Shares in Admiral (LSE:ADM) are up 92% in the last three years. There’s still a 4.35% dividend yield for income investors who buy now, but I think those who wait might get a chance to buy a world-class FTSE 100 company at a really great price.

In my view, this is a stock that all investors should have on their watchlists. There’s a lot to like about the business and attractive buying opportunities do present themselves from time to time.

Car insurance

One of the nice things about car insurance from an investment perspective is that everybody that drives a car needs it. That means there’s a durable market for the product.

The trouble is, there are a lot of companies in that market. And buyers don’t usually care that much about brands or company loyalty – they just want whichever cover is cheapest.

If insurers get their pricing wrong, though, they end up paying out more in claims than they take in as premiums and making a loss as a result. That’s where Admiral comes to the fore.

The firm consistently has one of the best combined ratios – a measure of underwriting profitability – of any UK car insurer. And unlike the things it pays out on, that’s not an accident.

It comes from Admiral having a technological edge. Its telematics data provides it with better information about drivers and this allows it to assess risk more accurately than its rivals.

I don’t see a meaningful threat to this on the horizon, so what investors have is a business with a competitive advantage in a non-discretionary industry. And that’s a powerful combination.

Inflation

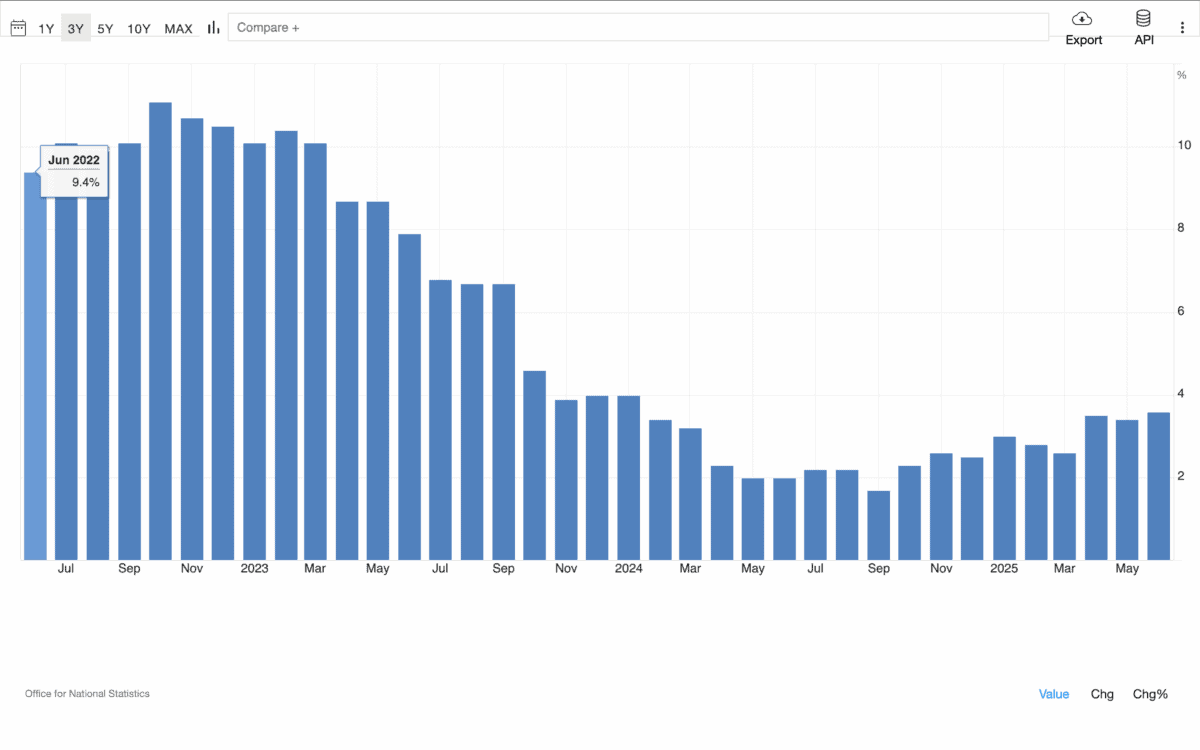

Given this, investors might wonder what the stock was doing at just over half its current price back in 2022. The answer is the UK was going through a period of high inflation.

United Kingdom Inflation Rate 2022-25

Source: Trading Economics

That’s a nuisance for car insurance companies across the board. It makes repairing and replacing vehicles more expensive and they have to wait until policies expire to increase their prices.

Even for a company like Admiral, this can be a genuine risk. But in terms of the stock market, it can also present an opportunity to buy shares in an outstanding business at a great price.

Leaving aside share price gains, the firm has returned £4.52 in dividends per share to shareholders since July 2022. That’s a return of almost 9% per year by itself.

Inflation in the UK is just starting to show signs of picking up again after falling to the Bank of England’s target 2% level a year ago. And I think investors should pay close attention.

I’m not expecting a return to the 9% inflation levels of 2022. But having missed the opportunity back then, I’m on the lookout for a chance to buy shares in Admiral if the stock falls.

Why wait?

Right now, Admiral shares come with a 4.35% dividend yield. Given the quality of the underlying business and its competitive position, there’s an argument to be made for buying the stock today.

I have a lot of sympathy with that argument. But at the very least, I think investors should have the stock on their watchlists and keep a close eye on inflation.