Dividend shares can be a great way to target a retirement income in a Stocks and Shares ISA. Here’s one strategy that could help investors reach that target.

Living off dividend stocks

Individuals who use a Stocks and Shares ISA have enjoyed stellar returns over the last decade — delivering an average yearly return of 9.6% (according to Moneyfacts). These products don’t just harness the enormous wealth potential of share investing. They also boost shareholders’ returns by protecting them from capital gains tax and dividend tax.

Past performance isn’t a reliable guide to future gains. But a monthly £300 investment in one of these tax wrappers that acheived that 9.6% average return would — after 30 years — build a portfolio worth £622,924.

With this nest egg secured, an investor could buy an annuity product for a guaranteed lifetime income. Or they can draw down a set percentage each year (4% is a popular figure that provides a passive income for roughly 20 years).

My preferred route is to buy high-yield dividend shares. With a £622,924 portfolio invested in stocks that yield 7%, on average, one could expect to enjoy a near-£44k passive income.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

A winning portfolio?

The trouble, however, is that dividends are never guaranteed. And even the most reliable passive income stock can cut, suspend, or cancel cash rewards when crisis rears its head.

Building a well diversified portfolio can help investors to shield themselves from shocks. Here’s one example of how a balanced share basket could look:

| Dividend share | Country | Sector | Dividend yield |

|---|---|---|---|

| Legal & General | UK | Financial services | 8.3% |

| Verizon Communications | US | Telecommunications | 6.3% |

| Evonik Industries | Germany | Chemicals | 7% |

| Engie | France | Utilities | 8.6% |

| Global X SuperDividend ETF (LSE:SDIP) | UK | Exchange-traded funds (ETFs) | 9.9% |

| United Parcel Service (UPS) | US | Transportation | 7.6% |

| Persimmon | UK | Housebuilding | 5.3% |

| Mizuho Medy | Japan | Healthcare | 7.4% |

| Warehouse REIT | UK | Real estate investment trusts (REITs) | 5.6% |

| HSBC | UK | Banking | 5.2% |

As you can see, this portfolio is well diversified by region and sector. This reduces risk, and — thanks to a balance of cyclical and non-cyclical companies — could help to provide a smooth return over the economic cycle. Its broad composition also provides exposure to a wide range of growth and dividend opportunities.

The average dividend yield on this portfolio is 7.1%, which is just above our 7% target needed to deliver that £44k passive income.

Diversifying for strength

While the portfolio isn’t very large on paper, the inclusion of the Global X SuperDividend fund actually provides it with substantial depth. The ETF market has boomed in recent years, allowing investors to instantly tap into a broad range of assets.

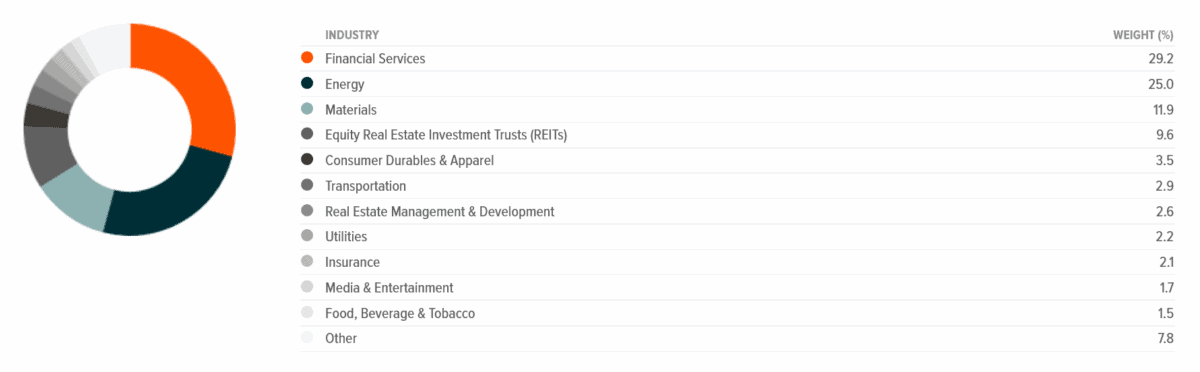

This particular one holds shares in 100 of the highest dividend-paying businesses on the planet. These range across more than a dozen industries, thus providing excellent diversification:

Major holdings here include financial services provider Bright Smart, satellite operator SES, and asset manager Aberdeen.

Region wise, the US represents the fund’s largest allocation. It makes up around 24% of the ETF, which adds risk if the recent rotation out of Wall Street equities continues. But on balance, I think it’s a great ETF to consider for portfolio diversification and a long-term passive income.