As the stock market rises, finding undervalued opportunities becomes more and more difficult. But I think UK shares are still the most promising place for investors to look.

Whether it’s businesses generating double-digit sales growth or out-of-fashion stocks trading at discounted valuations, the FTSE 100 has stocks to suit all styles. Here are two to consider next month.

Games Workshop

Games Workshop‘s (LSE:GAW) a great illustration of the fact that firms don’t have to set up their manufacturing in China to be successful. Most of its production’s based in Nottingham.

This does mean that tariff uncertainty can be a risk. And that’s especially true for a business that makes discretionary products, rather than things people need.

Games Workshop however has strong intellectual property. That means higher costs won’t make US consumers switch to a local Warhammer producer the way they might with other products.

That’s why the company’s continuing to perform strongly. The latest results show 17% revenue growth, earnings per share also up 17%, and a 40% increase in the dividend.

At a price-to-earnings (P/E) ratio of 27, the stock isn’t obviously cheap. But low capital requirements mean there’s still a dividend with a 3.25% yield even at today’s prices.

Games Workshop shares have generated outstanding returns for investors over the last five years. But strong trading means I still think they’re worth considering at today’s prices.

Croda International

Croda International‘s (LSE:CRDA) a speciality chemicals business based in Goole. Earlier this week, the company announced a dividend increase, extending its streak to 34 consecutive years.

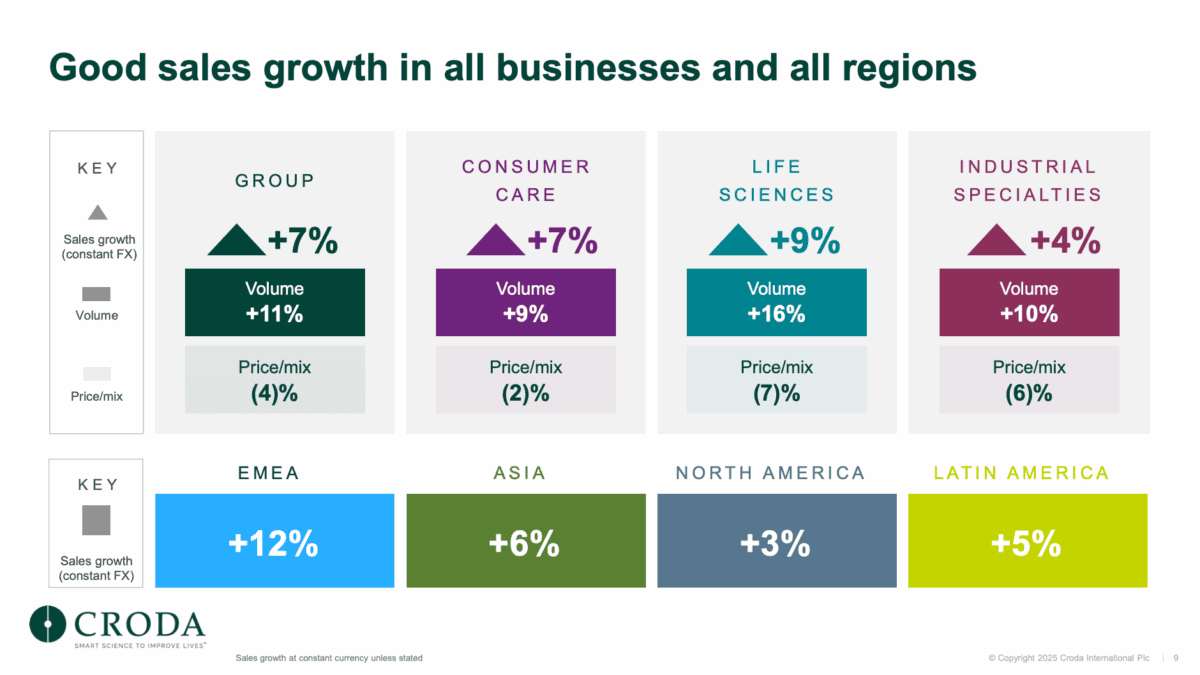

The firm also reported 4.9% higher sales and earnings per share for the first half of 2025, with growth in every division. But the stock market didn’t like this at all and the share price fell 10%.

Source: Croda International H1 2025 Presentation

One reason is that growth in Q2 was slower than Q1. But the bigger issue – in my view – is higher working capital requirements meant free cash flows fell to less than 50% of the dividend.

In other words, Croda’s currently paying out more to shareholders than it’s bringing in. The firm covered the difference by increasing its debt, but that’s not sustainable over the long term.

If sales keep growing however, it shouldn’t need to. The company’s looking to lower its working capital requirements and if they stabilise, I think things could get back on track pretty quickly.

Croda’s adjusted earnings per share are almost double its dividend. With the stock at a 10-year low and a dividend yield of 4.25% it’s worth thinking about ‘being greedy when others are fearful’, to quote billionaire investor Warren Buffett..

Long-term investing

Games Workshop shares trade at a multiple reflecting expectations of future growth. And Croda International’s going through a tricky period in terms of its inventories and working capital.

For that reason, investors thinking of buying either stock need to be willing to take a long-term view. But both companies have durable strengths that give them advantages over competitors.

This is why I think both stocks are worth considering in August. While share prices can be volatile in the short term, shares in strong businesses tend to be good investments over time.