While not without risk, I think these investment trusts could deliver terrific long-term returns. Here’s why they merit serious consideration.

Growth

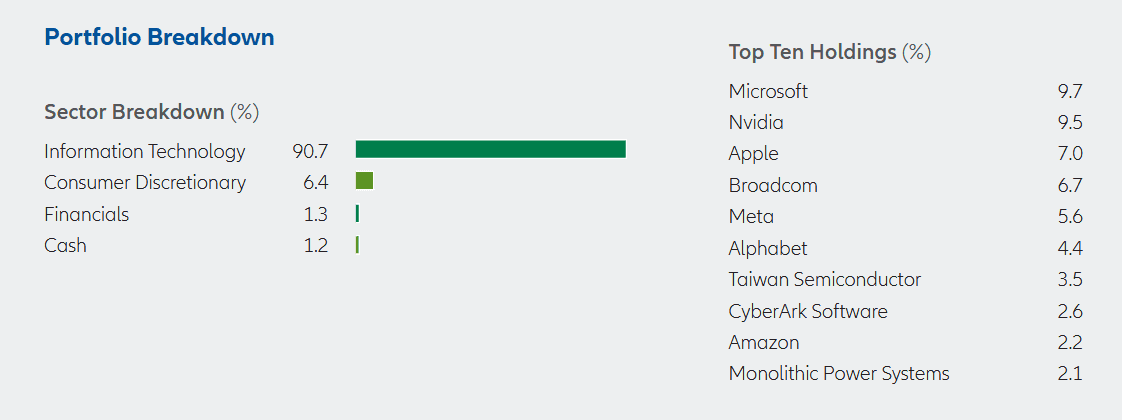

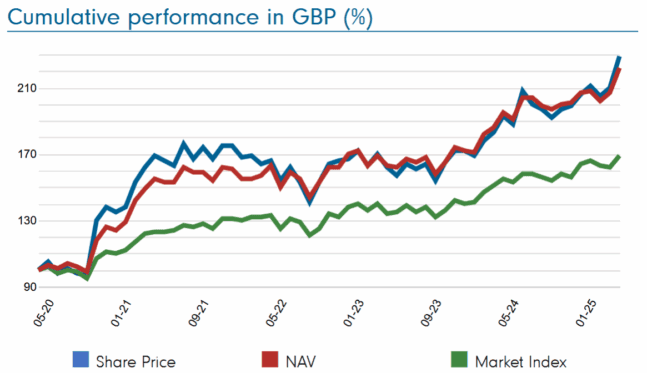

Thematic trusts with a tech flavour have considerable growth potential as the digital revolution rolls on. The Allianz Technology Trust (LSE:ATT) is one that’s already proved its mettle — the average annual return over the past five years is 14.9%.

This financial vehicle holds 46 companies, ranging from semiconductor and smartphone manufacturers to social media operators and software developers. This provides exposure to multiple megatrends for the next decade and beyond, from the artificial intelligence (AI) and cloud computing booms to increasing consumer electronics demand.

As we spend more time online and automation spreads, I think the trust could grow rapidly in size. Remember, though, that its holdings are highly sensitive to economic conditions. This means returns could disappoint during economic downturns.

Dividends

There’s much more to successful passive income investing than just choosing shares with the largest yields. With Schroder Income Growth Fund (LSE:SCF), investors have enjoyed consistent dividend growth AND yields that top the market average.

Since it was created back in the mid-1990s, dividends here have grown every year. And according to the Association of Investment Companies (AIC), dividend growth has averaged 2.8% during the last five years.

Today, its forward dividend yield is 5.3%, far above the FTSE 100‘s 3.5% average.

As the graphic shows, this trust has significant exposure to UK blue-chip shares across multiple sectors. This provides good diversification to reduce risk, and helps provide a smooth return across the economic cycle.

As a UK investment trust focused on domestic equities, it carries greater regional risk than more global trusts. However, this hasn’t prevented it delivering strong returns more recently (its annual average return since mid-2020 is a healthy 10%).

Value

The Fidelity Special Values (LSE:FSV) trust is designed to achieve capital growth “primarily through investment in equities (and their related securities) of UK companies which the investment manager believes to be undervalued or where the potential has not been recognised by the market“.

The results have been spectacular. During the last five years, it’s delivered an average annual return of 18.4%. That’s despite, as with the Schroder dividend trust I’ve described, its narrow geographical makeup bringing higher risk.

While this remains an ongoing danger, I think this focus on UK shares could also continue working in its favour, though. Recent demand for British shares has jumped due to their cheapness, and especially compared with US shares. Yet, many quality London-listed companies still look undervalued, providing scope for further gains.

Take Standard Chartered, this Fidelity trust’s single largest holding. Price-to-earnings-to-growth (PEG) and price-to-book (P/B) ratios of below one suggest the FTSE 100 bank still offers tremendous value.

The trust’s high weighting of cyclical shares (like financials, industrials, and discretionary consumer goods businesses) may leave it vulnerable during economic downturns. But on a long-term basis, I’m confident it can deliver outstanding shareholder returns.