Defence stocks like Babcock International (LSE:BAB) have been among the best-performing UK shares in 2025. This particular contractor’s breakneck ascent saw it promoted to the FTSE 100 from the FTSE 250 mid-cap index in March.

At £11.85 per share, Babcock’s share price has risen a stunning 135% since 1 January.

Anyone who’s opened a newspaper recently will understand renewed investor appetite for defence shares like this. Worries over Russia’s military goals are rising, as the Ukraine war rolls on and drone incursions into NATO countries become more frequent.

Elsewhere, the threat of widening conflict in the Middle East is substantial. And concerns are also high over Chinese foreign policy.

Threats…

Weapons spending is especially strong in Europe, which bodes well for local operators like Babcock. Continental defence spending breached €100bn for the first time in 2024, according the European Defence Agency. The body predicts that “the new NATO target of 3.5% of GDP will require even more effort”, with the entire defence bloc tipped to spend “more than €630bn a year.“

Having said that, there’s no guarantee that British operators will capture significant amounts of this business. According to The Guardian, France has suggested limiting the amount of UK military hardware provided to the European Union’s Security Action for Europe (SAFE) defence fund.

Babcock also faces uncertainty in other regions, most notably the US. Mixed signals over foreign policy in Washington and intentions to engage in future conflicts are a possible danger for Stateside operators.

… and enormous opportunities

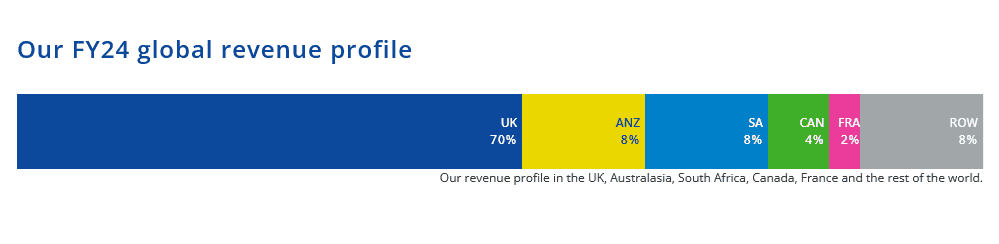

Helpfully though, Babcock sources only a tiny percentage of its sales from the US and Europe, leaving it less exposed than FTSE 100 peers like BAE Systems and Rolls-Royce.

In fact, as the graphic shows, it makes the lion’s share of sales from the UK, where defence spending commitments are especially robust.

Indeed, Britain’s renewed investment drive opens doors for further significant sales opportunities. Analysts at RBC Capital believe the UK’s recent decision to join the multinational Common Armoured Vehicle (CAVS) programme, for instance, could open the door for Babcock to sell around 1,500 vehicles along with providing service support.

I feel Babcock’s wide range of expertise — from servicing submarines and training pilots, through to manufacturing ships and land vehicles — sets it up well in the current landscape.

A top growth share

Babcock’s thriving at the moment, and earnings per share (EPS) rose 63% in the 12 months to March 2025.

City analysts expect this trend of strong growth to continue. They’re predicting an annual EPS improvement of 8% in financial 2026, and that growth will accelerate to 12% next year.

This all leaves Babcock shares trading on a forward price-to-earnings (P/E) ratio of 21.5 times. That looks toppy compared to the FTSE index’s broader multiple of 12.5 times. But then it’s worth remembering the defence stock’s superior growth opportunities compared to the broader blue-chip index.

While it’s not without risk, I think Babcock’s worth serious consideration from savvy investors.