With the cost of living in retirement soaring, the importance of investing in UK stocks is (in my opinion) growing considerably. New research from Shepherds Friendly this week underlines the scale of the challenge facing us.

Using the ’25 times’ rule, it calculates that the average Briton will need £743,338 in savings, investments or other income to enjoy two-and-a-half decades of financial independence. This concept suggests individuals must save 25 times their annual salary to maintain their lifestyle for 25 years.

Shepherds Friendly says its numbers are “based on an average annual expenditure of £31,653, amounting to £1,168,765 over 25 years with inflation, plus typical household debt of £121,525 and a six-month emergency fund.”

Building wealth

As one would expect, this £743,338 figure isn’t a one-size-fits-all target. It suggests the lowest-earnings households will need £381,107 to sustain their financial independence over 25 years.

However, the amount that a household in the top 10% of earners is three times that for lower earners, Shepherds Friendly says, at £1,322,483. That’s assuming an average annual expenditure of £57,914.

Some of these figures seem enormous on paper. It underlines the importance of starting early on the path of retirement planning, where the impact of compounding to build wealth is most effective.

But while this can make an investing journey less stressful and less expensive each month, it’s not impossible for those later on to catch up. Here’s one strategy that could see a 40-year-old achieve financial independence once they hit the State Pension age of 68.

Investing wisely

First, they should consider opening a tax-efficient Stocks and Shares ISA or Self-Invested Personal Pension (SIPP). By protecting themselves from capital gains and dividend tax, they’d get more from their investments and give them more financial firepower to compound their wealth.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

The next thing could be to prioritise investing in UK and international stocks. Putting money in savings accounts provides a guaranteed return where the money is safe. However, investing in low-yield cash accounts is unlikely to generate the returns needed for financial independence.

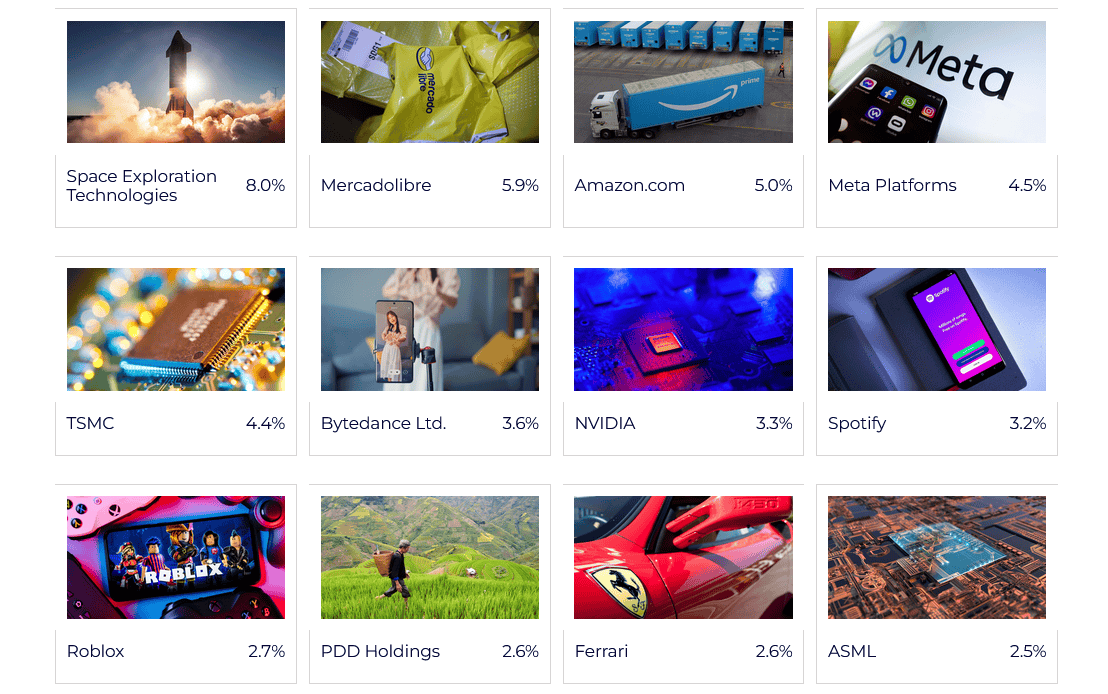

Investors can mitigate the higher-risk nature of stock investing too, without compromising the potential to make life-changing returns. This can be achieved with an investment trust that holds a portfolio of assets, like Scottish Mortgage Investment Trust (LSE:SMT).

It’s name is misleading, as rather than investing in loans or real estate, it actually focuses on high-growth technology shares. This can leave it vulnerable to underperformance during downturns. But over the long term, it provides the power for investors to harness white-hot tech trends like artificial intelligence (AI), space exploration, robotics and cloud computing.

Indeed, since 2015 it’s delivered an average annual return of 15.9%. As part of a wider portfolio, I think it could be a great way to build wealth over time.

A 40-year old, investing £500 in UK stocks and achieving a 9% yearly return, could achieve that magic £743,338 retirement fund by the time they hit State Pension age. However, it’s important to remember that returns could fall short of that target as well as exceed it.