Diageo‘s (LSE:DGE) share price has been battered in recent times. Slowing sales and worries over management strategy have seen the FTSE 100 stock shed 52% of its value over the last three years.

The Johnnie Walker and Baileys maker still faces significant challenges. Yet City analysts are confident it will rebound sharply during the next 12 months.

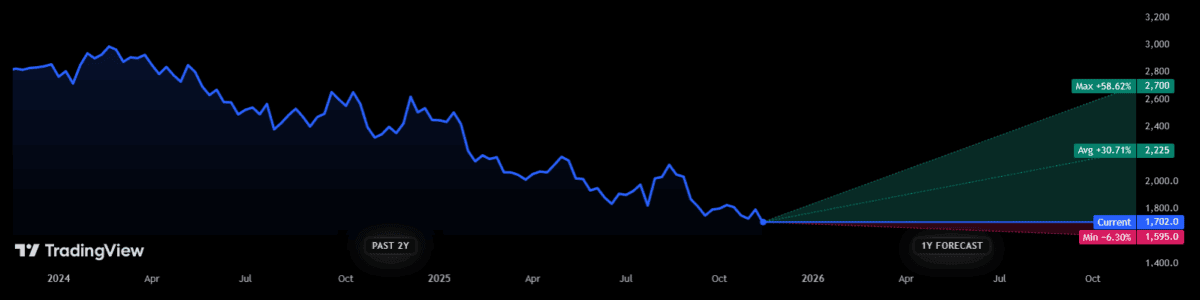

Twenty-one different analysts currently have ratings on Diageo shares, providing a strong range of opinions. The consensus view is that the battered Footsie share will rebound 31% over the coming year, to £22.25.

Here are four reasons why I also think the drinks giant could rebound over time.

1. Market growth

Diageo’s not been able to escape the broader pressures on consumer spending in recent times. With economic pressure in key markets persisting, things could remain tough over 2026.

That said, falling interest rates amid weakening inflation could help revenues rebound. Besides, things are looking brighter over a long-term horizon. Global demand for alcoholic drinks is tipped to rise steadily, driven by rising consumption in emerging markets. Weitnauer Group thinks the worldwide spirits market will grow at an average annual rate of 3.7% between now and 2032.

Thanks to its broad geographic footprint, Diageo is in the box seat to ride strong growth in markets like China.

2. Brand power

On top of this, the company has a huge range of market-leading brands to leverage this opportunity. In total, it has 13 billion-dollar brands in its portfolio. Products like Smirnoff vodka, Guinness stout, and Captain Morgan rum are leading labels in their sub-segments.

It does face rising competition, but Diageo has enormous marketing and R&D budgets it can deploy to reduce (if not eliminate) this threat.

Speaking of product development, the business also has a great track record of innovating labels to supercharge revenues. Sales of its no-alcohol Guinness 0.0 grew by double-digit percentages last fiscal year.

3. New CEO

Diageo has experienced trouble at the top more recently. Debra Crew lasted just two years as chief executive as she struggled to get sales moving again.

With the appointment of Sir Dave Lewis this month, though, things are looking up. A big beast in the retail and consumer goods space, he’s best known as turning around troubled Tesco during his six-year role as CEO there.

I’m expecting the new man to get right to work cutting costs and divesting underperforming brands.

4. Rock-bottom valuation

Given Diageo’s rock-bottom valuation, I think its share price could rally if investor confidence starts to improve.

At £17.02 per share, it trades on a forward price-to-earnings (P/E) ratio of 13.1 times. That is significantly below the 10-year average of 21 times.

Investors can also enjoy excellent value from a dividend perspective, with a 4.6% dividend yield. That’s better than the average of 2.8% stretching back to 2015, and higher than the FTSE 100 average of 3.2%.

On balance, I think Diageo shares are worth serious consideration today.