The FTSE 100‘s one of the best places in my opinion to buy passive income stocks. The UK’s blue-chip share index is packed with stocks whose robust balance sheets, market-leading positions and diverse revenue streams make them great candidates for long-lasting dividend income.

The Footsie‘s enjoyed strong gains over the last year. This has in turn pulled the index’s forward dividend yield down to 3.2%. That’s at the lower end of the 3-4% long-term average investors have enjoyed.

But that’s still far higher than other global share indices. And what’s more, investors can still get far higher yields than this by selecting some choice individual shares.

Here, I’ll show you how investors could make a £1,000 monthly passive income with a portfolio of FTSE-listed dividend shares.

A 5-star portfolio

Currently, some of the FTSE 100’s highest dividend shares operate in the financial services sector. The three I’m choosing for our mini portfolio are Legal & General (LSE:LGEN), Phoenix Group and Aviva.

Legal & General shares currently offer the highest dividend yield among this grouping, at 9%. Phoenix follows hot on its heels with an 8.5% yield. Aviva’s lower but still offers a tasty 5.5%.

Each of these businesses are market leaders and generate substantial amounts of cash they can distribute to shareholders. They also have excellent long-term growth potential as ageing populations and growing engagement in financial planning drive product demand.

The other companies our five-share dividend portfolio are packaging manufacturer Mondi — which stands to gain from the e-commerce boom — and defensive share National Grid. These shares yield 6.1% and 5.5% respectively.

Heroic performance

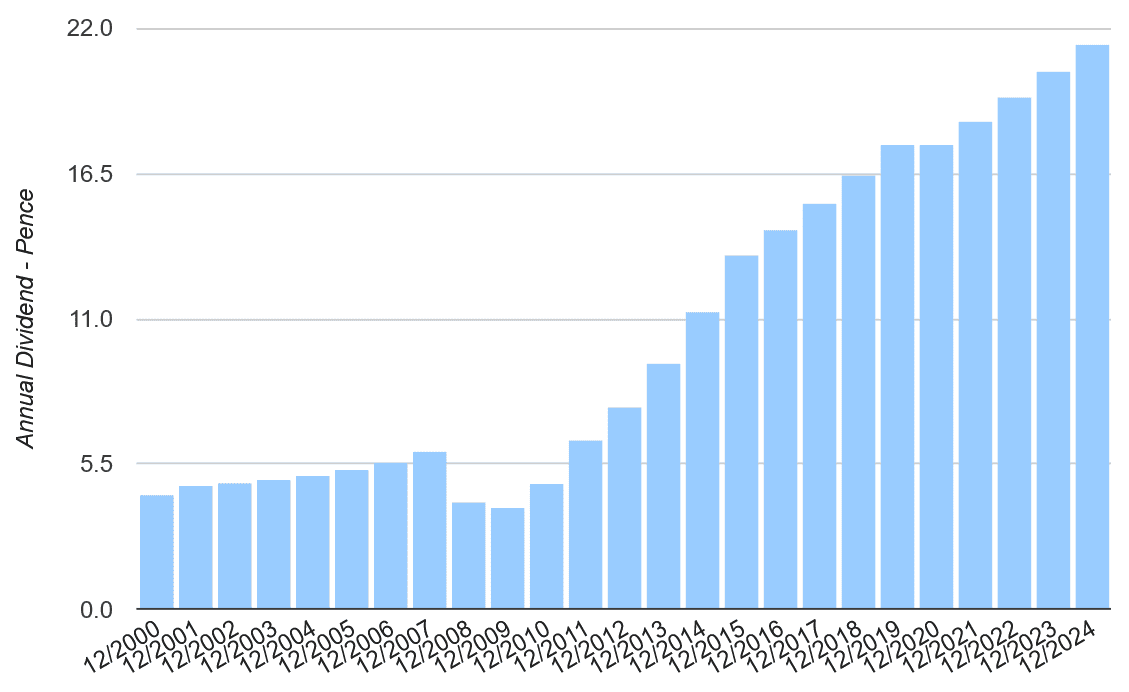

Legal & General’s one of the FTSE 100’s true dividend heroes, in my view. And that’s not just because of its enormous, near-double-digit dividend yield.

It’s raised annual dividends almost every year since the Great Financial Crisis. The only exception was in 2020 when it froze dividends during the pandemic. And even then, it performed better than many other blue-chips that slashed or cancelled dividends.

Like other financial services providers, earnings are highly sensitive to broader economic conditions. And right now the outlook remains uncertain as inflation rises and the economy splutters.

Encouragingly however, Legal & General has demonstrated resilience in this environment, with underlying operating profit climbing 6% in the first half It’s also well capitalised to help it weather any volatility and keep paying large and growing dividends. Its Solvency II ratio was 217% as of June.

A top FTSE portfolio

Of course, there are threats facing each of the five dividend stocks I’ve chosen. Dividends at Aviva and Phoenix could disappoint if consumer spending weakens. They could too at Mondi, which is also vulnerable to trade tariffs. National Grid’s dividends may come under pressure if capital expenditure balloons.

But I still think the average 6.9% dividend yield makes this mini portfolio worth consideration. A £174,000 fund, with equal sums invested across the five shares, this could generate a monthly passive income of £1,000.

That’s not a small sum. But someone could hit this target with a £500 monthly investment in just over 15 years, assuming an average annual return of 8%.