When it comes to buying stocks, I aim to try and strike a balance. My portfolio contains some relatively small, speculative names, but I also like to own shares in big established companies.

These often tend to have strong competitive positions with economies of scale or entrenched customer relationships. But this doesn’t always come with a correspondingly high share price.

Size matters

There are a lot of advantages to owning shares in businesses that have been around a long time. One of the most obvious is that they often benefit from strong reputations.

Take Legal & General as an example. The main thing anyone buying life insurance wants to know is that the company’s going to be able to pay out if they ever need to make a claim.

Another big difference is dividends. Smaller businesses often look to use their cash for growth, but many switch to returning cash to shareholders as they become larger over time.

This isn’t for everyone – some people might prefer greater growth potential and there’s nothing at all wrong with that. But for income investors, big companies can be attractive.

Target Healthcare REIT

Target Healthcare REIT‘s (LSE:THRL) a FTSE 250 stock that I’ve had my eye on for a little while. I think it’s in a really interesting sector with a lot of long-term potential.

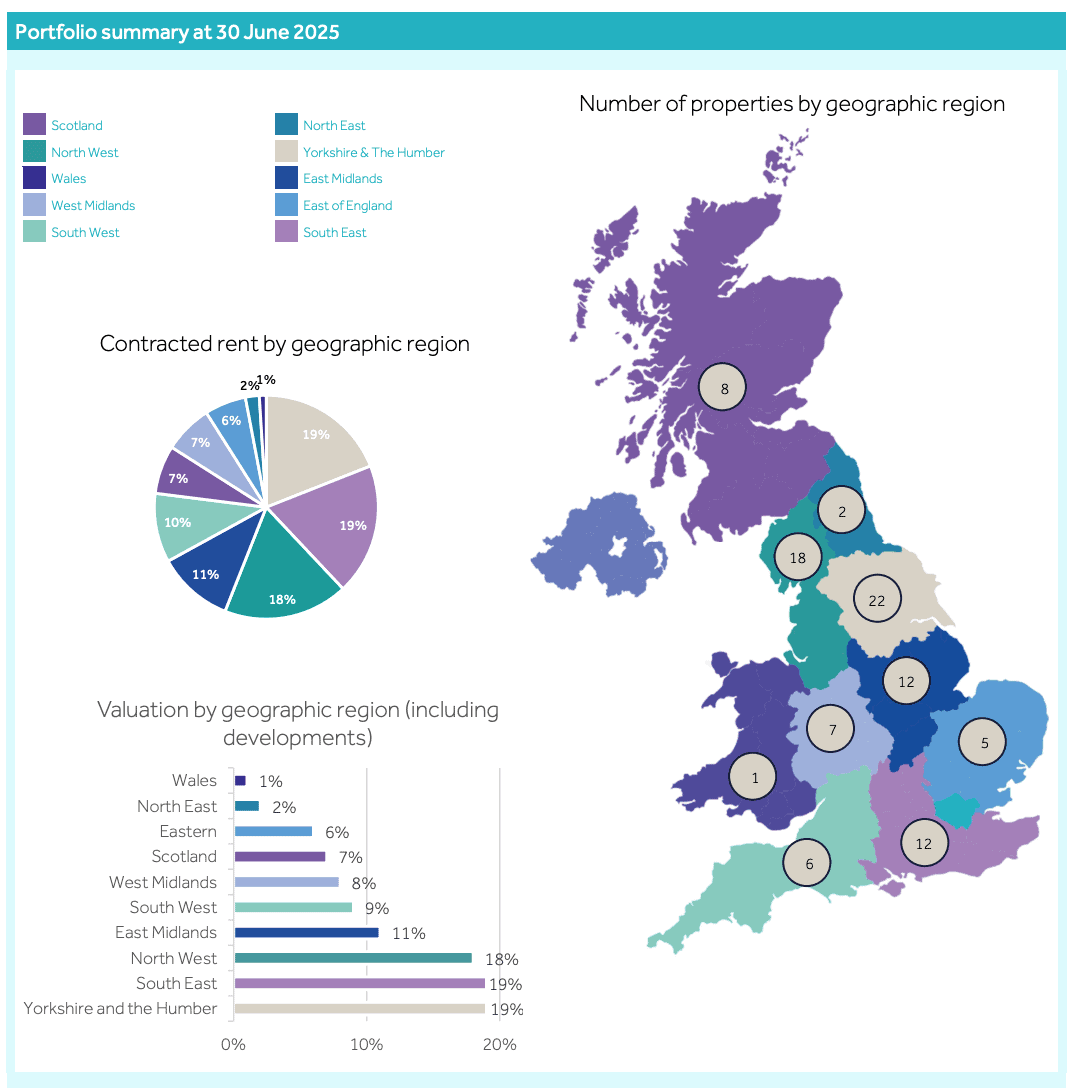

The company’s a real estate investment trust (REIT) with a portfolio of 93 care homes. And an ageing UK population should mean there’s plenty of demand for its properties in future.

Source: Target Healthcare REIT Q2 Investor Presentation

It’s worth noting that the care home business isn’t the most straightforward. Regulations keep changing and this has the potential to create future costs, which can weigh on returns.

A share price of 97p though, implies a dividend yield of 6%. And with inflation-linked rents protecting this from higher costs, this is a stock that could be a great addition to my portfolio next month.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

Vodafone

After climbing almost 25% so far this year, Vodafone (LSE:VOD) shares are now priced at around 89p. And the business might be in a much stronger position than it was in January.

The company’s merger with Three UK in May could be the start of something exciting. The deal both boosts the firm’s scale and reduces the number of competitors in the market.

All of this is very positive. But it’s still quite early to tell whether the move is going to be a success and there’s a lot to be done in terms of integration and capital investments.

That’s not really what I look for in a big company – I prefer established firms with clear strengths, rather than transformation potential. So I’m going to pass on this one for now.

Blue-chip bargains?

I’m always interested in owning shares in businesses that have developed strong reputations over time and I like the look of Target Healthcare REIT very much. Since Care REIT was acquired back in May it’s the only care home stock available on the UK market.

The stock might just offer me some valuable exposure to a market that’s likely to grow. And for less than £1, I can’t think of too many things I want to buy more.