Gamma Communications (LSE:GAMA) is a relative newcomer to the FTSE 250. The company only joined the main UK stock market in May and was added to the index at the end of June.

The stock’s down 33% over the last five years, but during that time sales have grown 76% and earnings per share have doubled. And that makes it stand out as a potential opportunity.

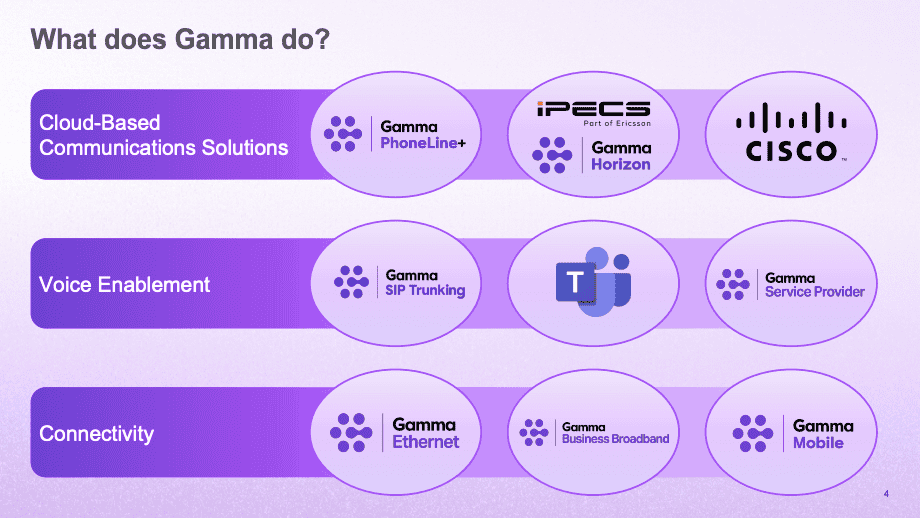

What does Gamma do?

Gamma Communications is a business-to-business communications provider. It provides integrated phone, video, and messaging services for businesses via the cloud.

Source: Gamma Communications FY 2024 Results

Importantly, it also integrates with other platforms. So firms that already use Microsoft Teams don’t have to shift their entire setup – they can add phone capabilities to their existing platform.

The firm achieves 99.999% uptime, which is crucial for businesses where reliability’s critical. And owning its own fibre gives it a competitive advantage – something I look for in all my investments.

Evidence of this comes from the fact that 89% of Gamma’s sales are recurring revenue. This is a sign customers either can’t or don’t want to switch to other providers.

Why has the stock been falling?

There’s a lot to like about Gamma, so the obvious question is why has the stock been falling over the last five years? Despite the firm’s growth, I think there are three main reasons.

The first is the way the world was five years ago. Remote working during the pandemic caused the stock to surge, but it came back down to earth as things returned to normal.

The other is the company’s latest guidance – in May, Gamma reported ongoing softness in the UK market. That’s an issue for a business that generates 80% of its sales domestically.

The third reason is the firm moved from the Alternative Investment Market to the main UK stock market. This might have resulted in some forced selling from funds with specific remits.

Valuation

Five years ago, Gamma had a market value of £1.4bn and generated £43m in free cash flow (adjusted for stock-based compensation). That’s a cash flow yield of around 3%, which is, well, ok.

Today, the market value is £973m and the company generated £85m in free cash last year. That’s an implied return of 8.7%, which is much more attractive – especially for a company with a strong balance sheet.

In other words, the current valuation reflects a much less optimistic outlook than the one from five years ago. And the short-term weakness provides some justification for this.

I think however, the market’s become too pessimistic. With earnings expected to reach £1.21 by 2028, the stock looks like a bargain to me at £10.70.

I’m buying

In general, I’m wary of buying shares in telecoms businesses. A combination of high capital requirements and limited growth prospects generally puts me off investing.

With Gamma though, I’m happy to be making an exception. The company achieves strong returns on equity and it has some genuine competitive strengths.

I’ve previously thought the share price was prohibitively high. But at a price-to-earnings (P/E) ratio of 15, I’m excited to have a chance to add the stock to my portfolio in September.