Since the start of 2025, the Diageo (LSE:DGE) share price has tanked 34%. In fact, the stock’s now changing hands for roughly the same price as it was in September 2015. This suggests the task facing the drinks giant’s new boss, Sir Dave Lewis, is an enormous one.

Can he help the group recapture some of its former glories? Let’s take a look.

A huge job

During his time at Unilever, The Grocer magazine nicknamed him ‘Drastic Dave’. And his reputation for embarking on dramatic changes followed him to Tesco, where he cut jobs, closed stores, and scrapped the group’s final salary pension scheme.

Arguably, his biggest task looms. From 1 January, he somehow has to find a way of reversing Diageo’s falling sales and earnings. On top of this, the group’s debt is rising.

Industry-wide challenges

But I’m sure Sir Dave knows that many of the problems facing Diageo are beyond his control. As the group itself acknowledges, people are drinking better, not more. Conditions in the spirits markets in China and the US are particularly challenging.

As a result, UBS reckons that European beverages stocks trade at a 30% discount to those in the wider food and household goods industry.

However, the group’s well positioned to recover if the wider market starts to pick up. In terms of global spirits sales, it remains the world’s number one.

The bottom line

While at Unilever, Sir Dave reduced the brands that it sold by around 75% and some reports claim that he cut Tesco’s head count by around 10,000. Diageo’s new boss has built a reputation on cutting costs rather than growing sales.

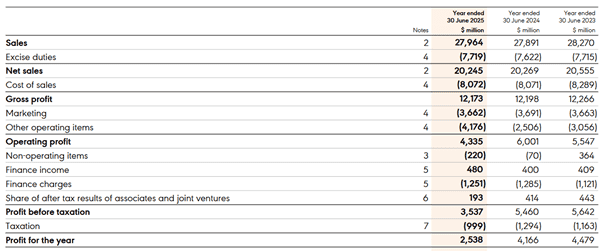

But I reckon a different approach is needed. During the year ended 30 June (FY25), the group employed an average of 29,860 people at a cost of $2.48bn. Reducing the headcount by half wouldn’t have been enough to restore earnings in FY25 to their FY24 level. This illustrates the enormity of the group’s problems. I think a recovery in its top line is key. Simply cutting costs isn’t enough.

However, the success of Guinness — one of the group’s 13 “billion dollar brands” — shows that it’s possible to take a 266-year-old drink and make it relevant. Various influencers have helped make the stout trendy, including its 0:0 alcohol-free variant.

My view

On balance, despite its woes, I think the stock could be worth considering. It owns so many brands that it has all price points covered in its key spirits market. And although there are never any guarantees when it comes to dividends, its yield remains comfortably above the FTSE 100 average.

If it can provide evidence of a turnaround, I believe its share price should bounce back quickly as its stock’s currently valued at an historically attractive level. I suspect it might take a while before this happens. But I remain hopeful that – over the longer term – it will start to move in the right direction.

Diageo has a motto: “Celebrating life, every day, everywhere”. If the group’s new boss can work his magic and lift the share price, I’m sure shareholders everywhere will be delighted and will celebrate by raising a glass or two to ‘Drastic Dave’.