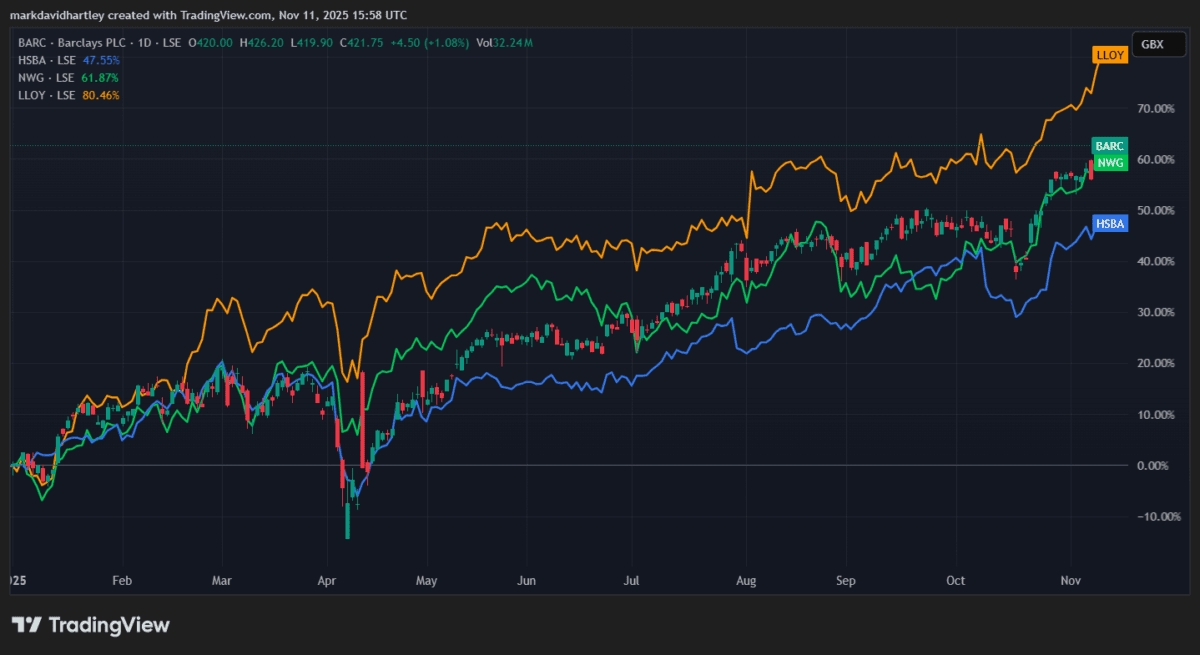

For much of the past two years, Barclays‘ (LSE: BARC) shares have outperformed other major UK banks. The recent dip may have scared some investors but, once again, they’re trading near a five-year high.

This follows a similar trend with other major UK banks, all of which have rallied this month.

While interest rates remain high, banks are cashing in on loans versus deposits. At the same time, global trade frictions and tariff risks weigh on their revenue growth — especially those with strong international operations.

So where does Barclays stand in all this?

No longer leading

After a strong start to the year, Barclays now sits in the middle of the pack among UK banks, performance-wise. Lloyds is up about 73%, Barclays up 58%, NatWest around 54% and HSBC trailing at about 40%.

But from an income viewpoint, it’s way behind, with one of the lowest dividend yields versus peers. Lloyds leads at 6.2%, HSBC 4.6%, NatWest 4.1%, and Barclays just 2%. This may suggest Barclays carries more growth expectation, or less immediate income appeal — something investors need to assess based on portfolio goals.

Why it still looks attractive

Exceptional earnings growth means Barclays now looks like one of the most undervalued banks in the UK. It has a price-to-book (P/B) ratio below 1 and a price-to-earnings growth (PEG) ratio of 0.21 — both hinting at undervaluation.

What’s more, strong results support a low-valuation assessment. Its third-quarter 2025 performance revealed income of £7.2bn, up around 11% year-on-year. Return on tangible equity (RoTE) reached 10.6% for the quarter and 12.3% year-to-date. Subsequently, it upgraded its guidance for 2025, stating it now expects RoTE above 11% and reaffirming a target above 12% for 2026.

The bank attributes the growth to an increase in lending and deposits in its UK business and progress in its three-year transformation plan to simplify operations.

So for investors looking for exposure to UK banking with signs of regained momentum, Barclays still warrants consideration.

Risks to consider

The UK’s base interest rate remains elevated, and any future cuts by the Bank of England would depend on inflation easing and economic slack appearing. Should mortgage demand weaken or deposit competition intensify, Barclays’ margins could be squeezed.

Internationally, tariff pressures and slower global growth may hit its investment banking and corporate divisions. In its Q3 update, Barclays flagged £235m in charges related to the motor-finance probe — reminding investors about ever-present regulatory, legal and credit risks.

Naturally, investors need to weigh the potential for reward against these lingering uncertainties.

Final thoughts

For a beginner investor seeking diversification, Barclays offers several attractive features. First, its improved profitability and raised guidance suggest the bank may be on steadier footing after recent restructuring.

Second, its exposure to higher interest rates means it can benefit from the ‘traditional bank model’ of earning more from loans versus deposits, especially while rates remain elevated.

For those looking to build a diversified portfolio over the long term, Barclays is worth considering. At the same time, there’s also some slightly riskier but more growth-focused finance stocks to choose from on the FTSE 100.

Balancing a lower-risk option like Barclays with growth and income stocks from other sectors and regions helps to spread risk without sacrificing returns.