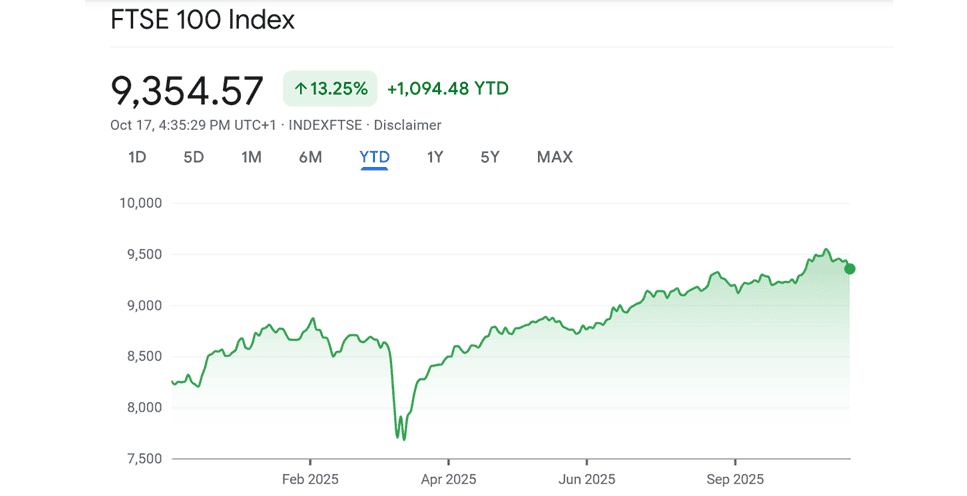

The FTSE 100 leading index of shares is up a whopping 13% in 2025. That’s more than double the return it achieved over the course of the last calendar year.

Given economic headwinds like trade tariffs and rising inflation, the FTSE’s gains look all the more remarkable — and some say, increasingly fragile.

Could they lead to a potential stock market crash?

Predicting the near-term direction of financial markets is notoriously difficult. But it pays to be prepared for a correction at all times.

Building a diversified portfolio, including holding defensive assets like non-cyclical shares and precious metals, can help cushion any fall. Focusing on high-quality shares with economic moats and robust balance sheets is another strategy to consider.

Having cash to deploy at a moment’s notice can also be vital. Indeed, this tactic has helped swathes of investors strike it rich down the years.

Ready to drop?

The Bank of England has warned in recent days that markets face a “disorderly adjustment“. Governor Andrew Bailey reckons that stock valuations may be “at odds” with the uncertain economic outlook.

JP Morgan chief Jamie Dimon has predicted a 30% chance of a market correction in the next six to 24 months. Risks that he’s described to the BBC in recent days including geopolitical uncertainty, fiscal spending and rapid global militarisation.

Stock markets have faced some of these threats in years gone by alongside others. Pandemics, banking sector meltdowns, and sovereign debt crises are just a few to have prompted corrections this century alone.

But share prices always have a knack of rebounding strongly over time, as the FTSE 100’s move to record highs just this month illustrates. Those who stay patient and buy when others panic can position themselves for huge long-term gains.

Doubling our returns

Since 2008, there have been 15 market corrections of 10% or more for the S&P 500. On all but two of those occasions, stock prices were a higher a year later, according to Dow Jones.

Indeed, the median one-year return on S&P 500 shares after these corrections has been 18.1%. That’s almost double the index’s typical one-year return of 9.4%.

The exact numbers may be different, but other global share indexes (including the FTSE 100) often enjoy similar sharp rebounds. It’s why I’m currently building a list of stocks to buy in the event of a market crash.

Scottish Mortgage Investment Trust (LSE:SMT) is one I’m eyeing up right now. Focused on the US tech sector, it has significant growth potential as the global digital revolution accelerates.

Reflecting this, the trust’s risen 53% in value over the last three years.

That said, I’m not tempted to buy just yet. Technology shares are highly cyclical, and could therefore be among the first to plummet amid a wider market correction. A drop could be compounded by worries over the valuations of many of the trust’s holdings, too.

But I’m optimistic Scottish Mortgage would recover strongly over time, pushed up by heavyweight tech stocks like Nvidia, Amazon and Meta alongside unlisted businesses like SpaceX. Buying at the bottom could help me to supercharge my portfolio’s long-term returns.