Lloyds (LSE:LLOY) has seen its share price surge a stunning 66% so far in 2025. To put these gains into context, the broader FTSE 100 has risen by a far more modest (if still admittedly impressive) 17%.

Can the FTSE bank continue its spectacular march northwards? I’ve asked ChatGPT for the answer.

Bullish outlook

I’m not one who believes in the wisdom of artificial intelligence (AI) models for investing advice and share tips. But it seems everyone and their dog is doing it now, so why not have a go myself?

I asked ChatGPT the simple question: “Will the Lloyds share price rise or fall over the next 12 months?” Its answer was:

Lloyds shares may rise modestly, perhaps in the region of 5% to 15 % if nothing adverse happens and the UK economy remains stable

Huh?

However, this is where things start to get sticky.

Explaining its rationale, ChatGPT said that “the UK economy shows signs of resilience (which helps a predominantly domestic bank).“

It added that “valuation metrics suggest the shares are trading at a fair valuation.”

Taken together, the AI model said “these factors support a modest positive case.”

Reality check

As an investor myself, I actively avoid ChatGPT to help me choose which stocks to buy. I’ve found the information it uses to make its projections and recommendations — along with the reasoning behind them — is often questionable at best.

Its views on Lloyds prove my point.

Firstly, latest UK GDP data showed an economy that faces significant challenges. It indicated growth of just 0.1% in Q3, down from 0.3% the prior quarter, and raising in some analysts’ views the spectre of a recession in 2026.

As for Lloyds itself, its shares hardly appear to be trading at fair value. This also suggests they may also struggle for further momentum.

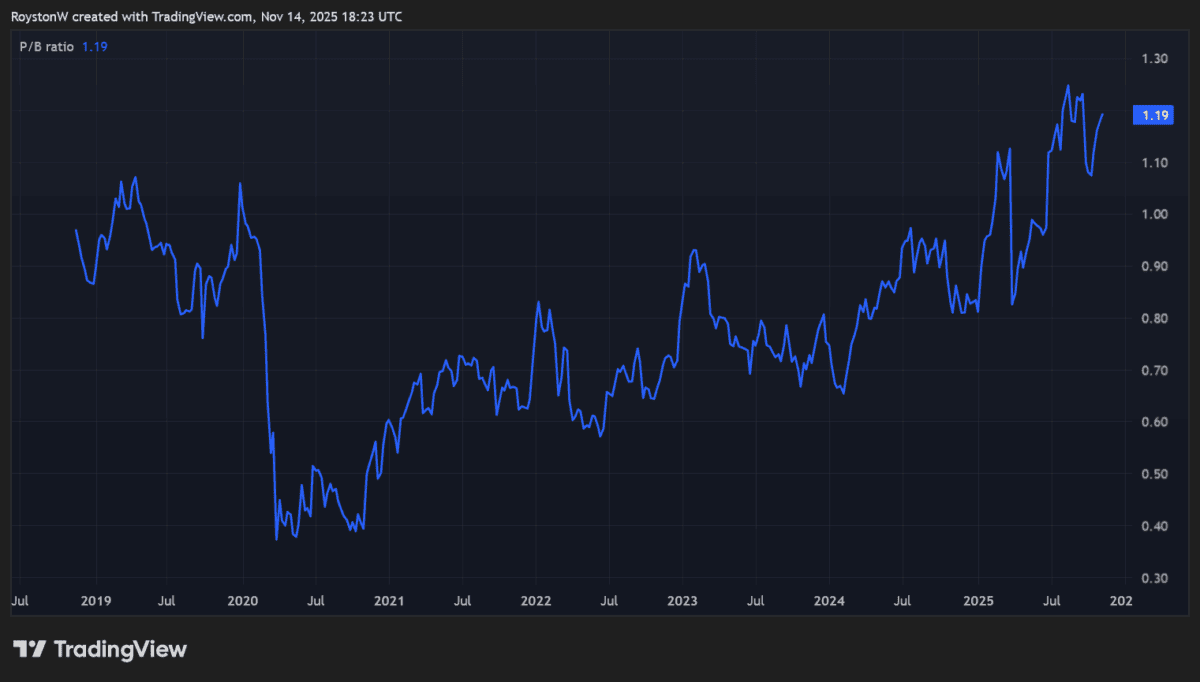

At 91.5p per share, its price-to-book (P/B) ratio is around 1.2. That’s above the 10-year average of 0.8, and shows the bank now trades at a meaty premium to the value of its assets.

Tough conditions

Needless to say, I’ve no plan to buy Lloyds for my own portfolio. The bank faces both weak income growth and rising impairments, a double-whammy that could endure given the UK economy’s huge structural issues.

What’s more, it’ll struggle to grow earnings as the Bank of England slashes rates to boost local growth. Lower interest rates are bad for banks’ net interest margins (NIMs).

With competition from challenger banks also heating up, things are looking uncertain for the Black Horse bank, both in the near term and beyond.

The verdict

As with any share, though, there’s both good and bad when it comes to Lloyds shares.

The bank can enjoys exceptional brand power it can leverage to support revenues during any downturn. It’s also making exceptional progress in digital banking, a key industry battleground. Earlier this month it was named ‘outstanding’ in Euromoney’s report on the world’s best digital banks.

But on balance, I think Lloyds could struggle to grow its share price from here. In fact, I think it’s in danger of a correction following this year’s stunning gains and the huge challenges it faces.