Scottish Mortgage Investment Trust (LSE:SMT) is a FTSE 100 favourite among retail investors, including some writers here at The Motley Fool. That’s partly because it offers exposure to growth companies that aren’t listed on public markets.

Importantly, these aren’t start-ups in dimly lit garages. Scottish Mortgage has chunky, long-held stakes in some of the world’s most ground-breaking unlisted firms.

For example, payments infrastructure provider Stripe processed roughly $1.4trn in total payment volume last year. That was equivalent to about 1.3% of global GDP!

Meanwhile, TikTok owner ByteDance surpassed Facebook and Instagram parent Meta in global revenue earlier this year.

Another holding, data analytics firm Databricks, is reportedly in talks to raise capital at a sizeable $134bn valuation. It’s posting 50%+ growth at the moment, driven by increasing use of its cutting-edge AI products.

Last but certainly not least, there’s SpaceX, the reusable rocket pioneer that has ballooned in value to become the investment trust‘s largest holding. And it was exciting SpaceX news that sent the Scottish Mortgage share price up 3% today (10 December).

Here’s what shareholders need to know.

Potential blockbuster IPO

According to Reuters, SpaceX is planning to list on the stock market in June or July next year. It would look to raise over $25bn at a valuation in excess of $1trn.

However, a Bloomberg article said it could be as much as $1.5trn! If so, that would rival oil company Saudi Aramco‘s record-breaking initial public offering (IPO) in 2019.

This is fantastic news for Scottish Mortgage shareholders because the trust first invested in SpaceX back in 2018 at a far lower valuation. And it got privileged access to that fundraise after patiently supporting Elon Musk’s other somewhat whacky venture (EV start-up Tesla).

Back in 2018, SpaceX was valued at about $31bn. So if this IPO successfully goes ahead, it would give a nice boost to Scottish Mortgage’s net asset value (NAV).

Presumably, it would allow the trust to crystallise some big returns, providing cash for new investments and/or share buybacks.

Orbital data centres

Of course, this IPO might not happen. Recently, Elon Musk denied press reports about a fundraise, writing that “SpaceX has been cash flow positive for many years“.

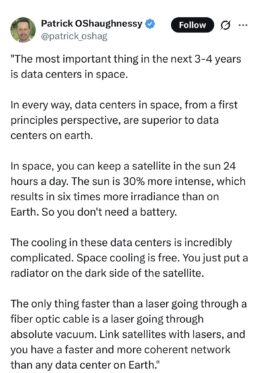

However, it may need fresh capital for space-based data centres. These are being proposed as a much more energy-efficient solution to data centres on Earth.

If giant tech firms like Google and Microsoft start sending data centre infrastructure into orbit, the demand for SpaceX’s reusable Falcon 9 rocket could go into overdrive.

And if successful, the firm’s gargantuan rocket Starship would take its competitive advantages to another level (though it’s still in the testing phase).

Meanwhile, there’s Starlink, its internet satellite business. This will drive much of the firm’s expected $22bn-$24bn in revenue next year.

Buy SpaceX shares?

Would I invest in SpaceX? Potentially, but the implied price-to-sales multiple of 50-65 looks very high. So I would probably wait.

In the meantime, investors could consider buying Scottish Mortgage stock. Granted, it would be vulnerable to a technology sector sell-off, but it gives solid SpaceX exposure and is trading at an attractive 12% discount to NAV.

I think patient Scottish Mortgage shareholders will be rewarded with long-term market outperformance. But there will be ups and downs along the way.