Passive income hunters often look to the FTSE 100 for reliable dividends – but could ChatGPT actually build a better passive income ISA portfolio than a human? I decided to put it to the test.

Selection criteria

ChatGPT began by laying out a set of sensible principles for building a passive income portfolio. These included:

- Sustainable payout ratios

- At least a decade of consistent dividends

- Strong free cash flow generation

- Defensive, resilient business models

- Meaningful global revenue exposure

It also warned against relying on highly cyclical companies with stop-start dividend histories.

To be fair, that’s a solid framework for anyone chasing long-term passive income. But what about the stocks it picked based on these criteria?

Core stock portfolio

The bot came back with five “core” stocks: Unilever, Diageo, National Grid, Shell, and HSBC. Based on the criteria above, the first and the last look like worthy contenders. But I’m far less convinced by the remaining three.

Take Diageo. Forget the share price collapse – the bigger issue is leverage. Its net debt-to-EBITDA ratio is now above three times. With a new CEO plus a cost-cutting programme underway, I wouldn’t rule out the risk of a dividend reset.

National Grid recently rebased its dividend lower to help fund its £60bn capital investment plan. Shell cut its payout during Covid too. To be fair, it has rebuilt the dividend since then, but with a yield of just 3.8%, it hardly qualifies as a passive income standout.

High yielder

A very high headline yield doesn’t automatically make a stock toxic – it just means you need to dig a bit deeper.

Legal & General (LSE: LGEN) yields 9.1%, only behind beleaguered WPP. On paper, it’s not cheap: trailing price-to-earnings (P/E) sits at 81.

Dividend cover is fragile too, at just 0.14 times, with earnings barely covering the payout. Negative free cash flow over the last two years has meant tapping alternative sources to maintain the dividend.

So why do I own the stock despite these worrying metrics?

Alternative measure

The issue with relying only on standard IFRS accounting is that it can mask a company’s real sources of capital.

A more meaningful metric, used by the business itself, is operating surplus generation (OSG). This measures the underlying, sustainable earnings engine of the company.

Dividends are funded by this long-term surplus, not by short-term accounting profits or cash flow fluctuations. It currently stands at 1.42 times, which is healthy.

Compounder

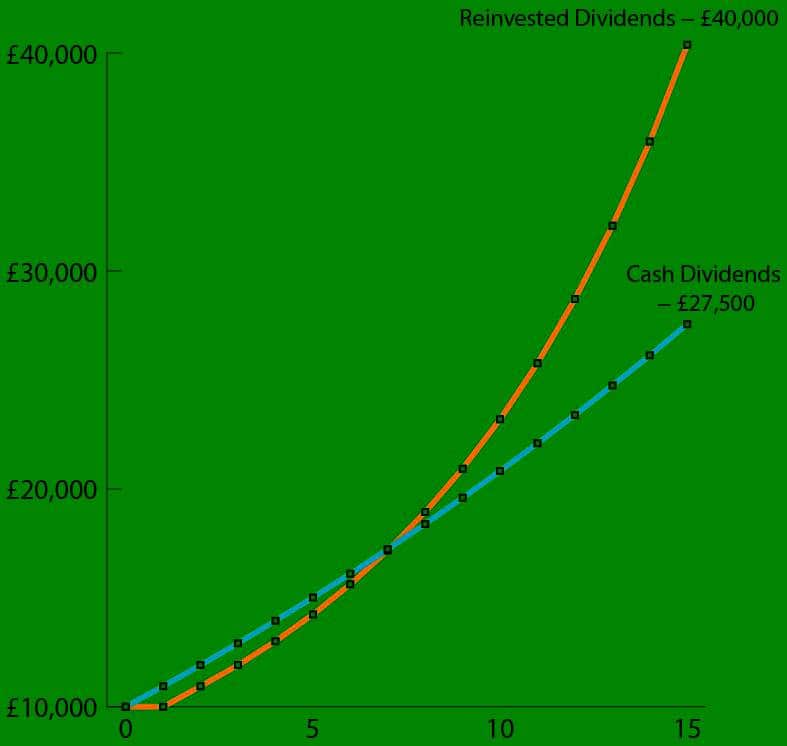

To visualise the stock’s passive-income potential, I like to show how dividends can compound over time. If I invested a lump sum of £10,000 and reinvested all dividends for 15 years, how much could it grow?

Chart generated by author

Assuming zero share price growth and a 3% annual increase in dividends per share, my initial investment could compound into four times its original value over that period.

Of course, a lot can happen over the next 15 years. A recession could lead to a dividend cut or there might be leaner years. But averaging it all out, I view the model as extremely conservative in nature.

Legal & General is one of my oldest ISA holdings and I have topped up along the way too, helping to build a steady passive income stream.