When it comes to securing a second income via the stock market, one of the most critical factors for long-term investors is the reliability and consistency of dividend payments. A typical FTSE 100 index tracker has delivered around 80% total returns over the past decade, generating yields of about 3.2%.

That’s not bad, but plenty of investors look beyond this to trusts in the FTSE 250 for potentially higher income streams. One such is the City of London Investment Trust (LSE: CTY).

Decades of consecutive growth

City of London Investment Trust holds a distinguished reputation as one of the longest-running trusts in the FTSE 250. Managed by Janus Henderson Investors, it invests largely in some of the FTSE 100’s biggest names, providing a blend of stability and attractive income.

Over the past 10 years, it has delivered total returns of 115%, which equates to a solid annualised return of around 7.96%.

The top five holdings include reliable names such as HSBC, Shell, BAE Systems, British American Tobacco, and Unilever. All household-name British stocks known for their consistent dividend payments. And it’s not just UK-focused: it offers broad diversification with 104 stocks spanning 11 industries across seven countries. This helps reduce risk and enhance income potential.

Crucially, the trust has repeatedly outperformed a typical FTSE 100 tracker fund. It’s delivered a 10-year total return of 112%, slightly ahead of the 107% average for UK equity trusts. Plus, its low ongoing charge of only 0.36% is among the lowest in UK equity income trusts.

Encouragingly, it also boasts a healthy balance sheet and decent profitability, reflected in a return on invested capital (ROIC) of 14.7%.

Aiming for a £1k second income

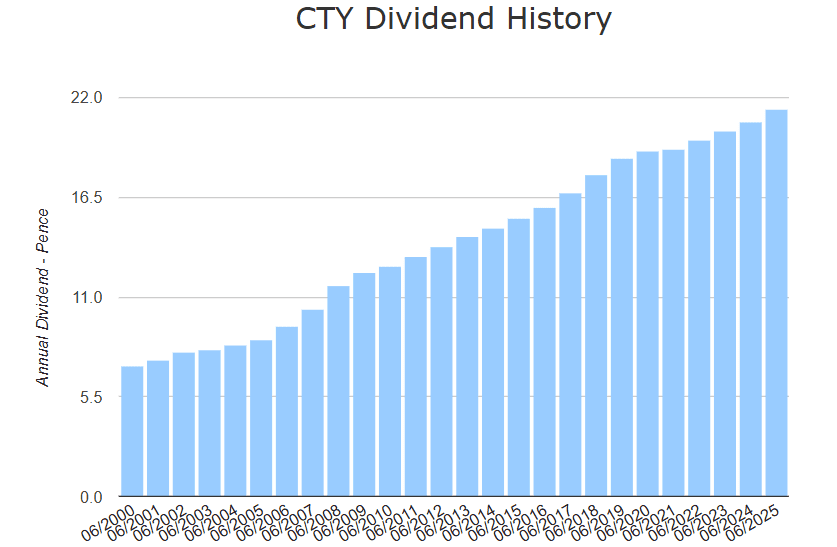

The dividend yield currently stands at 4.3%, with dividends well-covered by earnings. In total, payments represent just 30% of profits, giving some reassurance of sustainability. Impressively, the trust has a track record of 59 years of consecutive dividend growth, highlighting its reliability for income-seeking investors.

To aim for £12,000 a year in dividend income (£1k a month), approximately 54,000 shares would be required. That would cost a meaty £278,640. But while that may seem a sizeable investment, it’s achievable through regular monthly contributions and the miracle of compounding returns.

That said, investors should weigh up a few risks. Like any trust with global exposure, it can be affected by international economic conditions and currency movements. Also, trusts often trade at a discount or premium to their net asset value (NAV). Both these factors can cause the price to fluctuate independently of the underlying investment performance.

So, while it has demonstrated resilience, it’s important to consider how it fits within a diversified portfolio.

Final thoughts

When aiming to build a second income, reliability is often more important than chasing high yields. The City of London Investment Trust’s long history of dividend growth and income stability make it a trustworthy option for investors to consider.

However, since the 4.3% yield is a bit low, it should be considered as part of a diversified portfolio. By combining higher-yielding assets, that £1k monthly income target could be achieved with less capital tied up.

Overall, for an investor seeking a steady second income from the UK stock market, reliable dividend shares are worth checking out. Among others, City of London could be a cornerstone holding with the potential to provide consistent dividends over time.