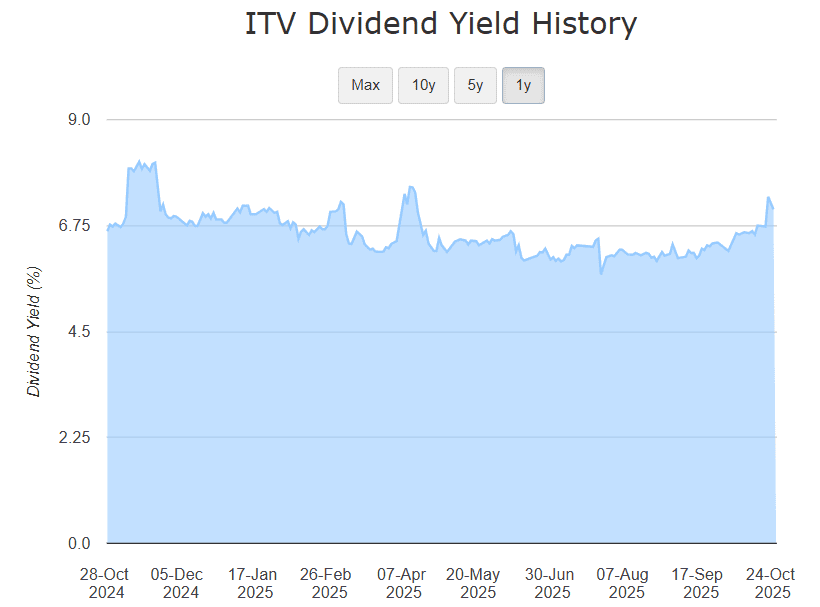

ITV (LSE: ITV) lost a bit of its shine earlier this year when its dividend yield fell below 6%. But as the share price has slipped almost 13% in the past six months, the yield has slowly climbed back above 7%.

That could present an opportunity for investors to scoop up some shares while cheap and aim to boost their dividend income.

But how many shares would be needed? Well, for the past three years, ITV’s paid out a full-year dividend of 5p per share. It hasn’t yet declared its final dividend for 2025 but it looks likely to remain the same.

That means 100,000 shares would bring in £5,000 worth of dividends a year.

With the shares now changing hands at around 70p each, that would require a hefty £70,000 investment. No small amount — but achievable with regular contributions compounded over several years.

How would that look? Let’s see.

Calculating returns

Say, for instance, an investor buys 500 shares a month for £350. In just over 10 years, by reinvesting the dividends, the pot would have grown to £70,000 (assuming the 7% yield held).

In the investment world, that’s not a long time to dedicate towards building a decent passive income stream.

But is ITV the best dividend stock to choose today? Let’s consider the pros and cons of investing in this famous British broadcasting company.

Changing tides

ITV’s working on a new strategy dubbed ‘More Than TV’ to diversify and grow beyond traditional broadcasting. While there are some encouraging signs, the business remains exposed to advertising cyclicality, regulatory shifts and margin pressures.

In its first-half results to 30 June, it showed total revenue of £1,848m. Advertising revenue dipped 7% to £824m while digital revenue rose 9% to £271m. This is indicative of the ongoing shift in media consumption trends.

It also announced additional cost-cutting measures to the tune of about £15m on top of existing savings, and trimmed its content spend to £1.23bn to better reflect shifting viewer patterns.

What does this mean for potential investors? From a financial standpoint, ITV still has some strengths. Its production arm, ITV Studios, saw UK revenue growth of 7% to £420m in H1, for example.

With streaming hours up and digital ad revenue growing, the strategy to move away from broadcasting and shift to digital is promising. However, profit before tax for the period fell markedly, revealing the challenges of this new business model.

With the lack of a major football tournament, advertising revenue took a hit this year. This was compounded by new UK regulations restricting the advertising of less-healthy foods. These are just two examples of the ongoing regulatory and cyclicality risks the broadcaster faces.

Final thoughts

As traditional broadcasting continues to slip, future profits rely quite heavily on the success of ITV Studios and its digital offerings.

With limited growth potential, the 7% dividend yield is the key attraction here. But I wouldn’t rely on it alone. ITV could make a great addition to an income portfolio, but should only be considered as part of a highly diversified selection of stocks.

Fortunately, the FTSE 100 and FTSE 250 are chock-a-block with reliable, high-yielding dividend stocks to choose from.