Legal & General (LSE:LGEN) has long been one of my favourite global dividend shares. It’s actually currently the largest single holding across my portfolio. I bought it as a way to source large dividends that grow over time.

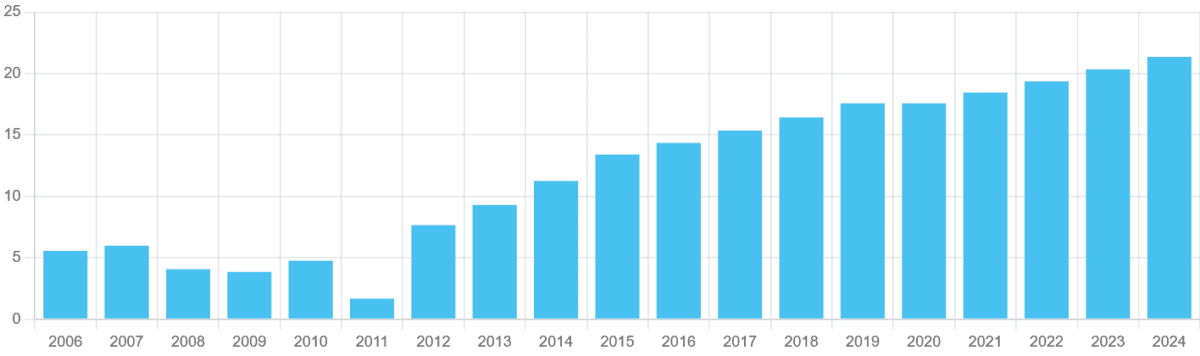

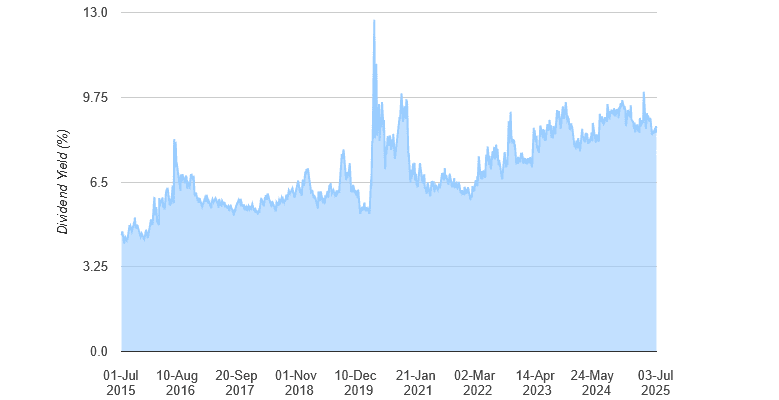

As you can see, dividends here have been rising consistently for well over a decade (excluding pandemic-hit 2020). What’s more, the dividend yield here has long surpassed the 3%-4% long-term average for UK blue-chip shares.

Even today, the dividend yield is more than double the current FTSE 100 average, at 8.7%. This is despite a near-9% rise in the share price so far in 2025.

I actually think it could be the Footsie’s greatest passive income stock.

Cash machine

The beauty of the business from an income perspective is that it’s swimming in cash. As of December, its Solvency II capital ratio was 232%, more than double what regulators require.

Legal & General has a broad range of revenue streams that provide a constant stream of cash. From life insurance, to pensions and asset management, and operations spanning four continents, it still enjoys robust cash flows even when certain products or regions underperform.

Reflecting this fact, the company is committed to raising annual dividends by 2% between 2025 and 2027. It is also planning substantial share buybacks. It’s targeted £500m of repurchases this year alone, and around 40% of its market cap (currently £14.4bn) in the next three years.

Growth opportunity

There may be bumps along the way, but I’m confident that Legal & General will remain a long-term winner. Some of the dangers it faces are economic downturns and higher interest rates that impact sales, and intense competition from other industry heavyweights like Aviva, Aegon, and Invesco.

However, the pace at which demographic changes are driving industry growth are significant. Protection and retirement products and asset management services are set for sustained growth, underpinned by growing awareness of the need for future planning, as uncertainty grows over the level of state support when we become older.

Last month (17 June), the business announced plans to boost annual operating profit growth at its asset management arm by a juicy 6%-10% between 2024 and 2028. I’m not surprised that it’s so bullish: analysts at Mordor Intelligence expect the global asset management industry to grow at an annualised rate of 13.4% from this year to 2030.

Value star

With its exceptional brand power and huge global operations, I think the FTSE 100 firm’s in one of the best seats to capitalise on this enormous opportunity. Yet I also don’t believe this is currently baked into its rock-bottom valuation.

At 250p, Legal & General shares trade on a forward price-to-earnings (P/E) ratio of 10.9 times. With it also packing that enormous dividend yield, I think it’s an excellent bargain stock to consider.