Aviva‘s (LSE:AV.) share price has been one of the FTSE 100‘s star performers in 2025. At 687.2p per share, the financial services colossus has risen a whopping 45% in value since 1 January.

By comparison, the broader Footsie has risen by a lower (if still pretty impressive) 19.9% since New Year’s Eve.

If one City broker is correct, Aviva shares are poised to deliver more spectacular gains over the next year.

800p target

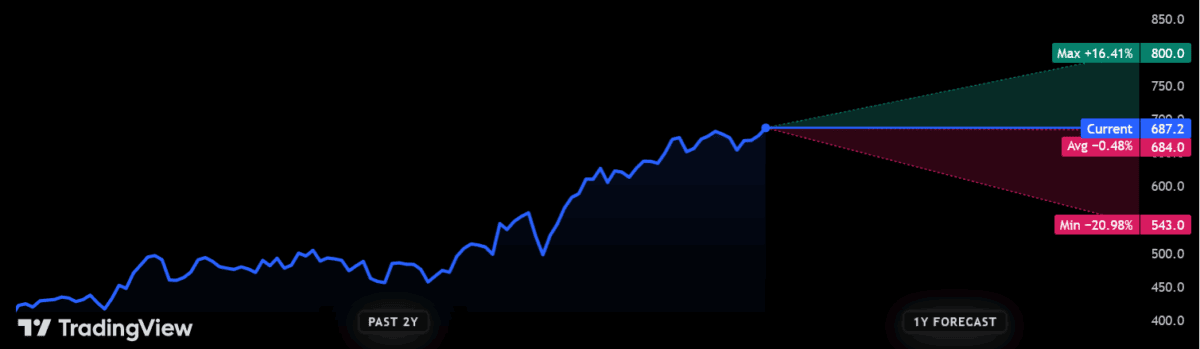

Today, 14 analysts currently have ratings on the company. One of them believes Aviva’s share price will blast to 800p between now and 12 November, 2026. That represents a gain of 16.4%.

Adding the FTSE firm’s dividend forecasts into the equation, Aviva could deliver a spectacular total return near 21% during the next 12 months:

But let’s not excited just yet. Based on all current forecasts, the City overall thinks Aviva shares may actually decline over the short-term. A 12-month price target of 684p per share represents a slight decline from current levels.

So who’s right?

The verdict is…

Accurately guessing the near-term direction of share prices isn’t easy. Even if a company performs strongly (as Aviva has), broader sentiment on stock markets can still pull equity values lower.

This is why I prefer to buy shares with a long-term view in mind. Over an extended time horizon, quality stocks tend to rise strongly in value and smooth out periods of volatility.

When it comes to Aviva and its share price, I’m confident it will continue to rise strongly over time. It’s risen 126% in value over the past five years, and I’ve bought it for my own Self-Invested Personal Pension (SIPP).

On the charge

Aviva has market-leading positions in multiple segments like insurance, wealth and pensions. Acquisitions like Direct Line have boosted its brand power still further, not to mention boosted its exposure to capital-light business that can generate greater returns.

Though its General Insurance units are less sensitive to external conditions, Aviva’s fortunes are closely correlated to the UK economy. This may pose a significant problem for its growth plans if the economic backdrop remains troubled.

That said, the FTSE 100 company’s so far done an excellent job of overcoming these issues, as reflected in its stellar share price gains. Operating profit surged 22% in the first half to £1.1bn, which encouraged it to lift the interim dividend 13% year on year to 13.1p.

Demand remains rock-solid across most of Aviva’s product lines. However, this isn’t the only factor for the company’s stunning profits growth, as cost-cutting efforts are also delivering impressive results. Brokers at RBC Capital think run-rate savings could eventually rise to £200m, up from the firm’s current guidance of £125m.

A premium pick

Today Aviva’s shares trade on a forward price-to-earnings (P/E) ratio of 12.3 times. This is above the 10-year average of 7.1 times. However, I think the company’s resilience and improved outlook merit such a premium.

I expect Aviva’s share price to soar over the long term, as demographic changes supercharge demand for retirement and wealth products, making it one to think about.