Although I suspect most FTSE 100 companies would prefer a lower interest rate environment, the Persimmon (LSE:PSN) share price is probably more sensitive than most to borrowing costs. But unlike the majority of its peers, the housebuilder doesn’t have any debt on its balance sheet. Its costs are therefore unaffected by the decisions of the Bank of England’s monetary policy committee.

Instead, its revenue is heavily influenced by the base rate. In simple terms, lower borrowing costs mean its houses are more affordable.

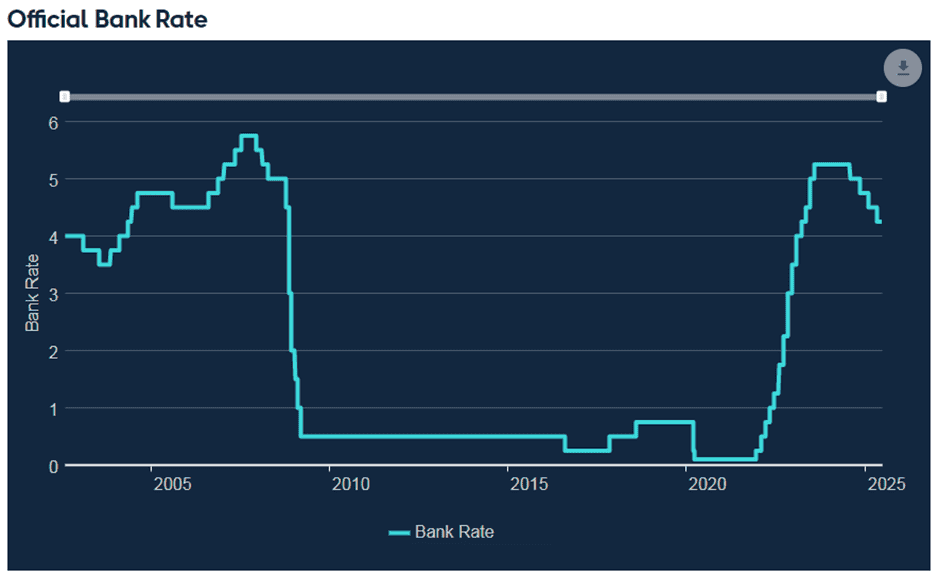

But I think it’s fair to say that post-pandemic inflation is being a little more stubborn than most economists had predicted. And the consequence is that interest rates have remained higher for longer than previously expected. The result has been share price volatility for the nation’s housebuilders.

At the Bank of England’s last meeting in June, its committee members voted six to three to hold the base rate at 4.25%. As the chart below shows, this is high by recent standards.

Green shoots

However, leaving this to one side, I believe there are reasons why the Persimmon share price might rally. Some of these are contained in other reports from the UK’s central bank.

Its May ‘Money and Credit’ report shows a 2,376 (3.9%) increase in mortgage approvals to 63,032. Encouragingly, net borrowing increased by £2.8bn in May. However, some of this increase was distorted by a large drop in April following a rush to beat the March deadline for stamp duty changes.

As well as the base rate, competition plays an important role in determining the cost of mortgages. In May, the actual rate on newly drawn loans fell marginally from 4.49% to 4.47%.

Taken together, I think these are early signs that the notoriously cyclical housing market could soon recover.

A better year

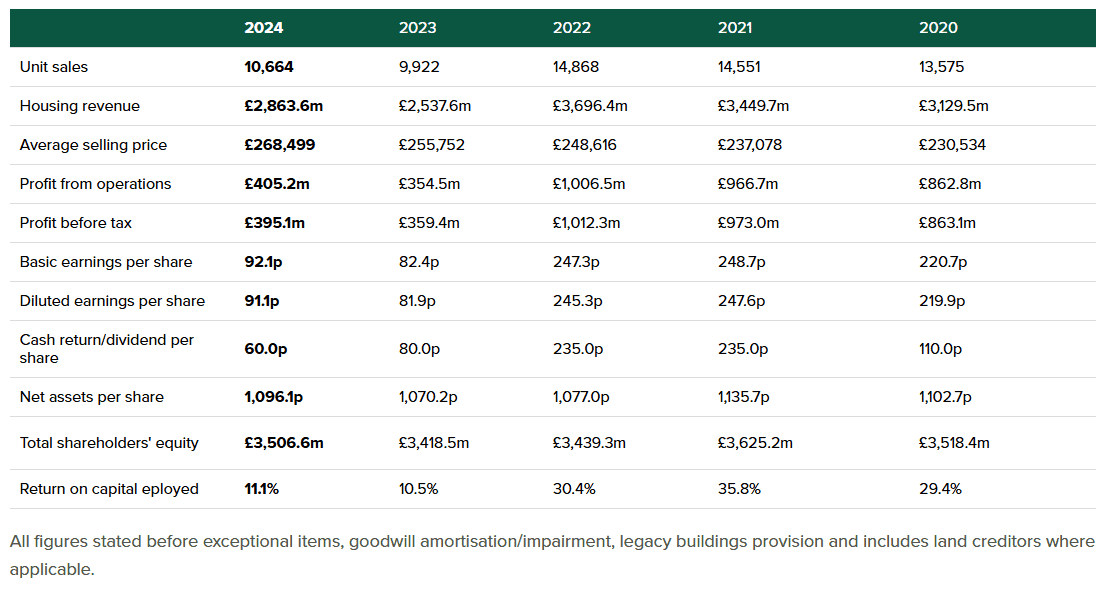

The housebuilder expects to complete 11,000-11,500 properties this year. If realised, it would be the third successive year with an increase. However, even at the top end of this range, it would be 3,368 lower than the record-breaking 14,868 achieved in 2022.

But even if Persimmon manages to build close to 15,000 homes again, it’s not going to be as profitable as previously. Since Covid, building cost inflation has squeezed margins. In 2020, the operating margin per house was just under £64,000. In 2024, it fell to £38,000.

However, if there is a rebound in the property market, the housebuilder should be one of the first to benefit. Its homes are approximately 20% cheaper than the UK average and have historically been popular with first-time buyers.

Looking further ahead, there’s no sign that the country’s shortage of housing is going to be resolved any time soon. The Office for National Statistics claims another 8m people will be living in the country by 2050. One estimate I’ve seen suggests there’s already a shortage of 2.5m homes.

The 12-month share price target of brokers also implies that the stock could have a good year. Of course, there are no guarantees but the average of their forecasts is 1,483p. This is 23% higher than today’s (4 July) price.

And even if the Bank of England fails to cut the base rate as anticipated, shareholders might take some comfort from a stock that’s yielding 5%.

For these reasons, investors could consider taking a position.