This week, the Diageo (LSE: DGE) share price dropped about 5.9%, joining other beverage giants like Brown-Forman (approximately -5%) and Constellation Brands (-4.9%) among the hardest hit in the sector.

Over the past year, Diageo’s market cap has lost roughly 17% of its value. Revenue has been only mildly weaker, but profits are not. In H2 FY2025, earnings sank to around £323m, compared with about £1.31bn in the same period a year earlier.

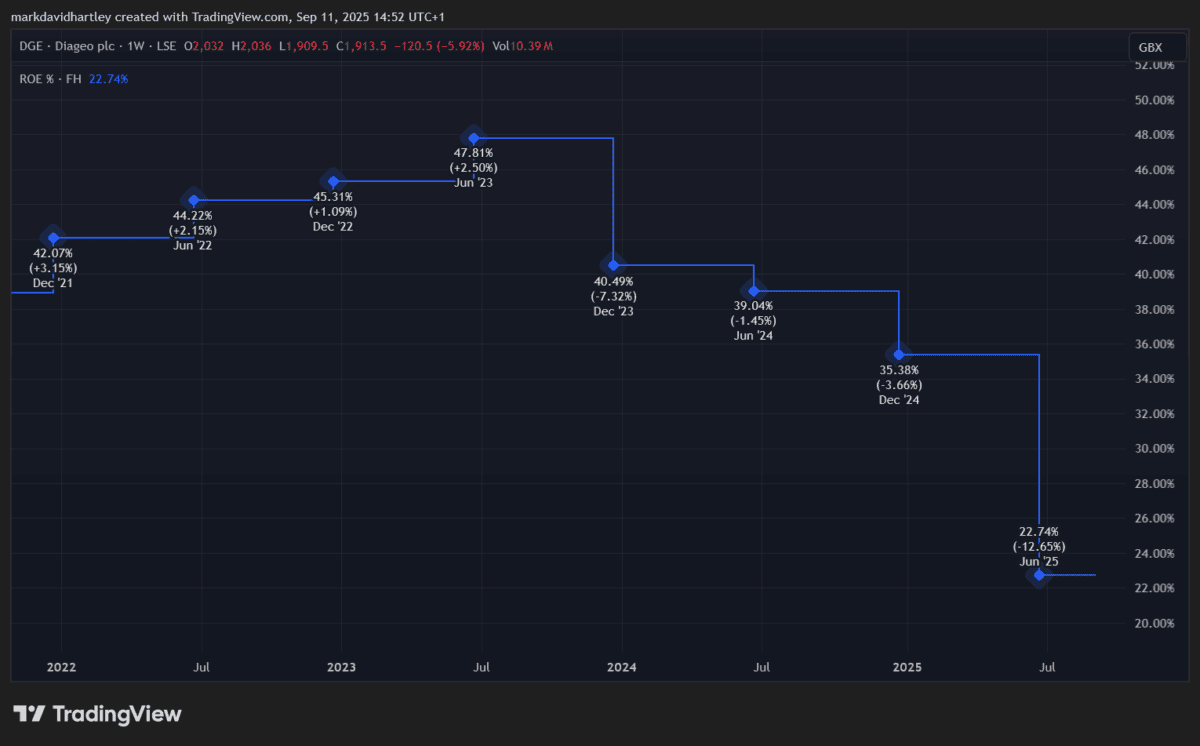

Net margin dropped from 19% to about 11.6% and return on equity (ROE) has more than halved since mid-2023.

These aren’t small fluctuations – they reflect real stress on the business.

What’s behind the slide?

A few forces are colliding. Across Europe, consumption of alcohol has been sliding and US tariff pressure have added to costs. A Jefferies survey of 3,600 consumers found that rising financial concerns are causing many to drink less – nearly 60% cited financial strain as a reason, up sharply from 36% in 2021.

In response, beverage companies including Diageo are being pushed to drive premium brands or pivot toward low- or zero-alcohol alternatives.

In support of a recovery

Amid the gloom there are signs Diageo is trying to right the ship. The company is implementing cost savings and unveiled a $500m savings programme, aiming to hit $3bn free cash flow a year from FY26 onward. It’s also pushing its ‘Accelerate’ programme to improve productivity and reduce leverage.

Meanwhile, the 4% dividend yield remains attractive to income-oriented investors and appears to be covered, though margins are squeezing.

The product mix is shifting, too. Ready-to-drink (RTD) spirits, canned cocktails, and flavoured malt beverages seem to be growing in appeal among younger drinkers. If Diageo can grab enough of that market while controlling rising costs, there is potential for recovery.

For value-savvy investors, the current pricing could be a compelling opportunity to consider — provided the risks are noted.

Diageo’s financial picture and risk factors

Looking closer at recent financials, Diageo’s organic net sales grew 1.7% year on year while operating profit slipped 0.7%.

Free cash flow rose modestly to £2.07bn, while net debt crept to £15.8bn, giving a leverage ratio of 3.4 times net debt to adjusted EBITDA. These figures suggest the business is earning less on sales and carrying a notable debt burden.

Inflation and cost-of-goods pressures remain a key risk. Tariffs still loom, particularly in the US, where Diageo’s whisky and spirits from Mexico and Canada play a large role. Furthermore, exchange-rate fluctuations are dragging on revenue in some markets.

Perhaps most critically, changing consumer preferences toward moderate or lower-alcohol options are a key threat to its business model.

Is Diageo a stock to consider now?

It’s complicated. Diageo may recover if it can effectively shift its portfolio toward trendier consumer preferences, rein in costs, and reduce its leverage.

For long-term income investors, the dividend yield still looks appealing. But with weakening margins, rising debts, and consumer behaviour shifting, the risks are real.

For those holding the shares already, it might be a matter of waiting to see whether recovery signals turn into solid results. For those considering Diageo, there’s still opportunity — but it’s definitely a stock to approach with eyes wide open.