Dividend shares are what the FTSE 100 is best known for. But with the index approaching 10,000, many of the standout yields have dwindled. My focus, however, remains on sustainable dividends. The following three companies all yield around 5%, which makes them worth considering in a market where generous payouts are becoming harder to find.

Oil major

BP (LSE: BP.) has been a core part of my portfolio for years. Its costly pivot from oil to renewables may have weighed on sentiment, but its cash generation remains exceptional.

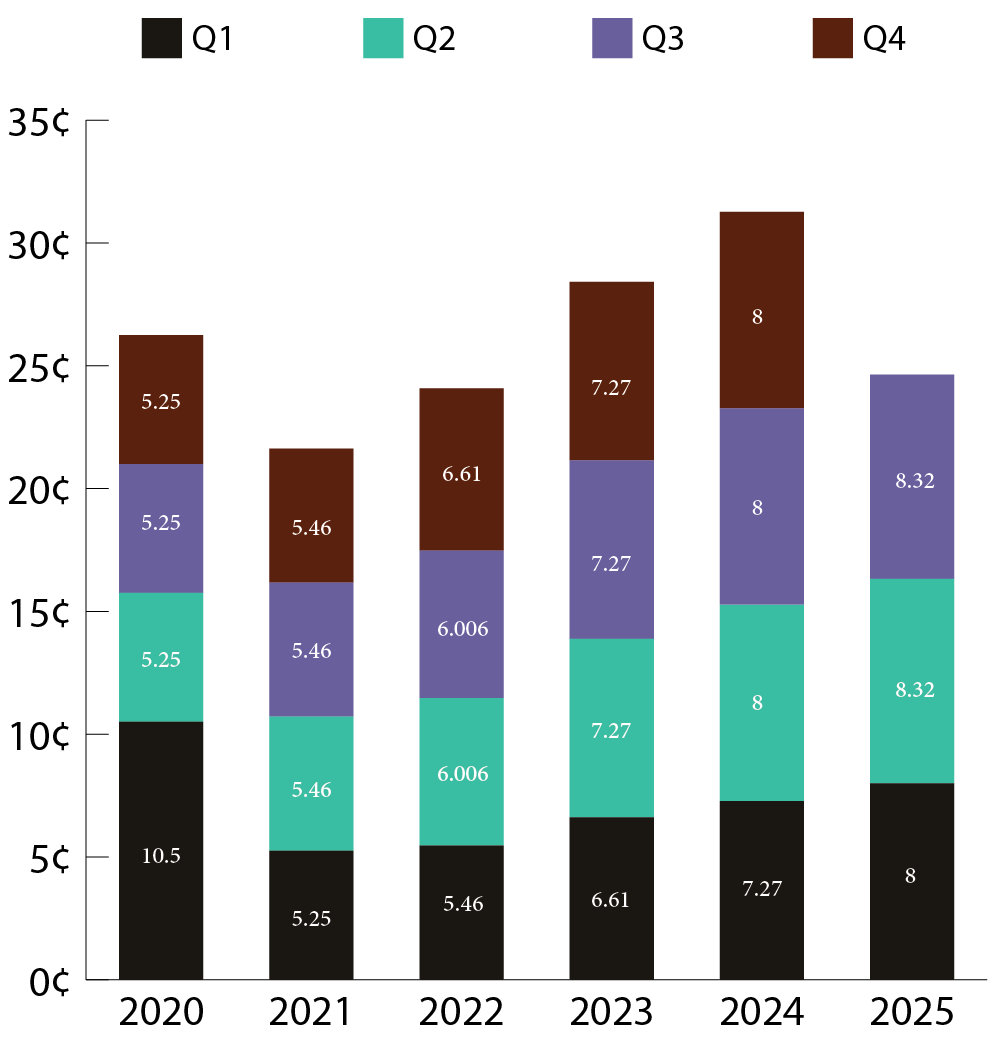

Even in a so-called lean year in 2024, the company generated over $11bn of free cash flow – more than twice the total dividend paid to shareholders. Its dividend has also grown steadily since Covid, as the chart below shows. Today, the yield stands at 5.3%.

Chart generated by author

Yet there are risks. The company remains weighed down by large impairment charges, largely from failed renewables projects and the Deepwater Horizon spill. Last year, impairments as a percentage of earnings were five times higher than peer Shell.

Banking giant

Next up in my dividend stars is Asian banking giant HSBC (LSE: HSBA). In 2024, it paid out 87 cents per share, its highest dividend since the global financial crisis. Currently yielding 4.6%, payouts have been supported by share buybacks, driven by rising earnings per share.

The company is best known for its Hong Kong ops, where it’s the biggest bank, but it has a truly global footprint with over $3trn in assets on its balance sheet.

The business has been diversifying away from core banking and interest-rate-driven income, focusing more on wealth management and fee-based services.

At the moment, it is in the middle of major restructuring. While this could improve efficiency long term, short-term costs and uncertainty may impact returns before the benefits materialise.

For anyone focused on passive income, HSBC’s combination of steady dividends and buybacks makes it a stock worth watching as part of a diversified ISA portfolio.

Insurance play

A third stock that has long been a stalwart of my ISA portfolio is general insurance heavyweight Aviva (LSE: AV.).

The share price has climbed 36% in 2025 and with a trailing price-to-earnings ratio of 27, it doesn’t look cheap on the surface.

Even so, at its H1 results in the summer it lifted the dividend by 10%. Cash dividend cover remained extremely strong at over nine times in 2024.

The company’s growth engine is motor and home insurance, where it already holds the number-one spot. Its bold takeover of Direct Line now gives it more than 21m customers, larger than many UK banks.

Crucially, the deal also expands its reach across retail channels, including price comparison sites, while the Churchill brand strengthens its grip on the fiercely competitive lower-cost market.

Of course, risks remain. Insurance premiums have declined over the past year, and with integration costs from the Direct Line acquisition landing at the same time, there’s potential pressure on near-term margins.

Bottom line

Dividend shares remain one of the simplest ways to build reliable passive income, even in a market near record highs. By focusing on strong cash generation and well-covered payouts, I’m aiming to protect my ISA income stream while giving myself the best chance of long-term, inflation-beating returns.