Achieving financial freedom with an ISA is a laudable aim. However, obtaining a yearly passive income of £18,000 in retirement will be challenging for most because they do not maximise the opportunity of getting their hard-earned money to work for them.

Cash ISAs are king

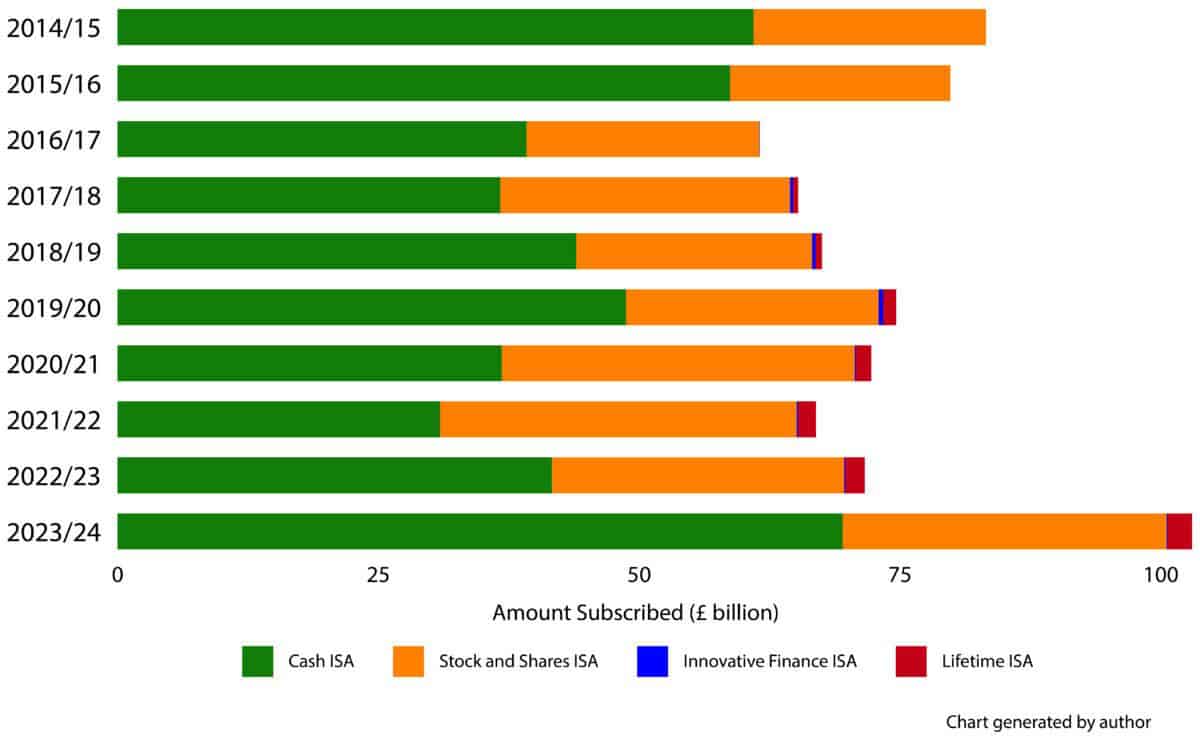

In the last financial year, for every new Stocks and Shares ISA opened, an equivalent of 2.42 Cash ISAs was opened. Even more starkly, of a total ISA savings market of £103bn, over two-thirds are stashed in Cash ISAs. The full breakdown is shown in the chart below.

Data source: HMRC

In my opinion, this weighting is skewed incorrectly. Today, the average Cash ISA yields about 4%. But, over the long term, the FTSE 100 has generated average annualised returns of 6.5% and the S&P 500, 10.5%.

Compounding gains

An individual looking for a second income of £1,500 a month at retirement will need to have accumulated an ISA pot worth £450,000. But thanks to the magic of compounding, small changes in annual percentage returns add up to huge differences when measured over decades.

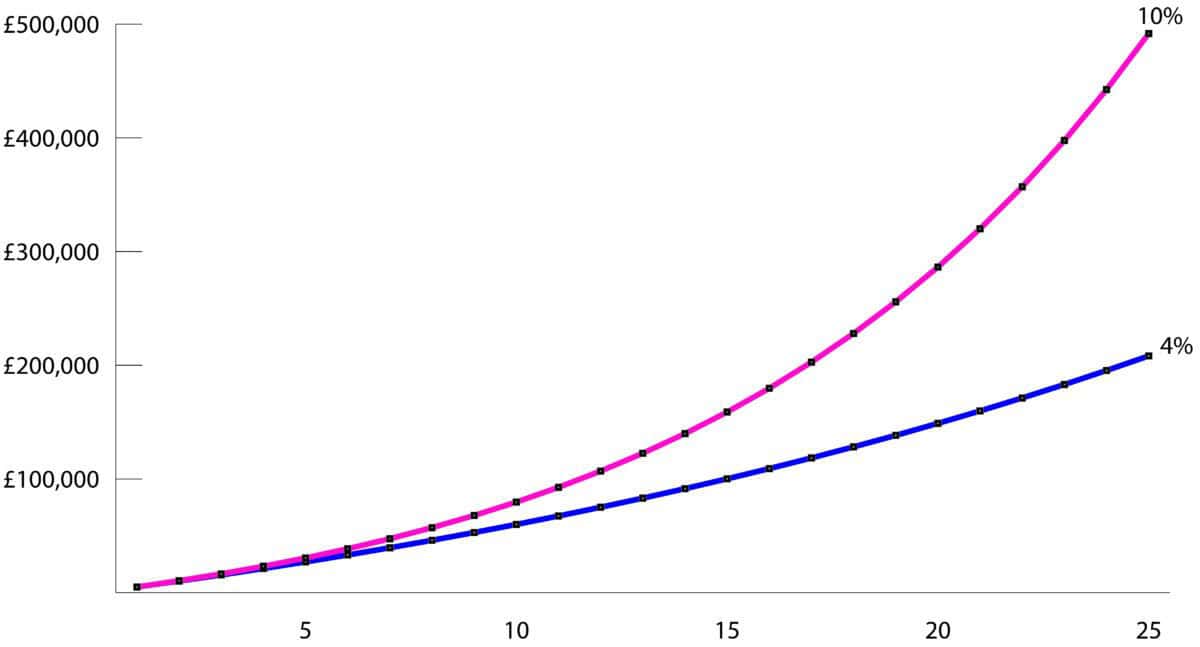

The following chart plots a yearly ISA contribution of £5,000 for 25 years attracting different annual returns. A 10% return would get comfortably to the target. But a 4% return would take 39 years – way beyond the parameters of the graph.

Chart generated by author

Stock picking

Achieving a 10% return for 25 years is undoubtedly no mean feat. But for someone willing to invest in individual stocks, it is a realistic target.

Since the turn of the millennium, many FTSE 100 stocks have been multi-baggers. These include Unilever, Associated British Foods, Diageo, Bunzl, and Rolls-Royce. As Warren Buffett once said: “let your winners run”. They will almost certainly comfortably outrun your duds.

Outside of luck, one is only ever likely to identify a handful of such stocks during an investing lifetime. This is where dividend stocks can really help supercharge a portfolio.

Dividend plays

Not all high-yielding stocks are created equal. I primarily look for a solid track record of raising dividends. Take pension and life insurer Phoenix (LSE: PHNX). Over the past 10 years, the dividend has been raised by 32%. Today, it yields a whopping 8.4%.

Both the sustainability of its dividend and future increases are tied to three financial metrics. Firstly, and most importantly, operating capital generation (OCG). At H1 2025, OCG stood at £705m. Of that amount, £274m was paid out in dividends.

Secondly, solvency coverage ratio. Currently at 175%, this signifies a strong balance sheet with plenty of options for capital investment. Finally, distributable reserves of the company are extremely healthy at £5.5bn, up 20% on 2024.

Of course, there are risks here. An ongoing challenge for the business is continued outflows from its various funds, particularly those relating to pension savings. In a highly competitive industry, this could put pressure on future margins.

But zooming out to take in the bigger picture, there is a lot to like about the business. On top of ageing demographics, a shift to defined contribution workplace pension schemes has resulted in individuals taking an increasing interest in ensuring they are saving adequately for retirement. For those seeking passive income, it is certainly a stock to consider.