With a £20,000 annual limit, the Stocks and Shares ISA provides an effective way for most investors to target a passive income in retirement.

Thanks to the huge tax savings the ISA provides — not to mention the significant compound gains share investing can deliver — someone who maxes out their £20k allowance could eventually sit back and enjoy an annual second income above £15,000.

Thinking long term

But how realistic is this target? ‘Very’ is the simple answer, based on the long-term returns of the global stock market.

Past performance isn’t always a reliable guide to the future. However, the 8% to 10% average yearly return that share investors have enjoyed over the decades is a pretty encouraging omen in my book.

Let’s split the difference, and say an investor with £20,000 in their Stocks and Shares ISA can get an average annual return of 9%. After 25 years, they would have a portfolio of £188,168, which — if they invested in 8%-yielding dividend shares — should throw off an annual passive income of £15,053.

Selecting dividend stocks

Of course, dividends are never, ever guaranteed. But a diversified portfolio of, say, 20 or more dividend stocks can protect against any company-specific shocks and help to deliver a stable second income over time.

Choosing companies with robust balance sheets, market-leading positions, and a diverse range of revenue streams can also help investors meet their passive income goals. It can also be a good idea to select companies in growing industries alongside ones in more mature, defensive sectors, as this can lead to healthy dividend growth over time.

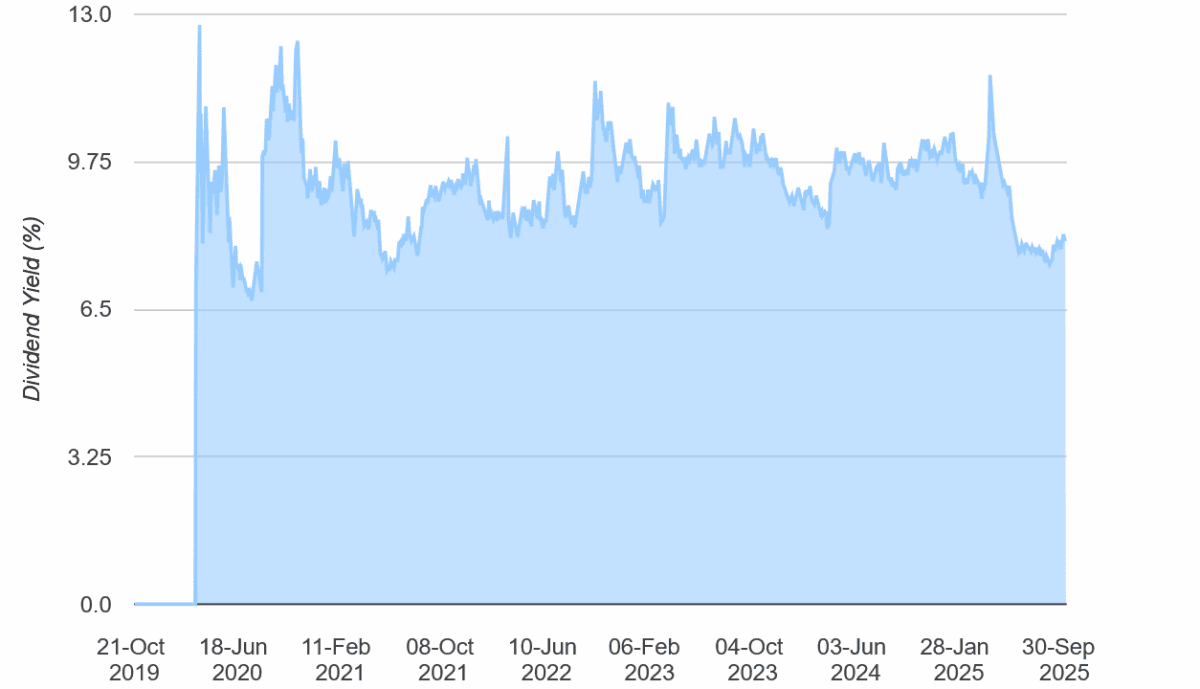

As an example, M&G (LSE:MNG) is a UK dividend share I think individuals should consider for a passive income. It’s raised annual payouts every year since it listed on the FTSE 100 in 2019. And as the graph below shows, its dividend yields have comfortably beaten the Footsie‘s long-term average of 3% to 4%.

For 2025, its dividend yield is an enormous 8.1%. And for 2026 and 2027, this improves to 8.4% and 8.7%.

A top FTSE 100 share

Dividends could disappoint if economic conditions worsen, dampening demand for M&G’s financial products. However, the likelihood of further interest rate cuts could help sales hold up in an otherwise tough environment.

Besides, the FTSE 100 company’s strong balance should continue giving it the confidence to pay large and growing dividends. As of June, its Solvency II capital ratio was an impressive 230%, more than double regulatory requirements.

Over the long term, I’m confident profits and dividends here will rise strongly, driven by ageing populations in its markets and a growing need for personal financial planning. As part of a diversified portfolio, I’m confident M&G could help deliver the passive income of £15,000 — or perhaps even more — that a £20,000 lump sum in a Stocks and Shares ISA could generate.