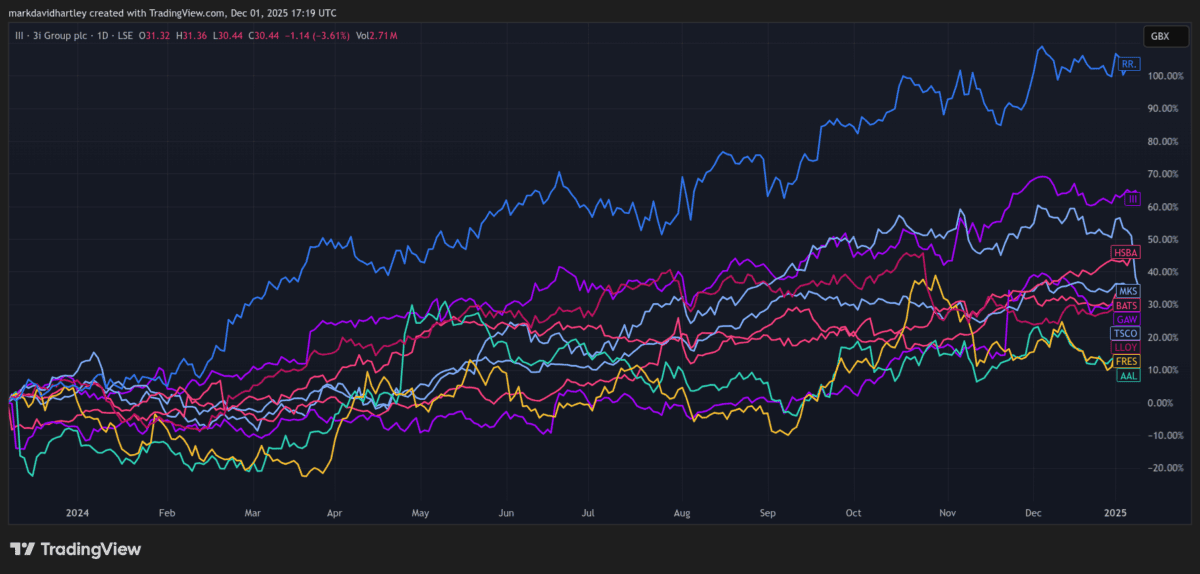

In 2024, 3i Group (LSE: III) outpaced almost every other growth stock on the FTSE 100. Gaining 55% that year, it was streaks ahead of Lloyds, Anglo-American, British America Tobacco and Tesco.

It even managed to beat break-out recovery stories like Marks & Spencer and Games Workshop (but Rolls-Royce still left it in the dust).

Fast forward to today, and it’s one of the worst-performing stocks on the index over the past month. So what happened — and is there any hope for what was once one of my favourite growth stocks?

An overlooked risk

The dramatic collapse of 3i Group’s share price was one of the most shocking things I’ve seen on the FTSE 100 this year. After achieving extraordinary returns and becoming one of the best-performing stocks in 2024, I watched the private equity giant nosedive 30% in November.

The fall wiped £15bn off its market-cap, making it the worst performer on the blue-chip index that month. No doubt, the event prompted a resounding “Ay, ay, ay!” from several shareholders.

But as the dust settles and details emerge, a somewhat obvious risk becomes apparent. One that, to a degree, I was aware of but chose to overlook. As a result, I learnt a harsh lesson in the importance of adequate risk assessment.

But it’s not all doom and gloom.

Uneven weight distribution

When building upwards, it’s critical to have a strong foundation. But even the best basis is no use if all the building’s weight is focused on a single pillar.

In 3i Group’s case that single pillar was Action, the Dutch discount retailer making up nearly three-quarters of the group’s entire £21.5bn portfolio.

For years, this concentration was a strength, driving the share price to record highs as Action expanded rapidly across Europe. The market loved the story so much it priced 3i shares at a steep 54% premium to the value of its underlying assets — essentially pricing in perfection.

The collapse came when that single pillar showed a hairline fracture. In November, despite posting strong overall results, management warned that Action might miss sales targets due to weakness in France, its largest market.

Because 3i’s so heavily concentrated in this one asset, that localised warning triggered a disproportionate 25% plunge in the share price.

Down – but not out

Despite the crash, 3i remains fundamentally sound — sales are up, dividends rose 20% and directors are buying shares. The correction, while sharp, is simply the market reacting to a fear that’s been building for some time.

Should I have taken profit a few months ago? Maybe, but I didn’t. So rather than cry over spilt milk I plan to take advantage of this opportunity and buy more shares while they’re cheap.

Ongoing risks remain, with stubborn inflation limiting consumer spending and lower-cost competitors edging in. But with a solid brand, strong market position and competitive edge, I expect Action — and 3i Group — will bounce back.

For value investors, I think it presents a compelling case worth considering. The recovery may take some time but I think it’s unlikely this small hiccup will bring down the entire house.

And it’s not the only one — after the recent market wobbles, I’ve noticed several potential value opportunties on the FTSE 100 that are worth looking into.