I think these UK shares are excellent choices for investors to consider if they’re seeking a strong second income. Here’s why.

Platinum play

Gold stocks aren’t the only game in town for investors looking to seize upon soaring previous metal prices. Purchasing shares in platinum group metal (PGM) producers is another potential play to look at as prices here also take off.

Gold prices have risen 45% in value over the last year. Platinum, meanwhile, has risen 47% over the period. And it could be due for further significant gains as metal supply falls.

According to the World Platinum Investment Council, total platinum supply will slip to five-year lows in 2025. With jewellery demand growing and investment interest also rising, the organisation expects the market to record an 850,000-ounce deficit this year.

Purchasing platinum stocks like Sylvania Platinum (LSE:SLP) can be a more profitable way of capitalising on appreciating metal prices than physical metal or a metal-tracking fund. This South African miner’s 75% share price rise over the last year illustrates this theory.

Miners enjoy a ‘leverage’ effect, where revenues rise alongside commodity prices while their costs remain largely stable. This can lead to supersized profits, as indicated by the 118% year-on-year EBITDA increase Sylvania enjoyed in the last financial year (to June 2025).

Be aware that the ‘leverage’ factor can also mean earnings can nosedive if metal prices reverse. But right now I think this phenomena should continue working in the company’s favour.

City analysts share my optimism, and expect earnings to almost double in the financial 2026. Forecasts are also boosted by company plans to boost full-year platinum, palladium, rhodium and gold — the so-called 4E grouping — to between 83,000 and 86,000 ounces from the record 81,002 last year.

This also means brokers expect the annual dividend to soar to around 4p per share this year from 2.75p last year. That leaves Sylvania Platinum carrying a healthy 5.2% dividend yield.

A FTSE 100 favourite

BAE Systems (LSE:BA.) doesn’t offer this sort of high dividend yield over the near term. For 2025 and 2026, they sit at 1.8% and 2%, respectively.

Yet the prospect of more market-beating dividend growth still makes this FTSE 100 share worthy of serious attention.

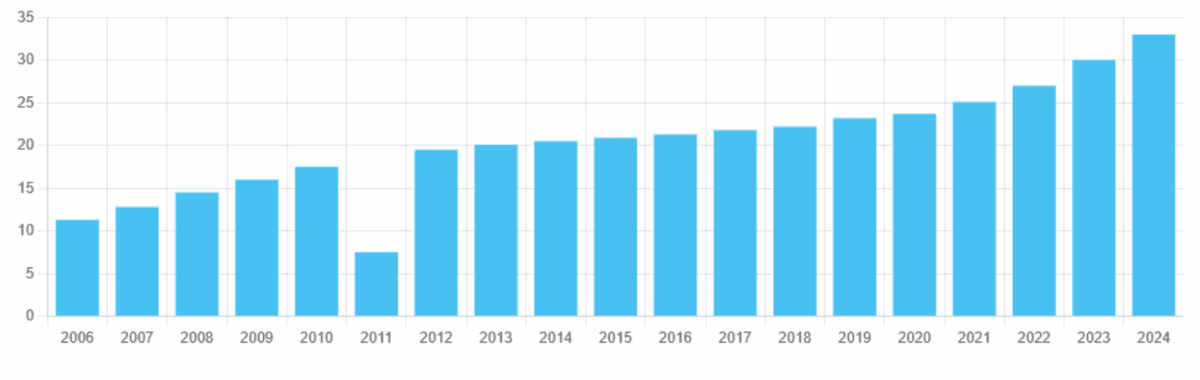

Shareholder payouts have risen every year since 2012, resulting in last year’s 33p per share dividend. And City brokers are expecting them to rise another:

- 8% in 2025, to 35.7p.

- 10% in 2026, to 39.4p.

To put all that in perspective, dividend growth across the broader UK share index has averaged 3%-4% this century.

This doesn’t make BAE Systems a no-brainer stock to buy though. As a major supplier to the Department of Defense, its profitability is exposed to any pulling back in US military activity on the global stage.

Yet this isn’t a formality as the geopolitical landscape continues to evolve. Besides, the company can expect sales to other key customers like the UK, Australian and Saudi Arabian governments to keep rising. Strong spending from NATO countries and partner countries drove group sales 11% higher in the first half.

This in turn encouraged BAE to lift the interim dividend 9% year on year. With Western rearmament tipped to continue, I’m expecting dividends to keep marching higher as well.