I’m not just interested in high near-term dividend yields when I’m buying stocks for passive income. I want dividend shares that can provide a sustainably large and growing dividend over time.

As this table shows, Greencoat UK (LSE:UKW) is expected to deliver impressively on both counts during the next few years:

| Year | Dividend per share (forecast) | Dividend yield |

|---|---|---|

| 2025 | 10.38p | 8.6% |

| 2026 | 10.70p | 8.8% |

| 2027 | 11.01p | 9.1% |

It’s critical to remember that dividends are never, ever guaranteed. What’s more, City forecasts (upon which these yields are based) can shoot both under and above.

Yet, I’m confident this dividend star an deliver a long-lasting second income for investors. If projections are accurate, a £10,000 lump sum today will provide dividends of £2,653 between now and 2027 alone.

Here’s why I’m considering the FTSE 250 company for my own portfolio.

Good and bad

Holding renewable energy stocks can be problematic at times. When the sun doesn’t shine or the wind doesn’t blow, profits can tumble as energy generation slumps, potentially impacting dividends.

This is a constant threat for Greencoat UK, all of whose assets are located in Britain, as its name implies. However, this tighter geographic footprint also has its advantages.

Britain is famed for its excellent wind speeds and long coastlines, and offshore wind capacity often exceeds 50%, making it one of the world’s leading places to build turbines. Capacity on future wind farms is tipped to rise as high as 65%, too, as technology improves.

The UK is also becoming one of the most supportive environments in the world for green energy. Just last Friday (4 July), the government announced new plans to turbocharge the onshore wind industry through steps like simplifying the planning process and boosting supply chains.

In doing so, the government is looking to almost double total onshore wind capacity, to 27GW-29GW by 2030.

A dividend hero I’m considering

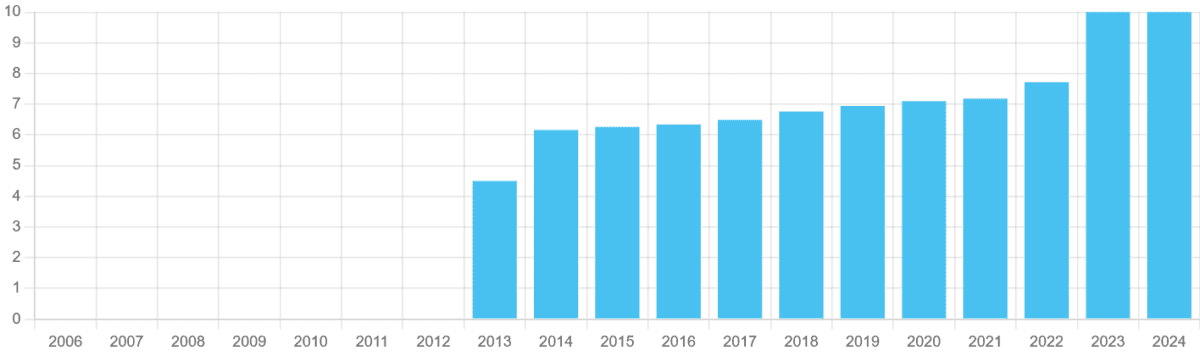

This provides significant scope for Greencoat UK, which currently owns 49 wind farms, to keep its progressive payout policy going. As you can see, annual dividends here have risen consistently since it listed on the London Stock Exchange more than a decade ago.

The only exception came in 2024, when the company cut its long-term energy generation forecasts by 2.4%, leading to a drop in asset values. But with these changes made, City analysts are expecting dividends to start chugging higher again from 2025.

The graphic also underlines another attractive feature of renewable energy stocks like this. Electricity demand remains generally stable during all economic conditions, even during high inflation and pandemic-related downturns. So while these companies can keep producing the energy, the revenues and cash flows continue to steadily roll in.

While it’s not without risks, I’m considering adding Greencoat UK to my own portfolio for a long-term income.