Are you worried about the future of the State Pension and your standard of living in retirement? If so, you’re not alone. The fear of not having enough money later on is driving me, like millions of other investors, to lean heavily into share investing.

My view is that everyone should consider taking action to safeguard their financial health for later on. Here’s why.

Pension pressure

Britain’s benefits system is under stain as the country struggles with its enormous and growing public debt. With the country’s elderly population rising sharply too, the future of the State Pension is increasingly uncertain.

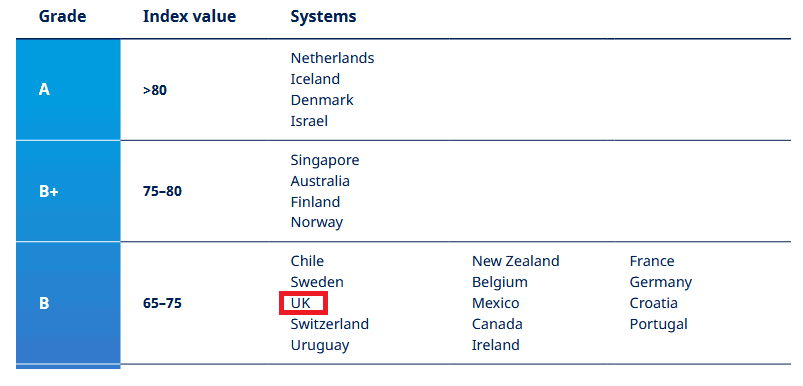

Research from consultancy Mercer underlines the pressure of these challenges. Its latest Global Pension Index showed the State Pension score decline to 71.6 out of 100. This is down from 73 last year.

The State Pension declined on all three categories that make up its ranking: Adequacy, Sustainability and Integrity).

I’m not suggesting now’s the time for panic. Mercer also says the UK’s ‘B’ rating indicates “a system that has a sound structure, with many good features but has some areas for improvement“.

However, a declining score in the UK suggest Britons need to take action to protect their future. In my opinion, investing in global shares is an excellent strategy to consider given the long-term performance of the stock market.

A FTSE 100 portfolio

Buying and holding FTSE 100 shares is one way I’ve sought to target long-term wealth. These blue-chip stocks are famed for their ability to pay a reliable and healthy passive income, which can be compounded through reinvestment to create long-term wealth.

The Footsie also features a large selection of high-performing growth stocks, providing investors the opportunity to achieve substantial capital gains.

Take Scottish Mortgage Investment Trust (LSE:SMT). This tech-focused investment trust has effectively capitalised on the digital revolution of the 21st century, delivering an average 10% annual share price gain since 2000

There have been some bumps along the way, and it’s likely to experience future turbulence in line with economic volatility. But I’m confident it can continue delivering long-term powerful results, with growth over the next decade driven by phenomena like artificial intelligence (AI), robotics and quantum computing.

I like how Scottish Mortgage’s portfolio blends major listed tech stocks like Nvidia — the world’s most valuable company — with smaller (sometimes private) businesses. This means investors enjoy exposure to robust, market-leading companies alongside smaller players that have greater growth potential.

Investing £500 a month

I think a strong seven-stock portfolio for retirement income could comprise Scottish Mortgage, Games Workshop and BAE Systems for growth, and HSBC, Unilever, National Grid and Legal & General for dividends.

In total, this mini-portfolio to consider provides exposure to 107 different UK and international shares, spreading risk and providing exposure to a myriad of investment opportunities. I think a 9% average return is a realistic target which could help safeguard retirees from an insufficient State Pension.

Achieving this high-single-digit return would turn a £500 monthly investment into more than £560,000 over 25 years.