Yesterday (17 July), Frasers Group (LSE:FRAS), the FTSE 250 owner of Sports Direct and other retail brands, released its results for the 52 weeks ended 27 April 2025 (FY25).

At one point during the day, the share price was down 5.6%. By close of business, it was 5.2% higher. That’s a swing of 10.8%!

This topsy-turvy performance suggests investors were unsure what to make of the results.

What did they show?

The group reported a year-on-year 2.8% increase in adjusted profit before tax (PBT) to £560m. This is within the £550m-£600m range it predicted in December 2024.

However, despite improved earnings, revenue was down 7.4%.

Its Premium Lifestyle division, which includes Flannels and the House of Fraser department store, was particularly badly hit with a 14.8% fall. Yet the segment was able to achieve a £20m increase in its trading profit.

And this appears to have been replicated in other parts of the group. Careful cost control — and synergies achieved through its “strategic partnerships” with other retailers – helped offset the impact of a declining top line.

The exception to this was Sports Direct. Although its results are not separately disclosed, the group reported “continued sales growth”.

Overall, the group improved its retail margin from 43.9% to 45.6%.

Looking ahead, the group’s forecasting an adjusted PBT of £550m-£600m in FY26 too. This includes extra employment costs of “at least £50m” arising from the Chancellor’s 2024 budget.

Despite this, the group retains confidence in physical stores. It has plans to open “hundreds” more over the coming year.

A bit of a bargain

Prior to the results announcement, I thought the group’s stock offered good value. Now, I’m even more convinced. And as yesterday progressed, it seemed as though more and more investors were beginning to agree with me.

At close of business, the group had a market cap of £3.06bn, equivalent to 678p a share.

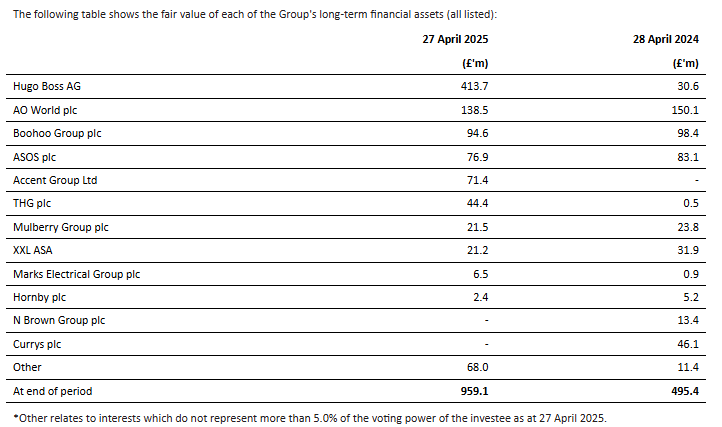

With the group’s minority stakes in other businesses worth £959m, it means it’s valued at less than five times its historic trading profit.

Why such a reaction?

Declining turnover is never a good look. And even though earnings per share beat the consensus forecast, investors might be concerned that the group’s going to struggle to increase its profit further if sales are falling.

Some might also be worried by the £527m increase in net debt during the course of the year. Frasers attributes some of this to additional spending on its strategic investments. Given that it’s unclear what — if anything — the group plans to do with these stakes, investors could see it as a bad idea to borrow to buy more shares in these businesses.

The group recently renegotiated its loan facility, which could be worth up to £3.5bn.

A positive outlook

But I remain optimistic.

Its flagship brand – Sports Direct – appears to be doing well both in the UK and internationally. In addition, it continues to explore retail partnerships in Europe and Africa.

Okay, if FY26 profit comes in towards the bottom end of its forecast, this would imply no earnings growth. But £550m is still impressive and would imply a very attractive forward earnings multiple.

For these reasons, I plan to hold on to my shares. And other investors could consider adding the stock to their own portfolios.