There are two commonly used measures that point to UK shares being undervalued compared to most other international markets.

CAPE

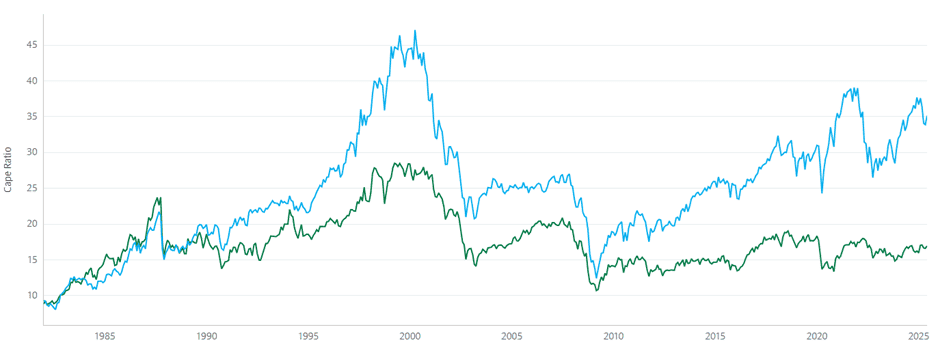

The cyclically-adjusted price-to-earnings (CAPE) ratio considers the value of a market relative to the profits of all its component companies. It’s then adjusted to remove the impact of the irregular nature of earnings. The maths is complex but, fortunately, some clever people at Barclays have taken care of the calculations and published the results for all to see.

The latest figures show that UK equities have a CAPE of 16.7. Although not the cheapest, Australia (21.4), Japan (21.9), France (23), Germany (23.8), Canada (24.4), and the US (34.1) are all considered to be more expensive.

And the gap between the UK and America appears to be widening.

As the chart below shows, the two were closely matched towards the end of the 2008-2009 financial crisis. However, since then, thanks to a heavy exposure to tech stocks, the US market’s soared and — in theory — become increasingly expensive.

The Buffett indicator

It’s a similar story with Warren Buffett’s eponymous indicator.

Usually expressed as a percentage, it compares the value of a nation’s stock market (price) to that of its economy (using gross domestic product as a proxy for income).

Presently (4 July), the UK’s indicator is 105.6% compared to 207.8% for America.

However, it must be said that both these calculations are flawed. They are overly simplistic and evidence shows that Warren Buffett doesn’t track his own measure.

And they are useless when it comes to choosing individual stocks.

But they could highlight where rational investors – who are always, in theory, on the lookout for cheap assets – might deploy their funds.

Information is power

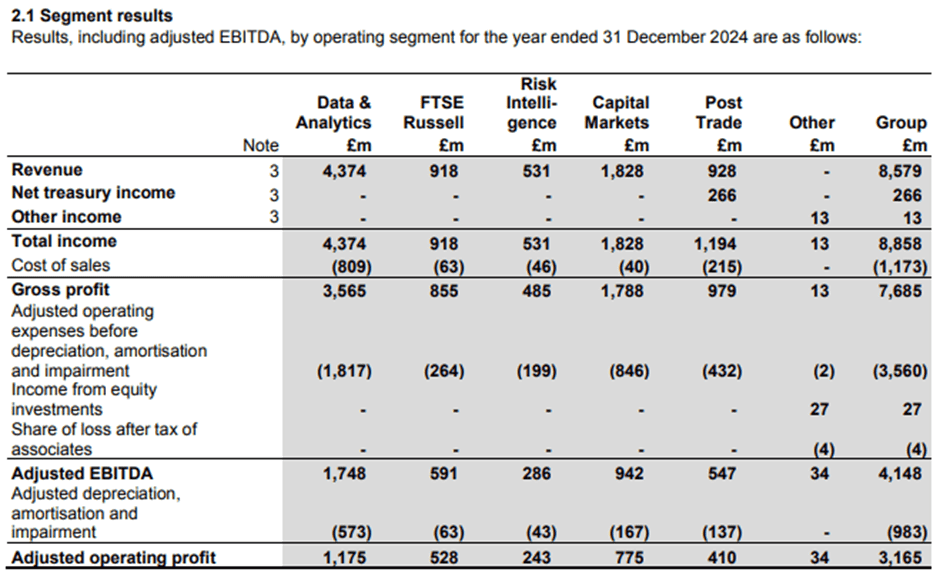

There’s one FTSE 100 stock that makes a lot of money from looking after all those ‘cheap’ UK shares. However, the London Stock Exchange Group (LSE:LSEG) also has a Data & Analytics division. This boasts of 40,000 customers and 400,000 users. The information available to subscribers can be tailored (using artificial intelligence, of course) to an individual’s specific needs or preferences.

And it’s easy to see why these types of businesses are so attractive. During 2024, the group’s gross profit margin was an impressive 86.8%.

And this has helped push its share price higher.

The stock currently trades on 29.6 times its adjusted 2024 earnings per share of 361.5p. This is approximately twice the average for the FTSE 100. It’s also straying into ‘Magnificent 7’ territory.

Like most, the principal challenge for the group is to continue to find new customers. But I suspect most finance professionals who can afford to pay for its data services are already using the group’s products.

To maintain such a healthy multiple, it’s going to have to continue to grow rapidly. Unfortunately, I don’t see where the additional revenue’s going to come from. And it doesn’t help that we regularly see stories about companies leaving the London market.

Its dividend’s also a little mean. With a payout of 130p, the stock’s yielding a disappointing 1.2%.

And with such a high earnings multiple, any sign of weaker-than-expected earnings will – I think – be punished heavily by investors. For these reasons, I believe there are better (less risky) opportunities elsewhere in the market that the London Stock Exchange Group runs so efficiently.