Alphabet‘s (NASDAQ:GOOG) found itself in trouble with US regulators over Search and Android. But with the company performing well on a number of fronts, is this an opportunity to buy shares at a bargain price?

There’s much more to Alphabet than Search and Android. And at a price-to-earnings (P/E) ratio of 21, the stock’s trading at a much lower multiple than some of its competitors.

Cloud

One big reason for optimism is Google’s Cloud division – in its Q2 update, the firm reported 32% revenue growth and operating income up 141%. And there could be more to come on both fronts.

Demand’s clearly strong and Alphabet’s investing aggressively to meet this. The company plans to spend $85bn in 2025 and this should translate into significant sales growth going forward.

As the business continues to increase its scale, I also expect operating margins to improve. These are currently at 21%, which is roughly half of what Amazon achieves with AWS.

In short, I’m expecting higher sales and wider margins from Google’s Cloud division. And this is a powerful combination that investors should take note of.

YouTube

YouTube’s another of Alphabet’s key strengths. The streaming service grew its revenues by 13% in Q2, but the most significant developments are arguably in its market position.

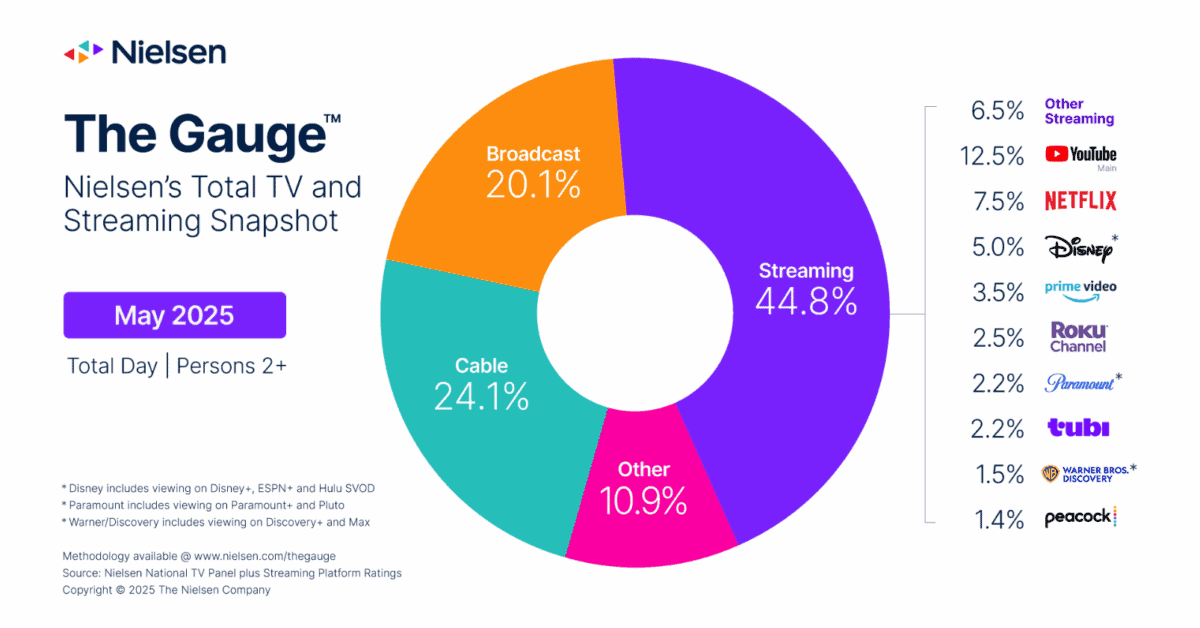

Source: Nielsen

According to data from Nielsen, streaming’s rapidly growing its share of US TV screen time. And YouTube’s leading the way, with a market share equivalent to Netflix and Disney combined.

This doesn’t include time spent watching videos on mobile phones or computers, where it seems likely that Alphabet’s platform has an even stronger presence. And it also excludes YouTube TV.

Alphabet’s success to date has been primarily driven by using a dominant market position to generate advertising revenue. So YouTube’s continuing success is worth paying attention to.

Waymo

Waymo’s revenues and profits aren’t significant – yet. But the market for robotaxis is expected to reach $189bn by 2034 and Alphabet’s already launched operations in multiple US cities.

Importantly, the business has managed to succeed in overcoming what Tesla currently sees as its largest obstacle – regulatory approval. And being first to market brings important advantages.

The most important is a head start in terms of real-world data to use in training its systems. This should improve safety, which helps the firm’s prospects for securing permits in new areas.

Being first isn’t a guarantee of long-term success. But if the robotaxis market grows as analysts are expecting, Waymo could develop into something very valuable for Alphabet shareholders.

Regulation

Alphabet’s facing regulatory challenges around its Android system and its Search monopoly. But there’s a lot for investors to be positive about elsewhere in the business.

Google Cloud, YouTube, and Waymo aren’t big enough to justify the firm’s current market value by themselves – at least not yet. But they are three strong and encouraging businesses.

A lot hinges on the future of Search. But it’s not Alphabet’s only business by any means and at a P/E ratio well below Meta Platforms, or Microsoft, the stock’s well worth considering.