The Stocks and Shares ISA is an incredible vehicle for our investments. It’s protected from capital gains and taxes on dividends. This means it can grow unimpeded by taxation and we can withdraw an income on it… without being taxed.

Now, according to reports, the government is set to target people with incomes over £46,000 in the upcoming Budget. So, that got me asking… how much money would you need in a Stocks and Shares ISA to take a tax-free income worth £46,000 per year?

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Running the maths

To generate an annual income of £46,000 entirely from a Stocks and Shares ISA, the key factor is the withdrawal rate — the percentage of the portfolio withdrawn each year to fund living costs.

Using a 5% withdrawal rate, the calculation is straightforward:

- £46,000 ÷ 0.05 = £920,000

That means a portfolio worth around £920,000 could, in theory, produce a £46,000 tax-free income each year. Of course, this assumes the portfolio continues to grow enough to offset withdrawals and inflation over time.

A 5% withdrawal rate is more ambitious than the traditional 4% guideline often used in financial planning, so it carries greater risk of eroding the portfolio if markets perform poorly for a sustained period. Nonetheless, it offers a useful benchmark for understanding the scale of investment needed to generate a comfortable, tax-free income entirely within the ISA wrapper.

But that’s a lot of money?

Of course, some readers will see this and think “I could never have a portfolio worth £920,000″. Well, it’s very possible. It just takes time, consistent contributions, and a some common sense when it comes to investing.

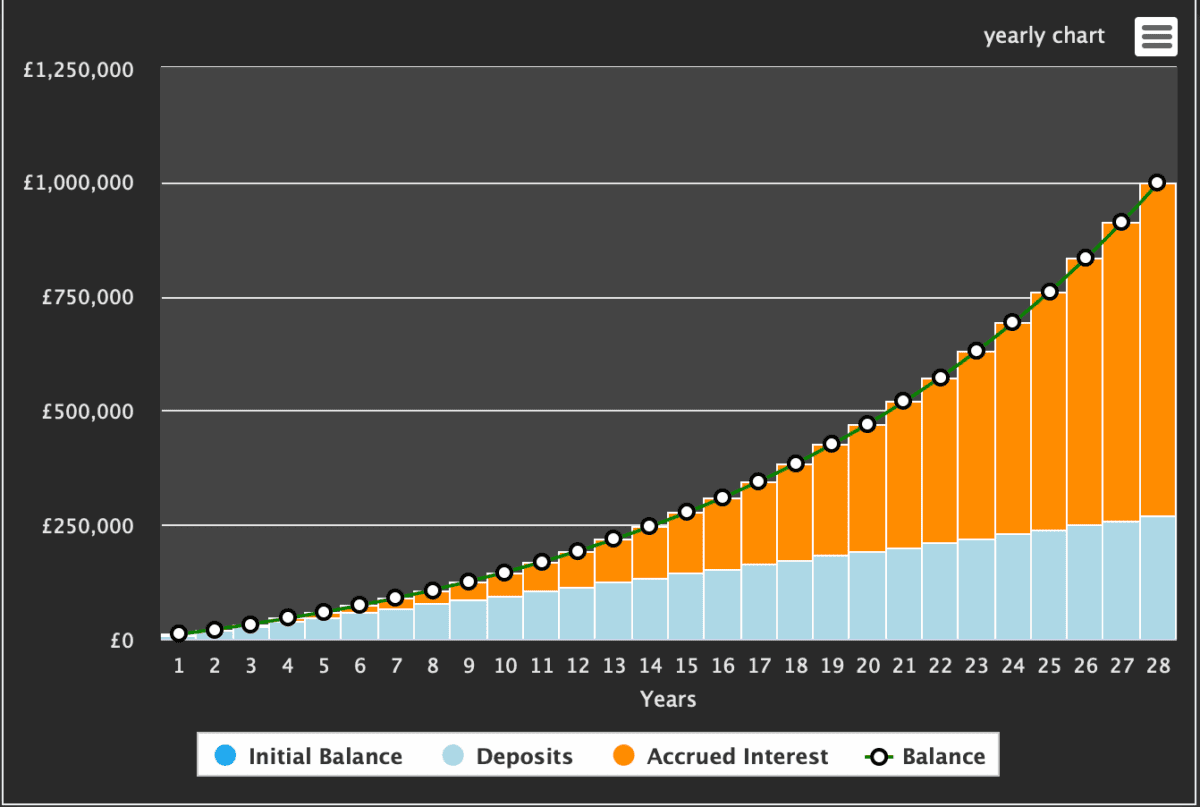

As this graph shows, £800 of monthly contributions coupled with an average 8% return, can compound massively over the long term. In this example, an investor would have £940,000 in 27.5 years.

And as we can see from the graph, the vast majority of that money will come from interest compounding. This is when our returns start to generate their own returns.

Where to invest?

Of course, the above is theoretical, and it’s dependent on the investor making the right investments. So, where to invest? Well, one stock that I believe is worth considering is Fresh Del Monte (NYSE:FDP).

It’s got nothing to do with technology, and that means there’s some degree of isolation against any pullback in the red hot technology and AI segments — and a pullback is certainly possible.

Fresh Del Monte is a major vertically integrated producer, marketer, and distributor of fresh and fresh-cut fruits and vegetables worldwide. It owns and conserves significant agricultural land — for example, around 9,400 hectares of forested land in Costa Rica tied to its pineapple and banana operations. Looking long-term, I really like companies with land holdings.

It’s also not expensive. Trading at 13.2 times forward earnings — falling to 12.1 times for 2026 — it’s well under the index average. It’s also a decent dividend payer too, with the yield currently sitting around 3.2%. This looks set to rise further in the coming years.

One risk is cost inflation into inputs like fuel and fertiliser. This could put margins under pressure.

However, for now, it looks like an excellent business at undemanding multiples.