By lunchtime today (22 October), ITV (LSE:ITV) shares were nearly 8% cheaper than at the start of trading. Investors were reacting to the news that the investment arm of Liberty Global had sold approximately 5% of the company, roughly half of its stake in the “global creator, owner and distributor of high-quality TV content”.

The amounts disclosed were all approximations but it appears as though the sales price was around 70.5p, which is slightly above the current share price of 68.9p.

Nothing to see here

Personally, I think it’s important not to read too much into the news. After all, the investment company’s only selling half its shares. And the transaction is part of its strategy of divesting of non-core assets.

It’s also done well out of its shareholding and I think it’s reasonable for it to want to cash in at some stage. At 31 December 2024, Liberty’s accounts show that it was sitting on an unrealised profit of $46.9m from its investment. Since then, ITV’s share price has fallen nearly 7%, although much of this fall could be blamed on Liberty’s own decision to reduce its stake.

And I think it’s worth reflecting that it’s only been three months since ITV published its half-year results, which were better than expected.

Looking ahead, Carolyn McCall, the group’s chief executive, is optimistic. In July, she said: “We are on track to deliver our 2026 key financial targets, with sustained good growth in ITV Studios and ITVX… as we reshape our cost base to reflect the dynamics of the industry in which we operate.“

Also, the stock could be attractive to income investors. Based on dividends paid over the past 12 months, it’s currently yielding an impressive 7.4%. This puts it in the top 10% of those on the FTSE 250.

Possible challenges

Of course, there can never be any guarantees when it comes to dividends. And structural changes in the industry could threaten ITV’s future earnings and, therefore, its payout.

Changing viewing habits means there’s a decline in linear viewing. And with advertisers following the audience, this is affecting the amounts spent with mainstream broadcasters.

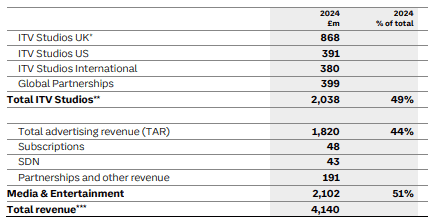

But if it can get things right, there’s huge potential as the group has a foot in two camps. In 2024, ITV generated 51% of revenue from advertising and 49% from making programmes. The global content market is estimated to be worth $233bn. And the amount spent on UK advertising is over £40bn a year. Next year, this could increase significantly due to the Fifa World Cup.

My view

In my opinion, ITV is a stock worthy of consideration.

Despite the threat of increased competition, due to its robust earnings and strong balance sheet, it’s still expecting to find sufficient cash to spend £1.25bn on content creation this year.

And there seems to be persistent speculation that the broadcaster will soon become a takeover target. I’m not advocating buying shares on the basis of a rumour. But this could be an indication that others view the group as being undervalued. Indeed, the stock’s trading on a modest 7.2 times its 2024 earnings per share of 9.6p.

Therefore, today’s share price drop could be an opportunity to consider rather than a sign of anything fundamentally wrong.