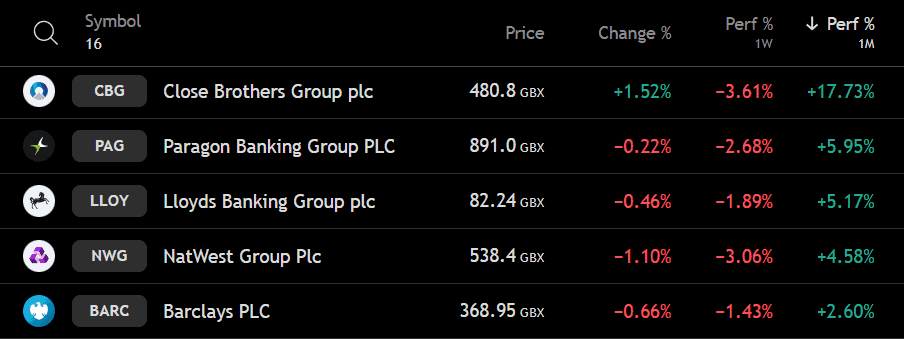

Up 5.17%, the Lloyds share price has done well this month, beating out all the other major UK banks including NatWest, Barclays and HSBC. As Britain’s biggest retail bank, Lloyds is often seen as the bellwether of the sector.

But while it’s led the FTSE 100 pack, two regional FTSE 250 players are actually ahead.

Close Brothers Group’s (LSE: CBG) jumped 17.73% this month, while Paragon Banking Group‘s (LSE: PAG) up 5.95% (as of 28 August).

That begs the question: do these smaller lenders offer the same long-term value as Lloyds? I decided to take a closer look.

Flying too close to the sun

Close Brothers has been one of the most remarkable performers of 2025, with its share price almost doubling year-to-date. The specialist financial services group provides lending, securities trading and investment management solutions across a range of sectors.

Much of the recent rally came after the Supreme Court overturned previous rulings on car loan sales practices. That decision lifted a cloud hanging over several banks – Lloyds included – and helped spark investor enthusiasm.

As a result of a one-off provision of £165m put aside, Close Brothers posted a loss in its latest results. However, it’s now unlikely that the full amount will be needed so this loss will likely adjust in the next earnings call.

Still, it remains vulnerable to economic downturns, regulatory changes and competitive pressures. While it does well in stable conditions, it could face headwinds in a weaker economic environment.

To be fair, the stock does look cheap on paper, trading on a forward price-to-earnings (P/E) ratio of 8.2 and a price-to-book (P/B) ratio of just 0.47. Yet some analysts believe the good news is already priced in. RBC Capital Markets recently downgraded the stock to Sector Perform, keeping its price target at 525p.

The risk, in my view, is that Close Brothers may struggle to justify the recent surge if profitability doesn’t follow.

A reliable income stock

Paragon Banking Group, on the other hand, offers a steadier story. Known for its focus on specialist mortgages, consumer loans, and buy-to-let lending, the bank has built a reputation as a dependable dividend payer. It currently yields 4.6%, backed by a 20-year history of payments and a payout ratio of around 40%.

Valuation looks undemanding too, with a forward P/E ratio of 8.6 and a P/B ratio of 1.2. Importantly, Paragon’s profitable – it boasts a 21.5% operating margin and a return on equity (ROE) of 14.7%. In its Q3 trading update, loan balances rose 4.8%, underlining steady business growth.

Broker sentiment remains cautious but constructive. On 26 August, Jefferies issued a Hold rating with a target of 1,015p, while the broader analyst consensus sits at around 1,000p – implying a potential 12% increase from today’s price.

My verdict

Despite outperforming Lloyds this month, Close Brothers has still shed 58% of its value over the past five years. But this year’s recovery has rewarded shareholders handsomely, so it’s starting to look like a promising stock that’s worth considering.

Paragon, in some ways, looks even more attractive. For income investors seeking a reliable and fairly valued opportunity, it seems like a stock worth considering. Lloyds may remain the UK banking heavyweight but, on balance, I think Paragon deserves a place on any watchlist.