Generating £20,000 a year in passive income might sound like a tough ask, but it’s achievable with consistency, time, and the power of compounding. I’m thankful to have been investing for some time, which means I’m well on my way to having a portfolio that could generate £20,000 annually.

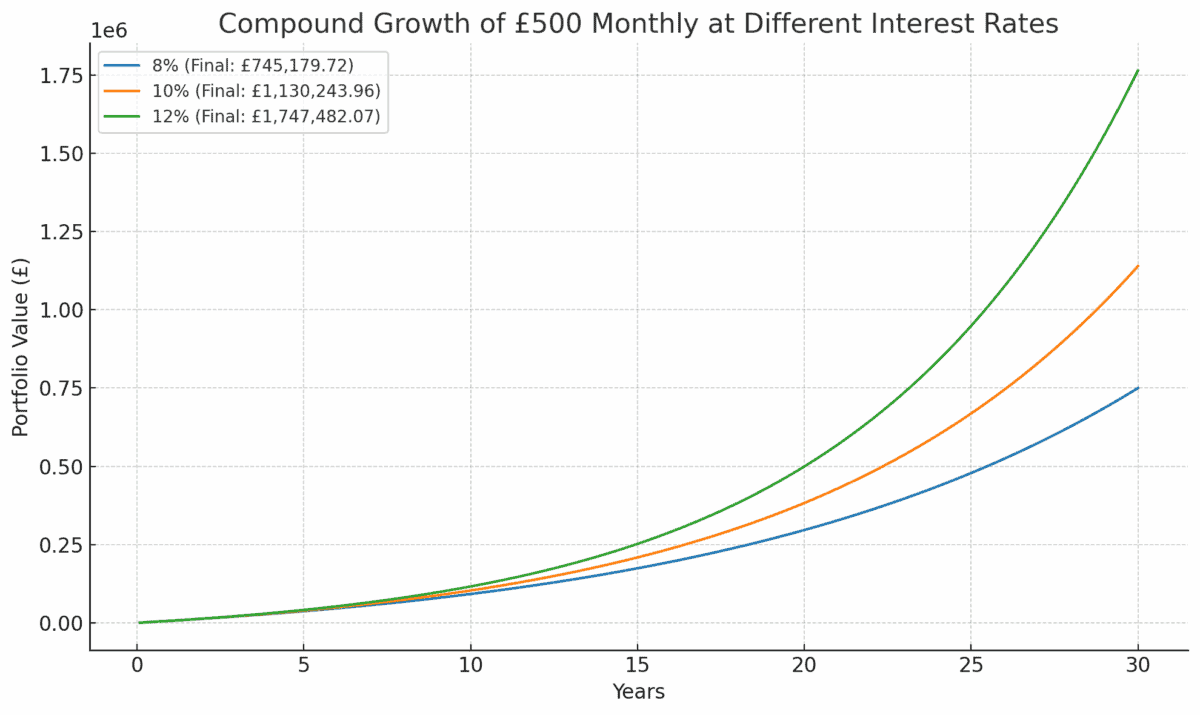

But what if an investor were starting from scratch? Well, starting this September, they could open a Stocks and Shares ISA with a reputable UK brokerage and invest £500 per month into a diversified portfolio of equities — not just UK stocks. Assuming an average 8% annual return, this simple plan could build real wealth over time.

Here’s how the numbers stack up:

- After 10 years: £60,000 invested, portfolio worth £91,473

- After 20 years: £120,000 invested, portfolio worth £294,510

- After 25 years: £150,000 invested, portfolio worth £475,513

Using these calculations, the investor could hit £400,000 after 23 years. And with a withdrawal rate of 5%, this could provide just over £20,000 annually — while potentially preserving the invested capital.

Staying on track

To stay on track, they could automate the monthly contributions, reinvest dividends, and rebalance annually. This removes the temptation to skip months and keeps the focus on long-term growth without needing constant attention.

The key, though, is to start. Delaying by five years could cost over £100,000 in missed gains. Investing rewards time, not necessarily timing. As such, even though the market looks a little hot in places, September could still be a great time to get going.

All of this is possible due to the power of compounding — the process by which returns generate their own returns over time. By reinvesting gains, even modest monthly contributions can snowball into substantial sums, especially when combined with time and a consistent growth rate.

It’s not just about how much is invested, but how long the money stays invested and continues to grow upon itself. This is why compounding is often described as one of the most powerful forces in finance.

Where to invest?

With £500 a month, the investor could choose to invest in one or two stocks a month, and build out a diversified and hand-picked portfolio over time.

One stock I like and that I believe investors should consider is Jet2 (LSE:JET2). Despite the challenges put on UK businesses by the Budget, especially those with a large number of staff, Jet2 remains attractive with a fortress-like balance sheet

This strength is reflected in its valuation metrics. While the forward price-to-earnings (P/E) ratio for 2025 is around 7.8 times, the enterprise value-to-EBITDA is closer to 1.4, which suggests the market is discounting its profitability once we adjust for net cash.

In other words, the stock looks cheap when you strip out the cash. Analysts seem to agree: consensus sits firmly at Buy, with an average share price target 31% above the current share price.

One reason for this undervaluation could be its slightly older fleet. However, I think that the overhaul programme is underway and won’t compromise the balance sheet.