It might seem strange to link value stocks with the Baillie Gifford China Growth Trust (LSE:BGCG). After all, it primarily invests in Chinese tech stocks that are growing like gangbusters.

Moreover, after enduring a difficult few years, shares of the investment trust are up 60% in the past 12 months. So, what’s going on? Let’s take a look.

Tricky period

Baillie Gifford took over the Witan Pacific Investment Trust in 2020 and gave it a Chinese growth makeover. However, after reaching a peak in early 2021, the share price fell off a cliff. In fact, it’s still down 55% since February 2021.

Three reasons explain this. First, there was a dramatic post-Covid slowdown in China, with its economy not bouncing back as strongly as expected. Weak consumer spending and property sector woes also weighed on growth.

Also, rising interest rates made growth stocks less attractive worldwide, hitting Baillie Gifford’s China bets especially hard.

Finally, there was a tech crackdown from Beijing’s regulatory bodies. These targeted internet giants like Alibaba and Tencent, spooking investors and slashing valuations.

Discounted tech stocks

These discounts still persist. E-commerce giant Alibaba, for example, is sporting a forward price-to-earnings (P/E) ratio of just 13.7.

For context, that’s less than Tesco, despite Alibaba operating in high-growth markets like international e-commerce, cloud computing, and AI.

Another cheap stock in the portfolio is PDD Holdings, the parent company of Pinduoduo and Temu. It’s trading on a forward P/E multiple of 12.5.

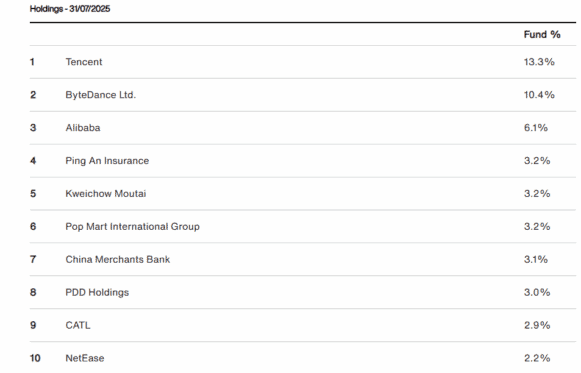

The investment trust also has private holdings, the largest of which is TikTok owner ByteDance, at around 10% of assets. Last year, ByteDance generated revenue of $155bn, up 38% year on year, and it’s aiming for roughly $186bn this year.

That would put it near rival Meta’s revenue. Yet ByteDance’s $335bn valuation is a fraction of Meta’s meaty $1.85trn market cap. So we can see how cheap these tech holdings are.

That said, it also owns Pop Mart International. Shares of the Labubu doll maker have surged 610% in a year, so they’re not cheap anymore.

Given the rate at which my daughter asks me to buy her more Labubu dolls, Pop Mart stock is destined to keep rising!

The top 10 holdings make up 50% of assets, meaning the portfolio is concentrated. High conviction is a plus for me, though it adds risk if top holdings don’t perform.

Mixed performance

While the one-year performance has been strong, the five-year chart hasn’t been so good. The net asset value (NAV) has fallen around 14% versus a 5% decline for its benchmark.

As such, the trust will offer shareholders a full buyback at NAV in 2028 if it fails to beat its benchmark between late 2024 and 2028.

This doesn’t protect against poor performance, but it does de-risk the investment case somewhat.

Worth a look

When US-listed Russian stocks essentially became worthless following Moscow’s invasion of Ukraine in 2022, I envisioned something similar happening with US-listed Chinese stocks if Beijing ever invaded Taiwan. I think this is an outside risk.

Therefore, I’m satisfied getting limited Chinese exposure through Scottish Mortgage Investment Trust.

However, for readers wanting to invest cheaply in leading Chinese tech firms, this trust may be worth a look. It’s currently trading at a 9.5% discount to NAV.