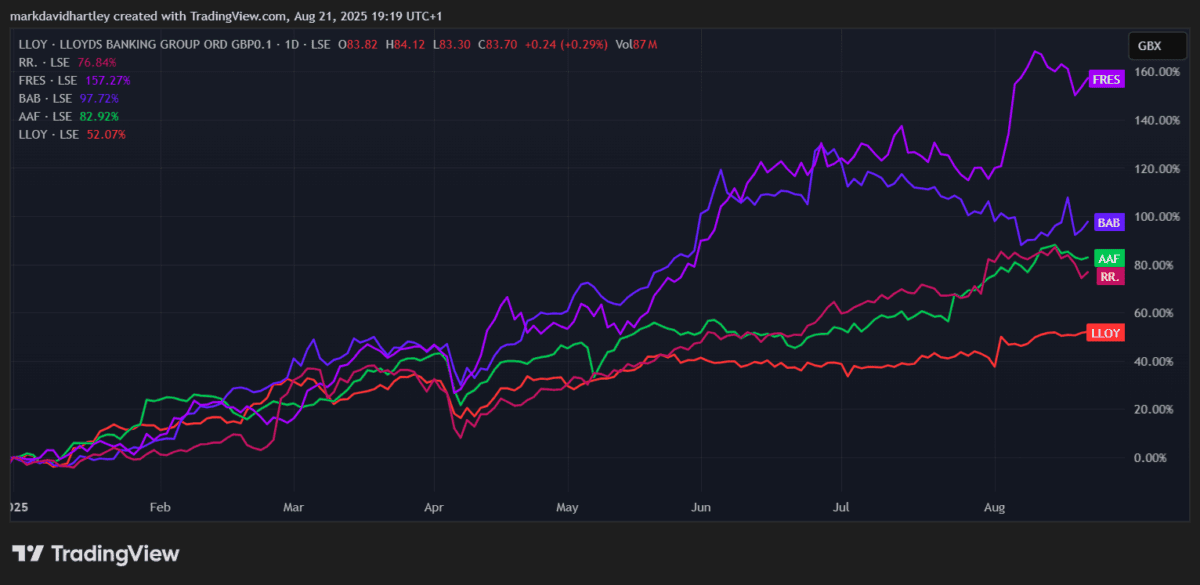

Lloyds‘(LSE: LLOY) shares continued their seemingly endless climb this week, bringing their total year-to-date gains to an astonishing 54%.

Only a handful of FTSE 100 stocks are doing better, including Fresnillo, Babcock, Airtel Africa and the ever-popular Rolls-Royce. Among the banks, Lloyds is leading the pack. NatWest and Barclays are up around 40%, while Standard Chartered has risen 37% and HSBC 24%.

That’s quite the turnaround for a bank that not so long ago was widely seen as a serial underperformer.

A speeding train?

RBC Capital Markets recently likened European banks to a “speeding train” in a research note. That sounds exciting, but the analysts also highlighted how vulnerable the sector remains to geopolitical and macroeconomic shocks. Lloyds was among their favoured picks, joined by Deutsche Bank and OSB Group.

Goldman Sachs has also taken a more bullish stance, raising its price target on Lloyds shares to 99p from 87p earlier this month. On average, 18 analysts now see the stock heading to 90.7p over the next year – around 8% higher than today. Eleven analysts even have a Strong Buy rating, while eight are sticking with a Hold.

It seems confidence is returning in a big way.

PayPoint partnership

Another promising development is the news of Lloyds’ partnership with PayPoint. Through the BankLocal service, the group’s customers will soon be able to make cash deposits at more than 30,000 locations across the UK.

That means simple and convenient access to pay in up to £300 a day in notes and coins, with the money showing in accounts within minutes. Importantly, Lloyds will be the first of the high street banks to fully embrace the scheme.

In an era where bank branches are closing at a record pace, it looks like a smart move that could help maintain customer loyalty.

Reliable income… for now

Income remains an important reason why many investors buy Lloyds shares. However, the recent rally has pushed the dividend yield below 4% for the first time in nearly three years.

Still, dividends are growing. Forecasts suggest payouts could reach 4.7p per share by 2027 – a 48% increase from today’s 3.17p. Not bad at all, though history shows caution is needed. When Covid struck, Lloyds slashed its dividend in half. If a similar shock reoccurred, shareholders could face the same disappointment.

Interest rates and inflation also remain risk factors. A sharp change in either could hit the bank’s profitability hard.

Still good value?

All this growth has not gone unnoticed. Lloyds’ forward price-to-earnings (P/E) ratio now sits at 11, which is higher than NatWest, HSBC and Barclays. Its debt-to-equity ratio is also notably higher than most of its peers.

That suggests Lloyds might no longer be the bargain it once was. But while the best gains could already be in the bag, I wouldn’t expect the growth story to vanish overnight.

For long-term income investors, Lloyds remains an attractive FTSE 100 pick to consider. The valuation is no longer dirt cheap, but with dividends set to rise and new services like PayPoint partnerships adding value, there’s still a strong case for owning this British banking giant.