By her second birthday, my daughter’s Self-Invested Personal Pension (SIPP) and Junior Stocks and Shares ISA could be worth £20,000. And if neither her nor I ever contributed to it again, it could reach £2.9m by her 52nd birthday, if we were lucky enough to achieve 10% annualised growth.

That’s the power of compounding. When money’s given decades to grow, even modest sums can snowball into life-changing wealth. The earlier the start, the greater the advantage. And in this case, the combination of a Junior ISA and a SIPP means her savings benefit from both tax-free growth and government top-ups.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

How it all works

Take the SIPP, for example. For every £80 contributed, the government adds £20 in Basic rate tax relief. That means a £3,000 out-of-pocket contribution turns into £3,600 invested. It’s a 25% uplift before a single share’s bought. Growth within the SIPP’s tax-free, and while she won’t be able to access it until her 50s, the deferred access could be a feature, not a bugbear. It’s long-term capital with a long-term purpose.

The Junior ISA meanwhile, offers flexibility and accessibility at age 18. With no tax on withdrawals, it can complement the SIPP as a retirement fund or contribute towards buying a house. As the investments grow, no capital gains or income tax will erode the returns.

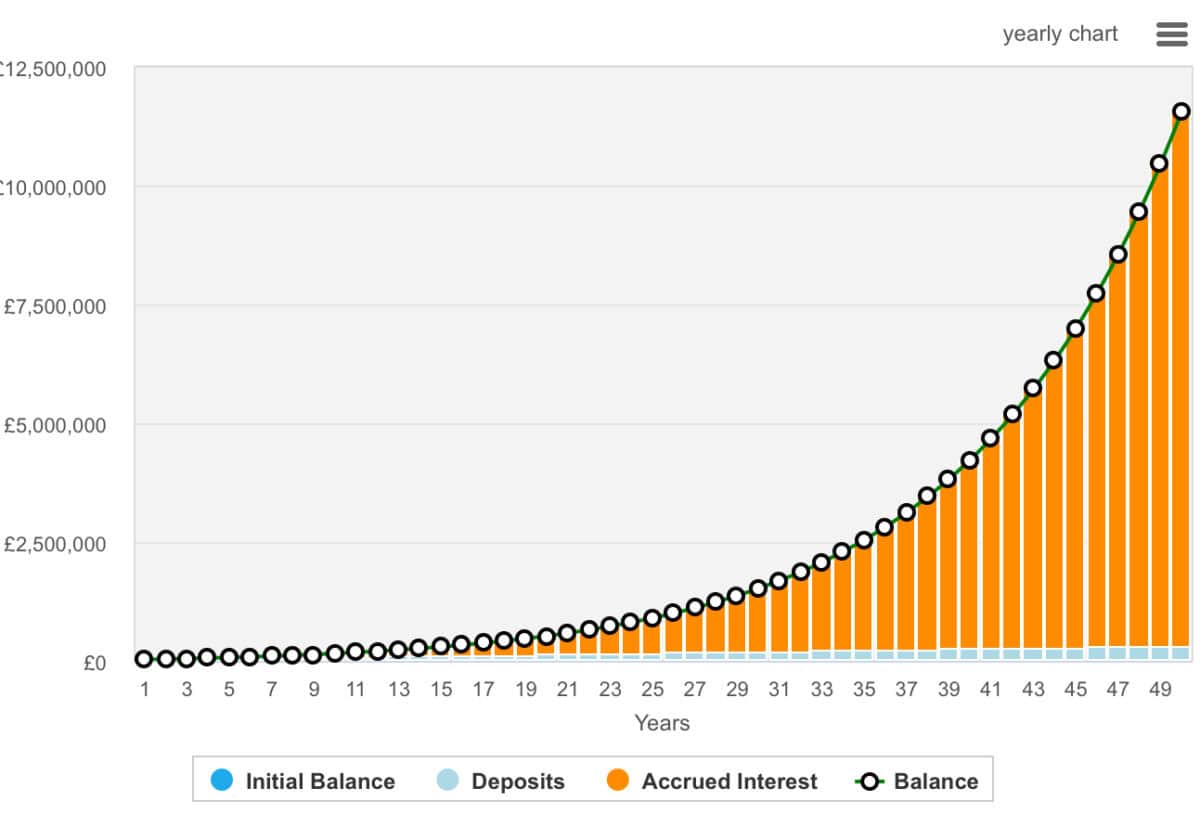

Of course, if either of us were to contribute £500 monthly over the next five decades, the result could be staggering — a portfolio valued at £11.5m. That figure assumes that 10% annualised return, which mirrors the historical performance of the US (not UK) market, but it’s not guaranteed. Markets fluctuate, and poor investing choices can lead to losses. But done well, starting young changes everything.

Where to invest?

Investors could look at index tracking funds or even investment trusts as an opportunity to gain immediate diversification. But some investors will prefer to pick individual stocks, aiming to beat the market over the long run.

Melrose Industries (LSE:MRO) is one stock I believe is worthy of consideration, trading at a forward price-to-earnings (P/E) ratio of around 15.1, indicating potential value relative to its earnings growth prospects.

The company’s financial performance has been strong. Adjusted diluted earnings per share increased by 30% to 15.1p in the first half of 2025. This growth’s underpinned by strong demand in the aerospace sector, particularly in defence and commercial aviation, where Melrose’s subsidiary, GKN Aerospace, holds significant positions. Management believes it can deliver 20% annualised earnings growth in the years through to 2029.

However, investors should be aware of certain risks. Net debt‘s one that needs to be considered. It stood at £1.4bn at the end of the first half. This could be a drag on performance going forward.

Despite this, Melrose’s strategic focus on aerospace, coupled with its strong potential for earnings growth, makes it as an attractive option for investors. I believe it’s certainly worth considering.