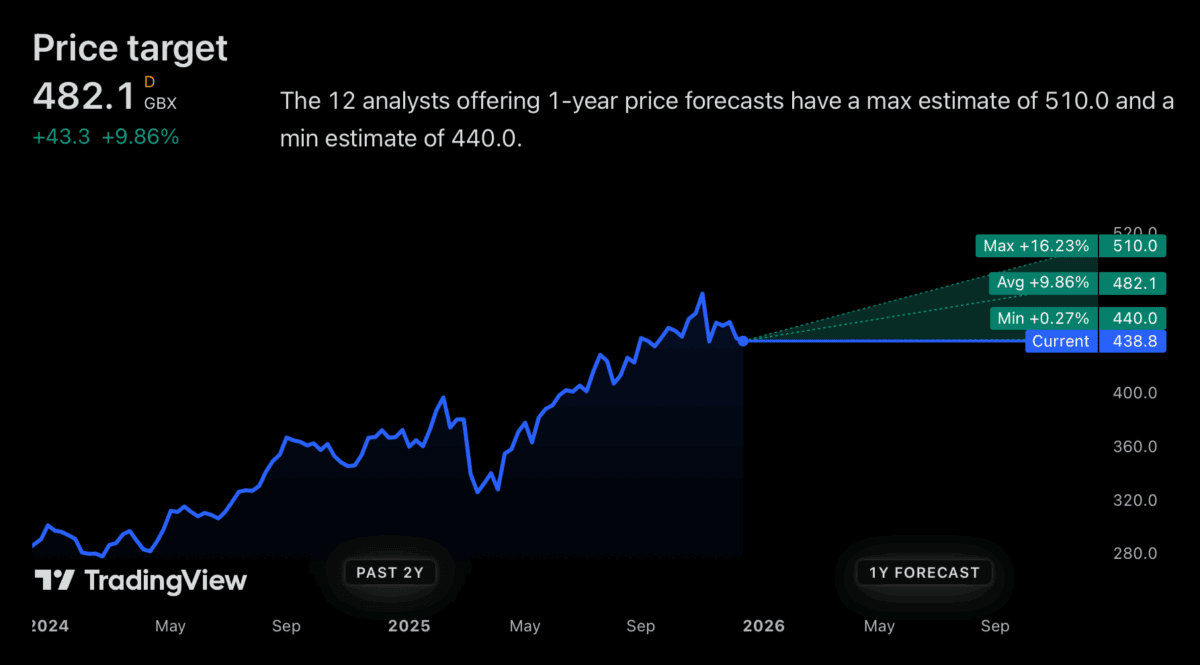

Analysts are pretty optimistic about Tesco (LSE:TSCO) shares in 2026. Price targets aren’t much higher than the current level, but nobody covering the stock thinks it’s going down.

Source: TradingView

A big part of investing in the stock market is minimising risk and avoiding losses as far as possible. So does that make Tesco a no-brainer investment for the year ahead?

Analyst estimates

Analysts are – apparently without exception – expecting Tesco shares to go up next year. With that being said, the lowest price target is less than 1% above the current share price.

Even combined with a 3.25% dividend yield, that’s not an exciting return in 2026, but it’s more than acceptable as a worst-case scenario. Unfortunately, that’s not how it works.

The Tesco share price absolutely can be lower in a year’s time. The most obvious risk is an economic downturn in the UK, which could cause households to try and pull back their spending.

Investing, though, is about what’s likely to happen beyond the next 12 months. And there’s actually quite a lot to like about Tesco from this perspective.

Supermarkets

The supermarket industry is a challenging one for investors. The biggest issue is that – loyalty programmes notwithstanding – customers can easily switch where they do their weekly shop.

That means virtually no business has a big ability to increase prices. And that results in low margins for almost all operators, which leaves profits very vulnerable to higher costs or theft.

The only real advantage in an industry where customers are price-sensitive comes from having lower costs than rivals. This allows wider margins without charging higher prices.

Despite the nature of the grocery industry, Tesco does actually have a strong position in this regard. And that’s why it’s the UK supermarket that I think is worth considering as a potential investment.

Competitive advantage

What Tesco has over other companies is scale. With 2,965 stores, it has more than twice the number of outlets as Sainsbury (1,478).

This is a big advantage for two reasons. The most obvious is that a higher store count means there’s often one near consumers when they’re looking for convenience.

Greater scale also puts the firm in a stronger position when it comes to negotiating with suppliers. To reach the widest customer base, companies have to go through Tesco.

This is a key reason the firm has been able to maintain its market share by competing with Aldi and Lidl on prices. And this kind of durable competitive advantage makes the stock worth considering.

Investment strategy

I don’t think low prices will ever lose their appeal with consumers. But in order to offer value, companies need to be able to control their own input costs.

This isn’t easy in a supermarket industry with low switching costs, but Tesco’s scale gives it a unique advantage over competitors. And I think that makes the stock worth considering.

I don’t know what 2026 will bring for the stock. I’m not sure if it’s ‘easy money’, but I do think the company’s scale puts it in a strong position and that’s what I look for first and foremost in an investment.