A Stocks and Shares ISA is one of the most efficient ways to grow wealth over time. Nevertheless, building a nest egg large enough to enable a yearly withdrawal of £100,000 is undoubtedly a tall order. But I am going to illustrate one potential way that it can be done.

Realistic example

Let us assume that an individual opens a Stocks and Shares ISA at 22, with their first job. Their aim is to retire at 63 and to withdraw £100,000 a year for 25 years.

Earning only a modest salary to begin with, they aim to put aside £2,000 a year for the first 15 years.

For the sake of this example, we’ll assume they invest the money at the end of the year. This makes it like an ordinary annuity, when the first payment occurs one year in the future. Using the long-term average return of the S&P 500 and FTSE 100, as a benchmark, the individual is targeting a modest 8% yearly return from their portfolio.

Crunching the numbers

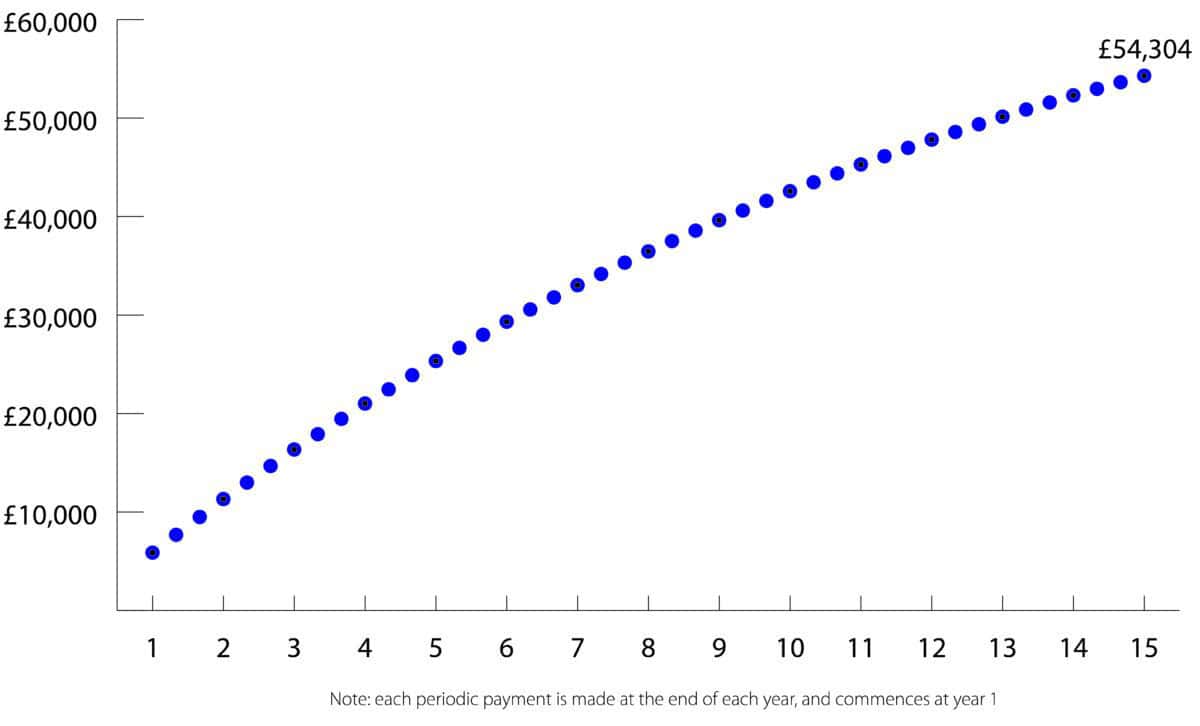

As the line graph below shows, a yearly contribution of £2,000 for 15 years, compounded at 8%, would be worth £54,304.

Graph generated by author

Next, we need to calculate the present value of the total retirement pot 40 years in the future. This turns out to be £1,067,477.

To figure out how much they need to save each year after the first 15 years is not simply a matter of subtracting the two amounts to find the savings gap. This is because the value of the savings aged 38 and aged 63 are not equivalent to each other.

Think of it this way: would £10,000 received today be equivalent in value if instead it was received in 25 years’ time? Of course not, because inflation erodes the value of money over time.

So what we need to do is to discount back the value of the retirement pot 40 years in the future (£1,067,477), to 15 years in the future. We discount back using the same rate of return, namely 8%. This is because the individual is aiming to compound their savings by that amount each year. Performing the calculation, this turns out to be £155,870.

Subtracting £54,304 from £155,870 equals approximately £100,000. That is how much will need to be invested, starting aged 38, for 25 years to meet their retirement goal. That equates to a yearly payment of £9,515.

Dividend stock

What this example illustrates is that time is an investor’s greatest ally. Over a 40-year time horizon, a modest sum of £155,000 can compound to over £1m!

Of course, an investor needs to compose a portfolio capable of returning an 8% annual return. I think this can predominantly be achieved choosing dividend-paying stocks.

One business yielding 7.8% today is FTSE 250 leading asset manager, Aberdeen (LSE: ABDN). A major reason for the market-beating return has been its faltering share price, which recently hit an all-time low. However, I believe there are reasons to be optimistic.

Firstly, interactive investor, its direct-to-consumer investment platform. Over the past few years, it has been gobbling up market share and is closing the gap rapidly on market leader, Hargreaves Lansdown.

Secondly, outflows from its critical Advisor business have reduced significantly over the past year. It looks to be on a clear path back to net inflows, which will provide a massive boost to profits – and potentially future dividends.

Significant risks still do remain. Passive investing strategies continue to be the preferred choice of investors today. This is nowhere near as profitable as many of Aberdeen’s funds, which are actively managed.

Nevertheless, as part of a balanced portfolio, the opportunity to compound returns over the long-term looks compelling to me. That is why I recently added the stock to my Stocks and Shares ISA.