Despite limited share price progress in recent years, the Phoenix (LSE: PHNX) share price continues to reward patient investors through reliable dividends. With one of the highest yields in the FTSE 100 and a solid record of payout growth, the insurer still offers appeal for those focused on building steady passive income over time.

Steady accumulator

Over the last 10 years, the insurer’s dividends per share (DPS) have grown at a compound annual growth rate of around 3.2%.

For income chasers, I believe it’s important to use historical DPS growth as a guide when modelling future returns. A 3% annual increase in the cash cost of the dividend looks a realistic assumption.

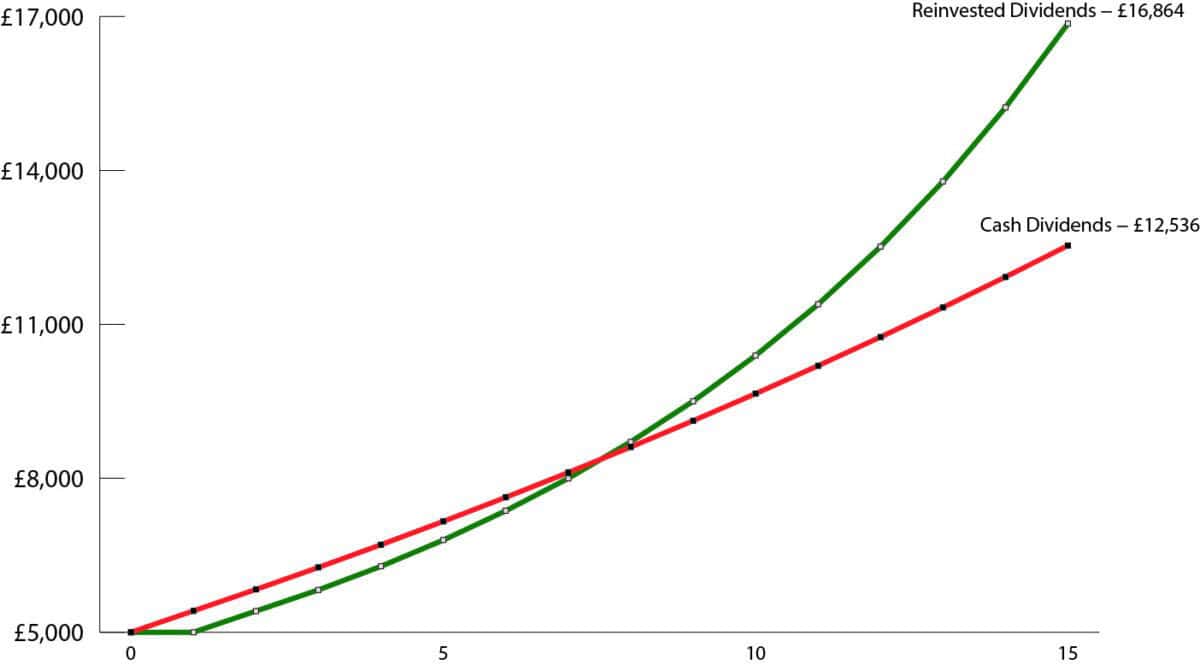

The following chart shows how a £5,000 investment could grow over the next 15 years, assuming a flat share price.

Chart generated by author

The key takeaway is that compounding is an investor’s best friend. Reinvesting dividends to buy additional income-generating units creates an exponentially growing curve, far more powerful than the linear growth achieved by withdrawing cash each year.

Dividend sustainability

It is all well and good building a future income model, but I also need confidence that profits will keep growing to sustain those payouts.

Phoenix operates with a clear capital allocation framework, with dividend increases linked to three factors.

First, and most importantly, is operating capital generation (OCG). At H1 2025, OCG stood at £705m, of which only £274m was paid out in dividends. That leaves the business with plenty of headroom to reinvest for growth.

Second is the solvency coverage ratio, currently 175%, placing it in the upper half of its operating range. Such a high figure reflects a robust balance sheet capable of absorbing financial shocks.

Finally, distributable reserves are extremely healthy at £5.5bn, up 20% year on year.

Accounting quirk

The insurer’s H1 results highlighted that shareholders’ equity, based on statutory accounting principles (IFRS), fell 37% to £768m. However, on an adjusted basis it came in at £3.5bn, a substantial discrepancy.

The company explained the decline as an “accounting mismatch” between IFRS and its preferred Solvency II framework. Under IFRS, long-term investment contracts such as annuities are valued using fixed economic assumptions, while Solvency II re-values them each period to reflect market conditions. Consequently, this can lead to vastly different valuation metrics for individual financial assets.

It may just be an accounting quirk, but if IFRS shareholders’ equity fails to recover over time, investors may begin to question the long-term sustainability of the dividend.

Bottom line

For now, Phoenix remains one of the FTSE 100’s most reliable income plays. The share price may be static, but the dividend is well-covered, supported by strong capital generation and solid reserves.

For patient investors seeking predictable cash flow and gradual compounding, the stock is worthy of consideration, even if capital growth remains elusive.